|

Factsheet as on November 30, 2024 |

Factsheet as on November 30, 2024

Structure

Open Ended

Fund Category

Multi Cap

Fund Manager

Chandraprakash Padiyar, Meeta Shetty

Exit Load

Within 90 Days - 1%

Fund Size

Rs 8342 crs

Launch Date

Feb 25, 1993

Investment Objective

To provide Income distribution and long term capital gain while at all times emphasizing the importance of capital appreciation.

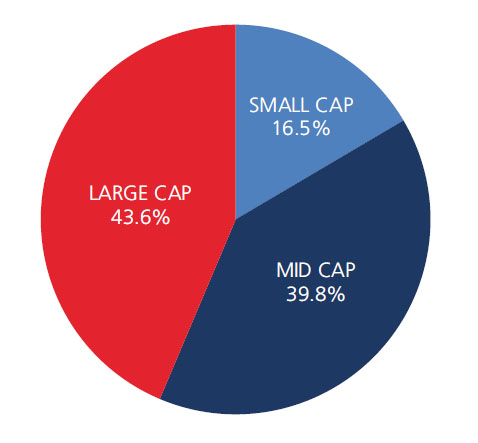

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 25.19 | 19.05 | 17.66 | 19.20 |

| BSE 200 (%) | 24.91 | 17.06 | 14.63 | 17.10 |

Top 10 Holdings

| Company Name | % of Assets |

| HDFC Bank Ltd. | 9.6 |

| Varun Beverages Ltd. | 5.1 |

| State Bank Of India | 4.4 |

| Reliance Industries Ltd. | 4.0 |

| ICICI Bank Ltd. | 4.0 |

| PI Industries Ltd. | 3.7 |

| IDFC First Bank Ltd. Erstwhile IDFC Bank Ltd. | 3.3 |

| Bharti Airtel Ltd. | 3.2 |

| Fortis Healthcare Ltd. | 3.0 |

| HDFC Asset Management Company Ltd. | 2.6 |

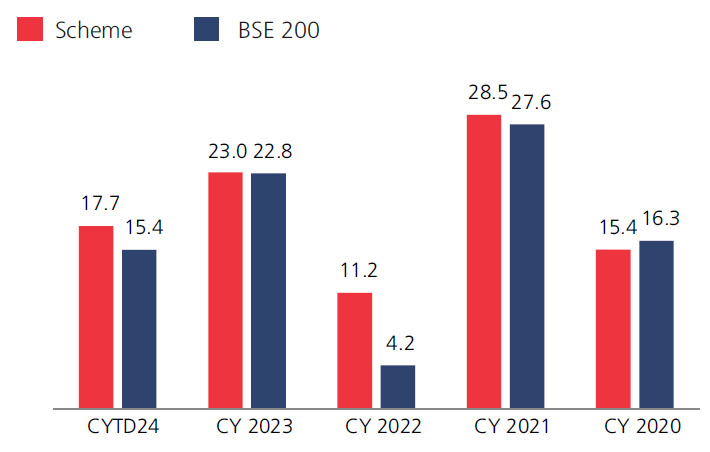

Year On Year Performance (Scheme V/S BSE 200)

Ratios:

| Standard Deviation | 12.08 |

| Beta | 0.86 |

| Information Ratio | 0.17 |

| Sharpe Ratio | 0.24 |

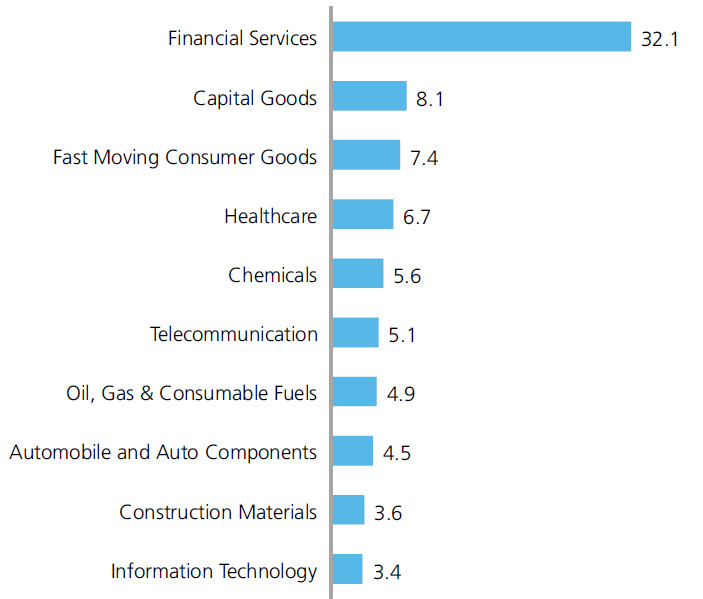

Top 10 Sectoral Holdings (%)

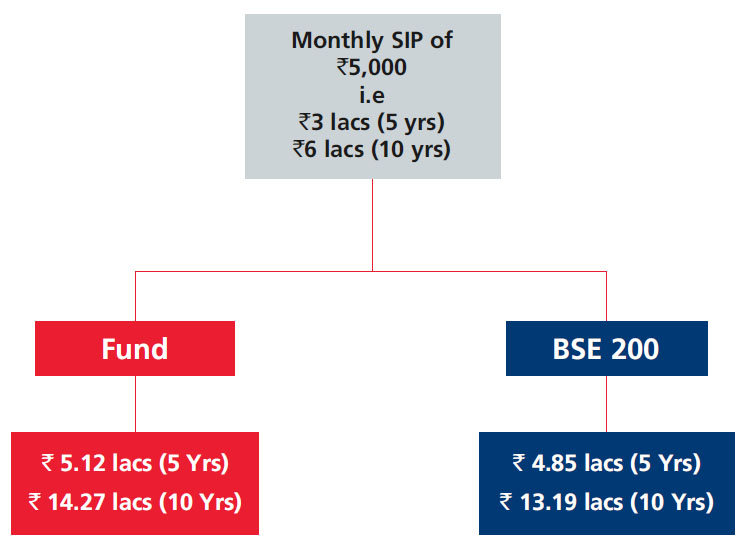

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390