Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Quick Help

Frequently Asked Questions

For Kotak Bank Customers

For Kotak811 Customers

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

Total Accrued Amount:

0 INR

at 8% interest rate for 14 years

Principal:

0 INR

Interest Earned:

0 INR

A compound interest calculator is a tool that helps you calculate the compound interest on your amount invested. All you need to do is enter the initial principal amount, the interest rate, and the duration. It shows you the total amount you will have in the future.

Compound interest is the interest on a savings account. It is calculated on the initial amount (the principal) and the accumulated interest from previous periods. This makes your money multiply faster. In this sequence, evaluating the functioning to invest smartly is essential. Unlike previous times, now you can calculate through a digital tool.

Kotak Mahindra Bank's compound interest calculator online does the math for you. It uses a compound interest formula to calculate how much your money will grow.

This tool evaluates how much your money will grow over time. It uses the compound interest formula to calculate your growth. The CI calculator can find the total accumulated amount by following easy steps.

The compound interest calculator online uses principal and interest amounts and the total duration to determine the growth.

The compounding interest is impacted by two factors - rate of return and duration.

Kotak Mahindra Bank's compound interest calculator considers these factors to determine your growth.

Compound interest is a method of calculating interest on savings or investment where the interest earned is added to the principal amount, and then interest is earned on both the principal and the accumulated interest. This can result in significantly higher earnings over time than simple interest, which only earns interest on the principal amount.

The compound interest formula is:

A = P(1 + r/n)^(nt)

where:

Example for Compound Interest Calculation

Let's say you invest Rs.1,000 at an annual interest rate of 5%. You plan to leave your investment for 10 years, and the interest is compounded annually.

Using the compound interest formula, we can calculate the future value of your investment as follows:

A = 1000(1 + 0.05/1)^(1*10)

A = 1000(1.05)^10

A = 1628.89

This means that after 10 years, your investment will be worth Rs.1,628.89.

There are many compound interest calculators available online that can help you calculate the future value of your investment. These calculators can also be used to compare different investment options.

Example for Compound Interest Calculation

| Year | Principal | Interest Earned | Total |

|---|---|---|---|

| 1 | Rs.1,000 | Rs.50 | Rs.1,050 |

| 2 | Rs.1,050 | Rs.52.50 | Rs.1,102.50 |

| 3 | Rs.1,102.50 | Rs.55.13 | Rs.1,157.63 |

| 4 | Rs.1,157.63 | Rs.57.88 | Rs.1,215.51 |

| 5 | Rs.1,215.51 | Rs.60.78 | Rs.1,276.29 |

| 6 | Rs.1,276.29 | Rs.63.81 | Rs.1,339.10 |

| 7 | Rs.1,339.10 | Rs.66.96 | Rs.1,406.06 |

| 8 | Rs.1,406.06 | Rs.70.30 | Rs.1,476.36 |

| 9 | Rs.1,476.36 | Rs.73.82 | Rs.1,550.18 |

| 10 | Rs.1,550.18 | Rs.77.51 | Rs.1,627.69 |

As you can see, the amount of interest earned increases each year, and the total value of the investment grows at an increasing rate. This is the power of compound interest.

With our compound interest calculator, you can effortlessly determine the accumulated interest earned on your savings and investments. To use Kotak Mahindra Bank's calculator, you only need to fill out the fields with the amount. And the calculator will provide you with the total amount you'll earn.

For example:

Imagine you invest Rs 10,000 in a savings account for ten years with a quarterly compounding interest rate of 5%. First, we need to convert this annual rate into a decimal form of 0.05.

Now, we apply the formula:

A = P(1 + i / n) ^ (nt)

Where

- P is the principal amount invested.

- i is the nominal interest rate (in decimal form).

- n is the compounding frequency (in this case, 4 for quarterly).

- t is the time, usually in years.

Plugging in the values:

A = Rs 10,000 * (1 + 0.05 / 4) ^ (4 * 10)

A ≈ Rs 16,436.19

So, your investment would grow to approximately Rs 16,436.19 after ten years. This shows that the compound interest earned is about Rs 6,436.19.

The concept of compound interest, or compound interest meaning, is that accumulated interest is added back into your principal, with future interest calculations being made on both the original principal and the already-accrued interest.

The benefits of using a CI Calculator to calculate compound interest rates are as follows:

The primary difference between simple and compound interest is the interest amount.

Several factors that affect the final amount when calculating compound interest. It includes the initial principal amount, the interest rate, and the compounding frequency. The choice of whether the interest is added to the principal (compounded) or paid out can also impact the final amount.

Learn all about Savings Account

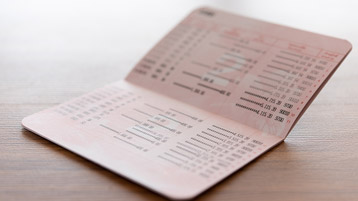

Applying for Kotak Bank Passbook:Step-by-Step Guide

Applying for Kotak Bank Passbook:Step-by-Step Guide

Easy Steps to Login to Kotak Net banking for Your Bank Account

Easy Steps to Login to Kotak Net banking for Your Bank Account

Download Your Bank Statement Online: Quick and Easy Steps

Download Your Bank Statement Online: Quick and Easy Steps

Safe Deposit Locker: Meaning, Importance, Factors & Tips to Secure Your Valuables

Safe Deposit Locker: Meaning, Importance, Factors & Tips to Secure Your Valuables