Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Quick Help

Frequently Asked Questions

For Kotak Bank Customers

For Kotak811 Customers

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

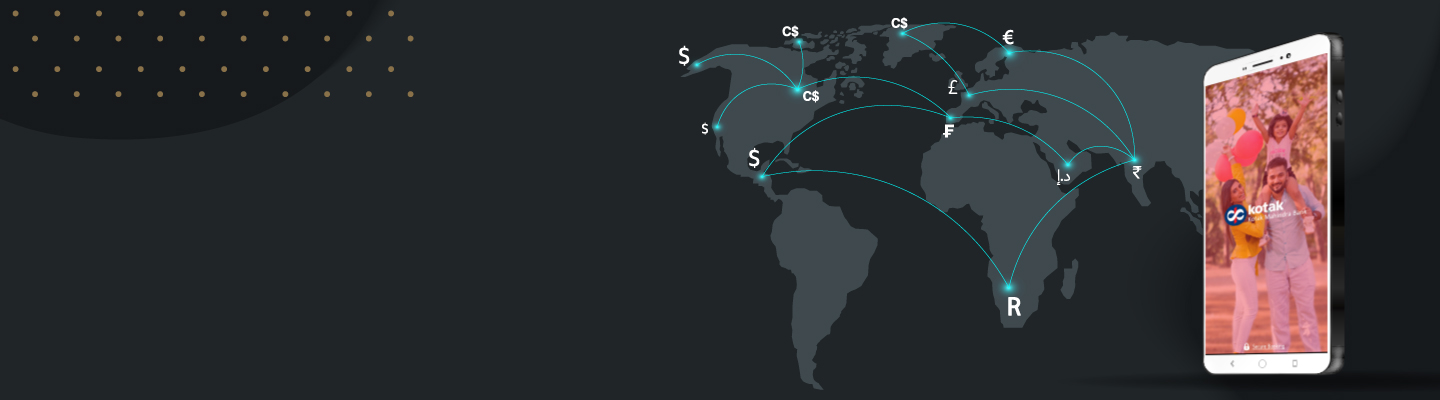

Outward Remittance also known as Telegraphic transfer/Transfer/Wire Transfer/Swift Transfer is the fastest and the most convenient way to send money to a beneficiary account anywhere in the world*.

Be it education fees, living expenses, or family maintenance, sending money abroad to your friends and family will be just few clicks away. You can do that with any of the 15 currencies (as mentioned below) making money transfer easier and more accessible.

Award-winning digital platform on net and mobile banking

Save beneficiary details for recurring transfers in the future

Send money abroad anytime from anywhere

Call Support - In case of queries, we are just a call away to assist you

| AED - UAE Dirhams | AUD - Australian Dollars |

| CAD - Canadian Dollars | CHF - Swiss Franc |

| DKK - Danish Krone | EUR – Euro |

| GBP - UK Pounds | HKD - Hong Kong Dollars |

| JPY - Japanese Yen | NZD - New Zealand Dollars |

| SAR - Saudi Arabian Riyal | SEK - Swedish Krone |

| SGD - Singapore Dollars | USD - US Dollars |

| ZAR – South African Rand |

What is LRS?

Under LRS (Liberalised Remittance Schemes), all resident individuals (including minors) are allowed to remit up to USD 250,000 per financial year (April-March) for any permissible current or capital account transaction, or a combination of both.

Under the Liberalised Remittance Scheme (LRS), all resident individuals (as defined under FEMA 1999), including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

It is mandatory for the resident individual to provide his/her Permanent Account Number (PAN) for all transactions under LRS.

TCS on foreign remittance under LRS is effective on any remittance transaction under LRS on or after 1st October, 2020.

The tax will be applicable on all remittance(s) that fall under the LRS of RBI.