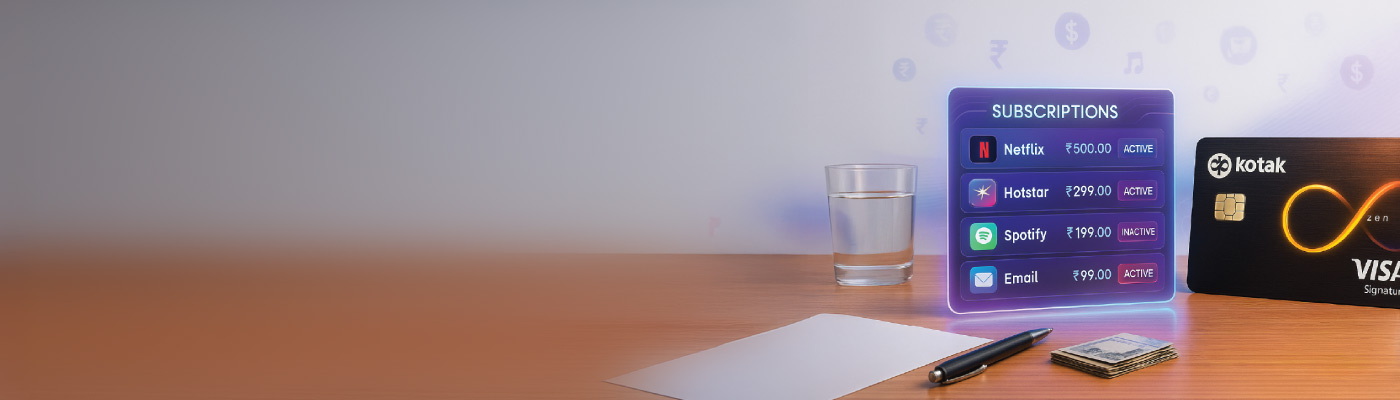

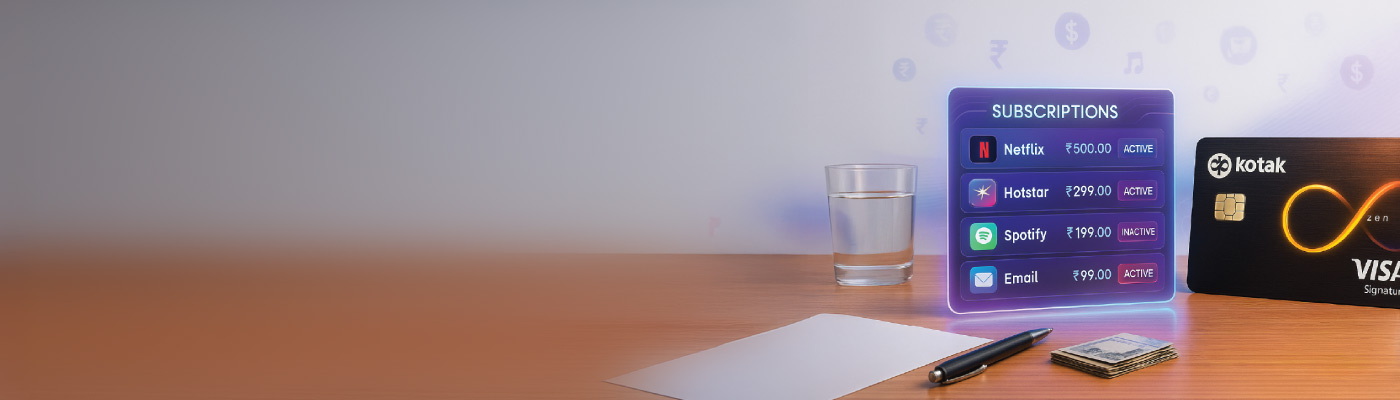

How to Track Autopay/Subscriptions on your Credit Card

Experience the all-new Kotak Netbanking

Simpler, smarter & more intuitive than ever before

Quick Help

Frequently Asked Questions

For Kotak Bank Customers

For Kotak811 Customers

Experience the all-new Kotak Netbanking Lite

Simpler, smarter & more intuitive than ever before. Now accessible on your mobile phone!

Review your autopay arrangements monthly when checking your credit card statement, and conduct a comprehensive audit quarterly to identify and cancel unused subscriptions.

Yes, you can set category-wise spending limits for autopay transactions and receive alerts when approaching these limits through your digital banking dashboard.

Most merchants will attempt to charge the expired card initially. Update your payment information with each service provider or contact Kotak support to update merchant payment details.

Report disputed charges immediately through the Kotak help centre or mobile app dispute section, providing transaction details and the reason for dispute.

Disclaimer: This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. The Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Article. The information contained in this Article is sourced from empaneled external experts for the benefit of the customers and it does not constitute legal advice from the Bank. The Bank, its directors, employees and the contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein. Tax laws are subject to amendment from time to time. The above information is for general understanding and reference. This is not legal advice or tax advice, and users are advised to consult their tax advisors before making any decision or taking any action.

By clicking on the hyper-link, you will be leaving www.kotak.com and entering website operated by other parties. Kotak Mahindra Bank does not control or endorse such websites, and bears no responsibility for them.

At your request, you are being re-directed to a third party site - https://www.billdesk.com/pgmerc/kotakcard/ wherein you can make your payment from a different bank account. Kotak Cards does not guarantee or warrant the accuracy or completeness of the information, materials, services or the reliability of any service, advice, opinion statement or other information displayed or distributed on the third party site. You shall access this site solely for purposes of payment of your bills and you understand and acknowledge that availing of any services offered on the site or any reliance on any opinion, advice, statement, memorandum, or information available on the site shall be at your sole risk. Kotak Cards and its affiliates, subsidiaries, employees, officers, directors and agents, expressly disclaim any liability for any deficiency in the services offered by BilIDesk whose site you are about to access. Neither Kotak Cards nor any of its affiliates nor their directors, officers and employees will be liable to or have any responsibility of any kind for any loss that you incur in the event of any deficiency in the services of BiIIDesk to whom the site belongs, failure or disruption of the site of BilIDesk, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials.

Note: Available in select banks only. Kotak Cards reserves the right to add/delete banks without prior notice. © Kotak Mahindra Bank. All rights reserved

By clicking on the hyper-link, you will be leaving www.kotak.com and entering website operated by other parties. Kotak Mahindra Bank does not control or endorse such websites, and bears no responsibility for them.

By clicking on the hyper-link, you will be leaving www.kotak.com and entering website operated by other parties. Kotak Mahindra Bank does not control or endorse such websites, and bears no responsibility for them.

By clicking on the hyper-link, you will be leaving www.kotak.com and entering website operated by other parties. Kotak Mahindra Bank does not control or endorse such websites, and bears no responsibility for them.

By clicking on the hyper-link, you will be leaving www.kotak.com and entering website operated by other parties. Kotak Mahindra Bank does not control or endorse such websites, and bears no responsibility for them.

By clicking on the hyper-link, you will be leaving www.kotak.com and entering website operated by other parties. Kotak Mahindra Bank does not control or endorse such websites, and bears no responsibility for them.

Introduction

Noticed a charge on your credit card for a subscription you forgot about? Or a gym membership you thought you had cancelled?

With so many services running on autopay, it’s easy to lose track. One missed update, and you are billed again.

In this guide, we break down how to spot, manage and stay on top of recurring payments so you are never caught off-guard again.

What is autopay and why should you track it?

Autopay (automatic payment) allows merchants to charge your credit card automatically for recurring services like subscriptions, utilities, and memberships. While convenient, autopay requires careful tracking to avoid financial surprises.

Unmonitored autopay arrangements often lead to duplicate charges, forgotten subscriptions, and budget overruns.

Effective autopay tracking helps you maintain better financial control, prevents unwanted charges, and ensures you're only paying for services you actively use. This practice becomes essential for managing multiple subscriptions across different categories and maintaining a clear view of your monthly expenses.

What autopay features does Kotak Credit Card offer?

Kotak Credit Cards provide comprehensive autopay management through integrated digital banking platforms, allowing you to view, modify, and cancel automatic payments directly from your dashboard.

The platform offers real-time subscription tracking, categorising your recurring payments by merchant type entertainment, utilities, shopping, and more. You'll receive detailed transaction alerts for each autopay charge, helping you stay informed about when and where your money goes.

Security features include instant notifications for new autopay setups and spending limit controls for automatic payments. The system also provides historical data showing your subscription trends over time, making it easier to identify patterns and optimise your recurring expenses.

Discover smart credit card features that make subscription management effortless. Explore Kotak's range of cards designed for modern financial needs.

How can you set up autopay through net banking or mobile app?

Method 1: Direct Access via Kotak Website

● Visit www.kotak.com and navigate to "Subscriptions/Recurring Payments" under "Others" section ● Click "Proceed" to enter the e-mandate portal

● Create your account or log in with existing credentials

Method 2: Through Product Navigation

● Select "Explore Products" → "Cards" → "Credit Card Services"

● Choose "Subscriptions/Recurring Payments" option

● Click "Know more" followed by "Check now" or "Click here"

Account Setup Process:

● For first-time users: Register with name, email, password, and confirm via email verification code

● Existing users: Enter username and password to access the e-mandate dashboard

● Complete OTP verification sent to your registered mobile number

Essential Setup Requirements:

● All autopay setups require OTP confirmation for security

● The system automatically links to your Kotak credit/debit card

● Keep your registration confirmation for future reference

● Ensure your mobile number and email are updated for notifications

How do you view and monitor your active subscriptions?

Your Kotak e-mandate dashboard provides a comprehensive view of all active recurring payments through the "Merchant e-Mandates Summary" section, displaying merchant names, maximum amounts, end dates, and SiHub IDs for easy identification.

The platform shows due amounts and next payment dates prominently, with options to "View," "Edit," or "Cancel" each subscription directly from the summary page.

You can also access detailed invoice history and transaction records for each merchant, helping you track spending patterns across different subscription categories.

For transactions requiring approval (amounts over ₹5,000 or exceeding your set limits), the system displays "Approve" buttons and sends pending payment notifications to keep you informed of actions needed.

Manage all your payments seamlessly with Kotak's digital banking platform. Experience the convenience of centralised financial control.

How can you cancel autopay on Kotak cards?

Accessing Cancellation Options:

Cancellation Process:

Completing the Cancellation:

Viewing Cancelled Subscriptions:

What are the best practices to avoid unwanted charges?

Regular Monitoring and Reviews:

Proactive Alert Management:

Free Trial Management:

How do you stay updated with due dates and alerts?

Comprehensive SMS Notification System:

Transaction Monitoring:

Dashboard Management:

Conclusion

To manage autopay in credit card accounts involves accessing Kotak's e-mandate system at www.kotak.com, monitoring subscriptions through the dashboard, and maintaining regular oversight. Setup requires visiting Subscriptions/Recurring Payments, completing OTP verification, and configuring payment preferences.

Checking credit card subscriptions through Kotak's dashboard displays all active arrangements with merchant details, amounts, and action options (View, Edit, Cancel). Regular monitoring includes monthly reviews, enabling SMS alerts, and setting spending limits.

To cancel autopay in credit card arrangements: locate the subscription, click Cancel, provide remarks, confirm with OTP, and receive SMS confirmation. Cancelled subscriptions remain accessible via "View Inactive e-Mandate."

Successful management combines automated notifications with monthly audits and immediate removal of unused services. For personalised assistance with subscription management or technical support, contact Kotak's help center for expert guidance tailored to your specific needs.

You have already rated this article

OK