What is a Cancelled Cheque: How to Write it & Cancelled Cheque?

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

Disclaimer: This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. The Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Bank, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.

The term "cancelled cheque" might seem tricky in financial transactions, but it holds significant importance. Do you know, how to write a cancelled cheque for specific purposes or how to void a cheque when needed? This comprehensive guide will provide you with a clear understanding of cancelled cheques. We will discuss everything from cancelling them correctly to unlocking their essential applications. Join us to understand the concept so you can confidently write, utilise, and cancel cheques when required.

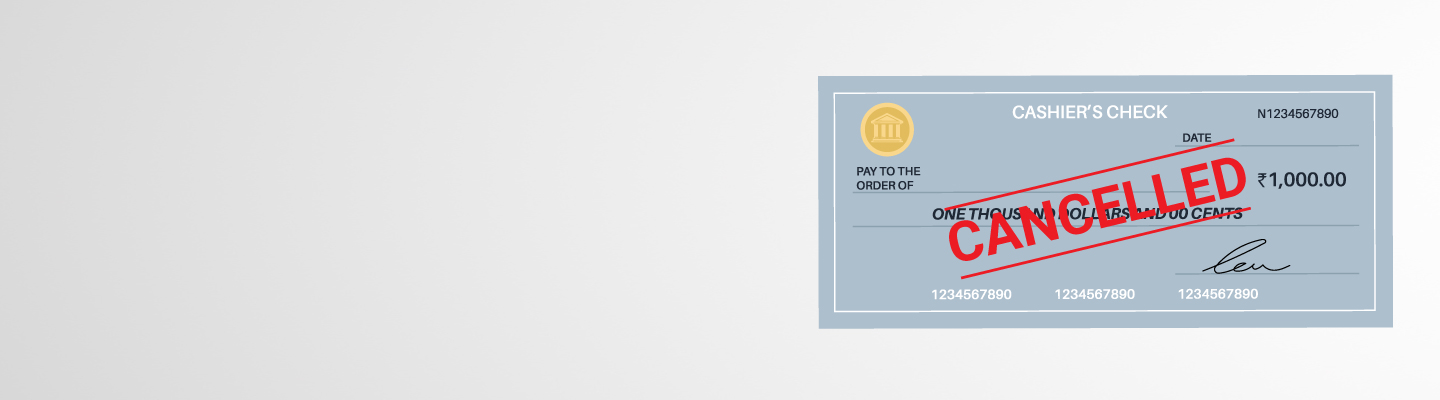

What is a Cancelled Cheque?

A cancelled cheque is a financial tool, notated by the word "CANCELLED" written prominently across it, with two crossed lines. While its primary purpose is to prevent misuse, it is an essential proof of one's bank account. Cancelling a cheque is very important to safeguard your financial transactions.

This modest yet influential instrument carries vital information, including the account holder's name, account number, MICR code, IFSC code, branch details, and cheque number. While it cannot withdraw funds, it finds utility in verifying bank details, Electronic Fund Transfers (EFT), KYC requirements, and other financial transactions.

How to Make or Write a Cancelled Cheque?

If you're curious about "how to write a cancelled cheque," we have an easy guide. It's a simple process, and we'll walk you through it.

Please note that the parallel lines drawn across the cheque should not cover essential details such as the account number, account holder's name, IFSC code, MICR code, or the bank's name and branch address.

In case you are cancelling a cheque due to errors, you can begin the process from step 2 mentioned above.

When is a Cancelled Cheque Required?

Understanding the significance of a cancelled cheque and knowing how to create, provide, and use one can significantly enhance your financial transactions in these contexts:

KYC Compliance

A cancelled cheque is pivotal for adhering to Know Your Customer (KYC) norms, especially when delving into investments such as stocks, mutual funds, or various financial schemes. It serves as proof of a valid bank account.

Electronic Clearance Service (ECS)

When you want to harness the convenience of the Electronic Clearance Service (ECS) to transfer funds electronically between your bank accounts, a cancelled cheque is a prerequisite. It acts as verification and authorisation for this service.

EMI Processing

Lending institutions often request a cancelled cheque before finalising your EMIs for loans or credit. It is vital for streamlining payment processing by directly debiting your bank account.

What Should I Do If A Cancelled Cheque Is Lost Or Misplaced?

Losing a cancelled cheque can be concerning, but there are steps to take:

Contact Your Bank

Immediately contact your bank to report the loss. They can guide you on the necessary actions to safeguard your account.

Monitor Your Account

Keep a close eye on your bank statements to detect any unusual activity. Report any unauthorised transactions promptly.

VII. What are the Various Uses of Cancelled Cheques?

A cancelled check has versatile applications; some of these are as follows.

Vendors and Suppliers

Vendors may request a cancelled cheque to set up electronic payment methods, simplifying transactions.

Landlords

Landlords often ask for a cancelled cheque to facilitate rent payments via Electronic Clearance Service (ECS) or as a security measure for rental agreements.

Loan Providers

Lenders may require a cancelled cheque to validate your bank or Current account for processing loan EMIs.

Utility Bills

Some utility companies accept cancelled cheques for automated bill payments, ensuring hassle-free transactions.

Security Precautions to be taken

Also Read- Top 5 Benefits of Current Account for Start-Ups

Tips For Minimising The Risk Of Fraud Or Misuse When Cancelling A Cheque

Here are some tips to take care of your financial interests when making a cancelled cheque:

Use Dark Ink

When marking a cheque as "CANCELLED," use a pen with dark ink. It ensures the cancellation mark is clear and harder to alter.

Void the Cheque Completely

Make sure to void the cheque thoroughly, covering all areas where information can be written. Draw diagonal lines, "X"s, or fill the entire space to leave no room for manipulation.

Protect Sensitive Information

When cancelling, ensure that important details like your account number, name, and bank information remain visible. Covering these could lead to issues during verification.

Keep Records

Maintain a record of the cancelled cheques, including the date and purpose. This documentation can be valuable in case of disputes or discrepancies.

Securely Dispose of Unused Cheques

If you have unused cheques you don't intend to use, keep them secure or destroy them to prevent unauthorised access.

Educate Yourself

Stay informed about the latest banking security practices and fraud prevention tips to protect yourself and your finances.

By following these precautions, you can cancel cheques confidently, knowing you've taken measures to minimise the risk of fraud or misuse.

Also Read: Types of Current Accounts

Cancelled Cheque: FAQ’s

How to cancel a cheque?

To cancel a cheque, simply write "CANCELLED" between the parallel lines drawn across the cheque. It is also recommended to sign below it to ensure it's void. It prevents unauthorised use.

Is it possible for my bank to cancel my cheque?

No, your bank cannot do it automatically. It depends on your choice. A formal appeal directed towards banks requesting the annulment of a cheque or the halt of an unresolved payment is commonly referred to as a "stop payment order" for a cheque.

Can I sign a cancelled cheque?

It's important not to put any information on a cancelled cheque, including your signature, amount, payee's name, or other details. Keep it blank and mark it as "CANCELLED" to prevent misuse.

Can I block a cheque leaf online?

Absolutely! You have the option to block your cheque either by getting in touch with your bank or by accessing their official website online.

What are the common uses of a cancelled cheque in the BFSI industry?

The common uses of a cancelled cheque in the BFSI industry are:

How to Apply for a New Cheque Book Easily?

Use your bank's mobile app or internet banking to get a new chequebook. Follow the steps they provide, and they'll send the new chequebook by mail. Banks might have varying procedures, so consult your bank for guidance.

You have already rated this article

OK