What is Cheque Deposit Slip: How It Works And Benefits

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

Disclaimer: This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. The Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Bank, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.

Depositing money into your bank account is a routine task to manage your finances. Among the methods available, the traditional route involves visiting the bank branch. When you choose this method to deposit cheques, you must fill out a cheque deposit slip to deposit money. These slips are important to credit funds to your accounts accurately. Plus, they make deposits easy for customers. Below are details on how these slips work and the benefits they offer for a seamless deposit experience.

What Is a Deposit Slip?

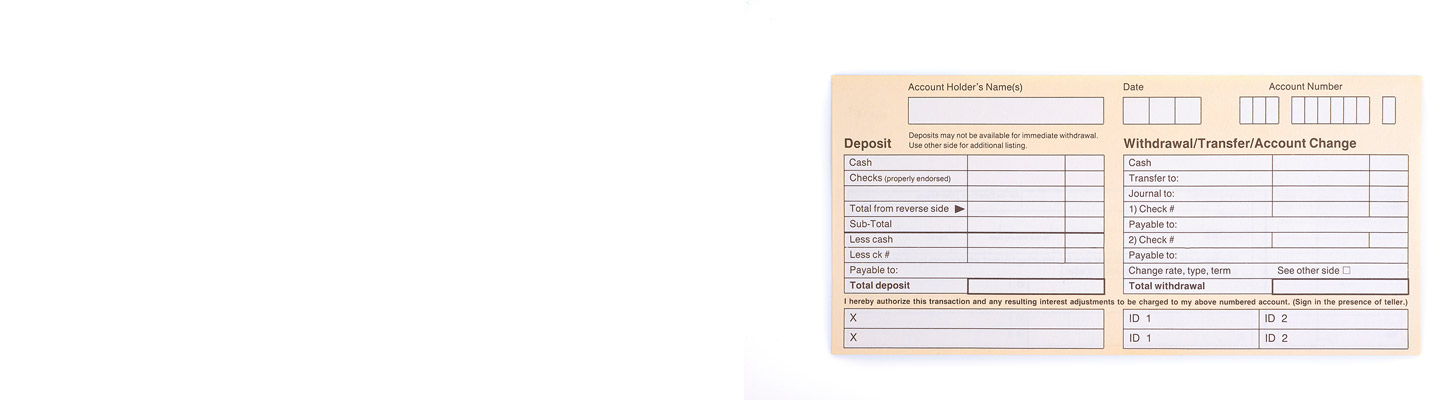

A cheque deposit slip is a simple form used to deposit funds into a bank account. It includes the deposit amount, account number, and currency denominations. When you fill out the slip and submit it along with your funds, a bank employee processes the deposit accordingly. Once completed, you will receive an acknowledgement slip for your records.

This simple document is a signal that your funds are accurately deposited into your account and they are also used as a record of the transaction. A deposit slip is important for both banks and customers. It facilitates seamless financial transactions and ensures transparency in banking activities.

Why Deposit Slip is important?

A cheque deposit slip is important for accurate fund transfers. Before visiting the bank teller, fill in the slip with your account details. It specifies the deposit composition, whether cash, check, or requested cashback. A well-filled deposit slip ensures a smooth and error-free transaction, providing clarity on the nature of the deposit.

Without it, processing the deposit money into the right account will be difficult for banks. It will lead to potential errors in crediting funds to the correct account. Plus, the slip is a record for both the bank and the customer. It offers proof of the deposited amount and its intended allocation. A deposit slip contributes to transparent and efficient banking procedures.

Benefits of Deposit Slips

In addition to being mandatory, a cheque deposit slip offers various advantages for both banks and customers. Here are some of them:

What are the Steps Involved in a Cash or Cheque Deposit Process?

If you are wondering how to fill cheque deposit slip, don’t get confused just follow these simple steps:

What are the Steps Involved in a Cheque Deposit Process?

The cheque deposit process involves a few simple steps:

For added convenience, customers can use Cheque Deposit Machines (CDMs). Simply drop the cheque along with the cheque deposit slip into the CDM, and the bank will handle the rest. This automated process expedites cheque deposits, making banking transactions more efficient for account holders.

Do Banks Have to Keep a Record of Deposit Slips?

Banks are obligated to monitor cash transactions of Rs. 10 lakhs and above in deposit, cash credit, or overdraft accounts. Detailed records of such large transactions are maintained in a separate register. This regulatory requirement ensures transparency and helps them track significant financial activities for both the bank and the customer.

Keeping thorough records aligns with regulatory standards and contributes to the financial integrity of the banking system. This practice is put in place as a precautionary measure to deter illicit financial activities and maintain the security of the banking sector. It enables banks to fulfil their regulatory obligations and facilitates a systematic approach to monitoring large cash transactions.

Read Also : DA: DA Full Form, Meaning, Types And Calculation

FAQs About Cheque Deposit Slip

How does a cheque deposit work?

To deposit a cheque, fill out a deposit slip with details like account number and amount. Present the cheque and slip to the bank teller. The bank processes the cheque, verifies funds, and credits the specified amount to your account. This method ensures a secure and documented transaction.

How do deposit slips work?

Deposit slips facilitate the submission of funds into a bank account. They include account details, the date, and the amount to be deposited. When completed, submit the deposit slip along with cash or cheques to the bank, allowing for efficient and accurate record-keeping.

How do you make a cheque deposit?

Complete a deposit slip with your account information and the cheque details. Submit the cheque and deposit slip to the bank teller for processing. The bank verifies the cheque's legitimacy and credits the corresponding amount to your account.

Do all banks use deposit slips?

Yes, deposit slips are commonly used by all banks. They streamline the deposit process, ensuring accurate and organised records of funds being added to an account.

What is the meaning of a cheque?

A cheque is a written order directing a bank to pay a specified sum from the drawer's account to the payee. It serves as a negotiable instrument for transferring money and is a widely accepted form of payment.

OK