IGRS UP 2024: Online Stamp Duty, Property Registration, and IGRSUP Guide for Uttar Pradesh

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Quick Help

Frequently Asked Questions

For Kotak Bank Customers

For Kotak811 Customers

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

IGRS Uttar Pradesh is an Integrated Grievance Redressal System for Uttar Pradesh aimed at improving governance using the latest technology. Since it involves all stakeholders, citizens can conveniently file a grievance, receive a response, and track the lodged grievance on all significant platforms. Apart from lodging complaints, the platform allows interaction with the government, offices, and departments. Simply put, it is a single platform that all departments use to improve monitoring, access, and redress.

The Inspector-General of Registration and Stamps (IGRS) is responsible for tax implications on property transactions, generating revenue for the state’s growth. All the activities that the Stamp and Registration Department of UP carry out are done through the IGRSUP. This guide will focus on the website, its services, and how to utilise it for the intended purpose.

IGRSUP make stamp duty calculation easier and quicker for property-related transactions. The platform has a Stamp Duty Calculator that users can use to determine the applicable stamp duty charges based on factors like property location, type, and transaction value. Visit the online IGRS UP portal, open the stamp duty calculating tool, and enter the property details to calculate the stamp duty charges in seconds.

Prepare these documents to apply for property registration using the UP IGRS portal:

The portal has an IGRSUP property search feature that helps retrieve specific property-related documents and details. Follow these steps to use the IGRSUP search option:

Various services available on IGRS Uttar Pradesh include the following:

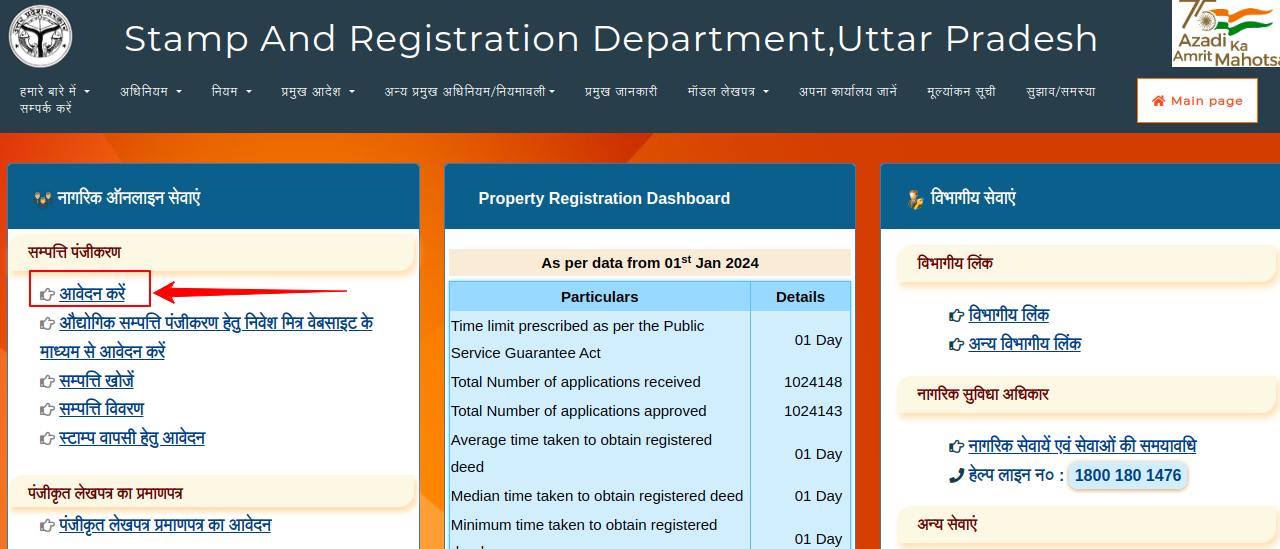

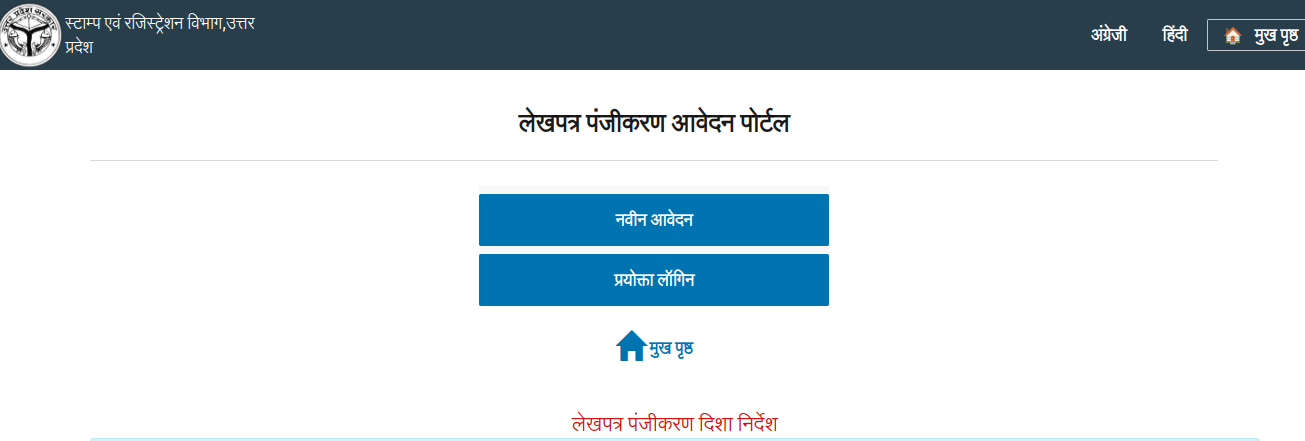

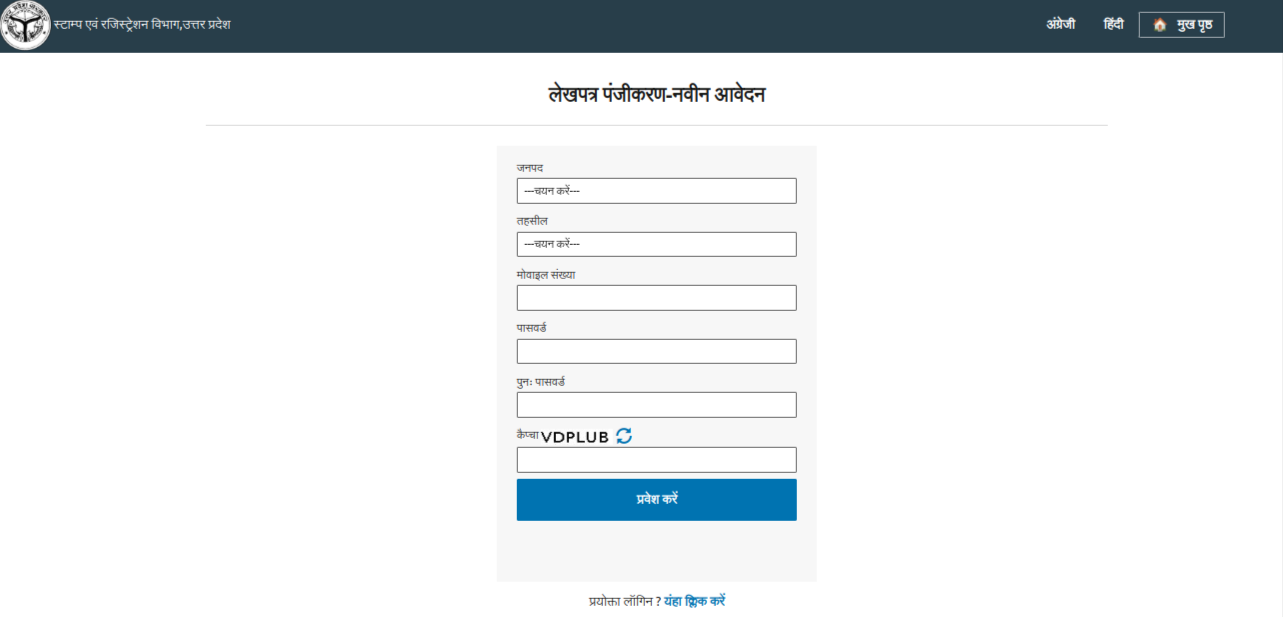

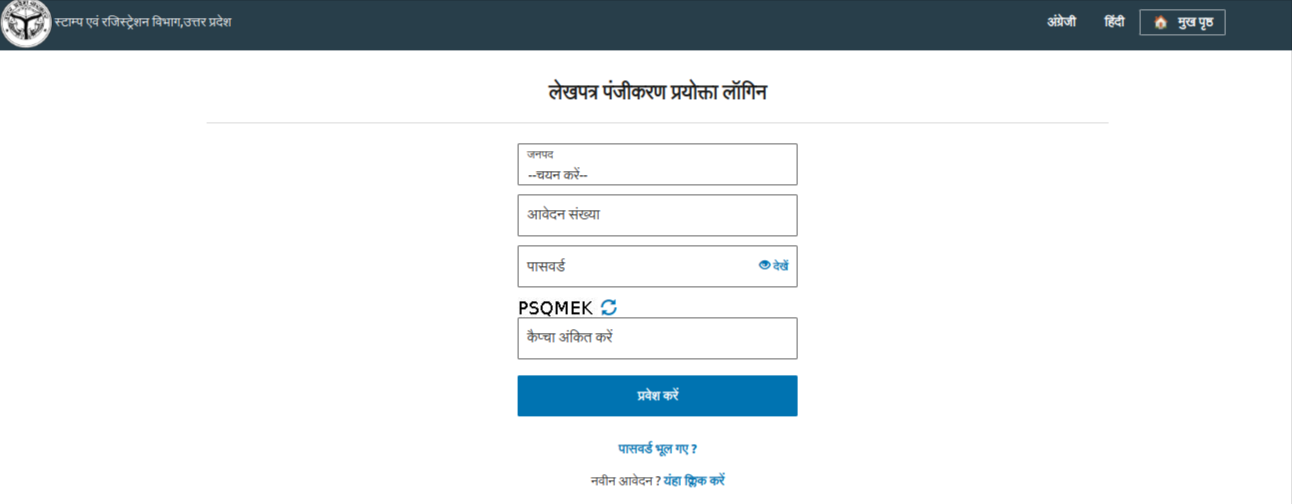

Follow these steps for property registration on IGRSUP:

Step: 1

Step: 2

Property buyers can get a stamp duty refund of up to 98% if the sale deed is not executed. The IGRS UP website allows property buyers to apply for a stamp duty withdrawal. Users must log in to their account on the portal and upload their original sale and cancellation deeds for consideration. Once approved, they can receive the stamp duty withdrawal in their bank account.

Follow these steps to apply for an encumbrance certificate at the Uttar Pradesh IGR portal:

Other services available on the UP IGRS portal include the following:

Also Read: Kaveri Online Services : Karnataka Land Record & Property Registration Portal

You can pay your stamp duty and registration charges through several modes in UP, including debit card, credit card, net banking, demand draft, etc. However, the platform does not accept payments through cheques.

You can get an e-stamp in UP at a CRA counter in the Registration office, a CRA branch office, or an authorised collection centre of the SHCIL.

IGRSUP is the Integrated Grievance Redressal System of Uttar Pradesh, an official web portal by the UP Stamp and Registration Department. It is the government department’s information portal for property and land transactions in the state.

Visit the official IGRSUP website, find the ‘Encumbrance Certificate’ option, click ‘Apply’, fill out the application form with the number, and click ‘Submit’.

**Disclaimer: Interest rates and market conditions are subject to change. This information is accurate as of July 2025 and is meant for informational purposes only. Please consult with certified financial advisors for advice specific to your situation. Home loan approval is subject to the bank's terms and conditions.

Credit at sole discretion of Kotak Mahindra Bank Ltd. and subject to guidelines issued by RBI from time to time. Bank may engage the services of marketing agents for the purpose of sourcing loan assets.

Disclaimer: This Article is for information purpose only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. Bank make no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Newsletter. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from Kotak. Kotak, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein.