|

Factsheet as on November 30, 2024 |

Factsheet as on November 30, 2024

Structure

Open Ended

Fund Category

Thematic/Sectoral

Fund Manager

S Bharath, Rohit Seksaria, Pathanjali Srinivasan

Exit Load

Within 365 Days - 1%

Fund Size

Rs 3907 crs

Launch Date

September 21, 2018

Investment Objective

To seek capital appreciation by investing in equity / equity related instruments of companies who drive a majoirty of their income from business predominantly in the Services sector of the economy. however, there can be no assurance that the investment objective of the Scheme will be realized. Services sector includes healthcare, Fitness, tourism & hospitality, transportation & Logistics, education, Staffing, Wealth management, media, Retail, aviation, Legal, architecture, Design services etc.

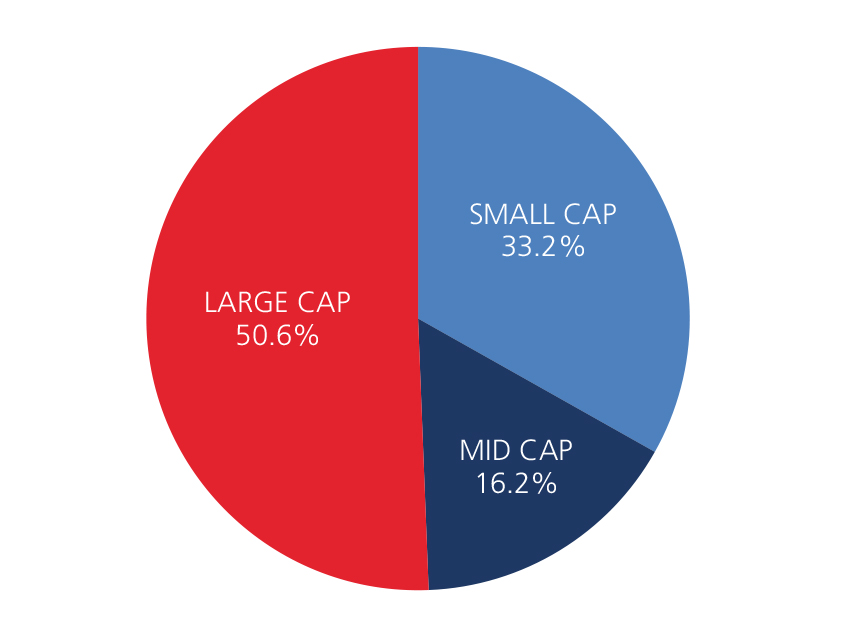

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 24.06 | 20.90 | 16.04 | 21.48 |

| Nifty 500 (%) | 26.12 | 19.28 | 15.70 | 18.23 |

Top 10 Holdings

| Company Name | % of Assets |

| Bharti Airtel Ltd. | 8.1 |

| HDFC Bank Ltd. | 5.2 |

| Bajaj Finance Ltd. | 4.7 |

| Reliance Industries Ltd. | 4.3 |

| ICICI Bank Ltd. | 3.9 |

| Axis Bank Ltd. | 2.9 |

| Zomato Ltd. | 2.8 |

| Apollo Hospitals Enterprise Ltd. | 2.7 |

| Multi Commodity Exchange of India Ltd. | 2.6 |

| ICICI Prudential Life Insurance Company Ltd. | 2.6 |

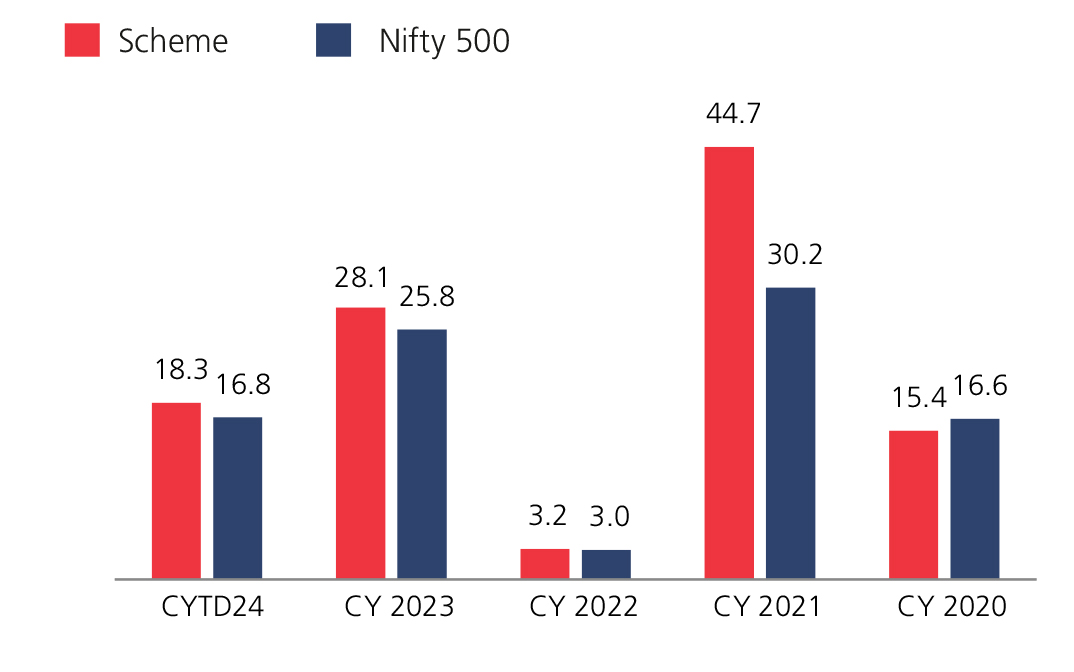

Year On Year Performance (Scheme V/S Nifty 500)

Ratios:

| Standard Deviation | 13.32 |

| Information Ratio | 0.02 |

| Beta | 0.92 |

| Sharpe Ratio | 0.19 |

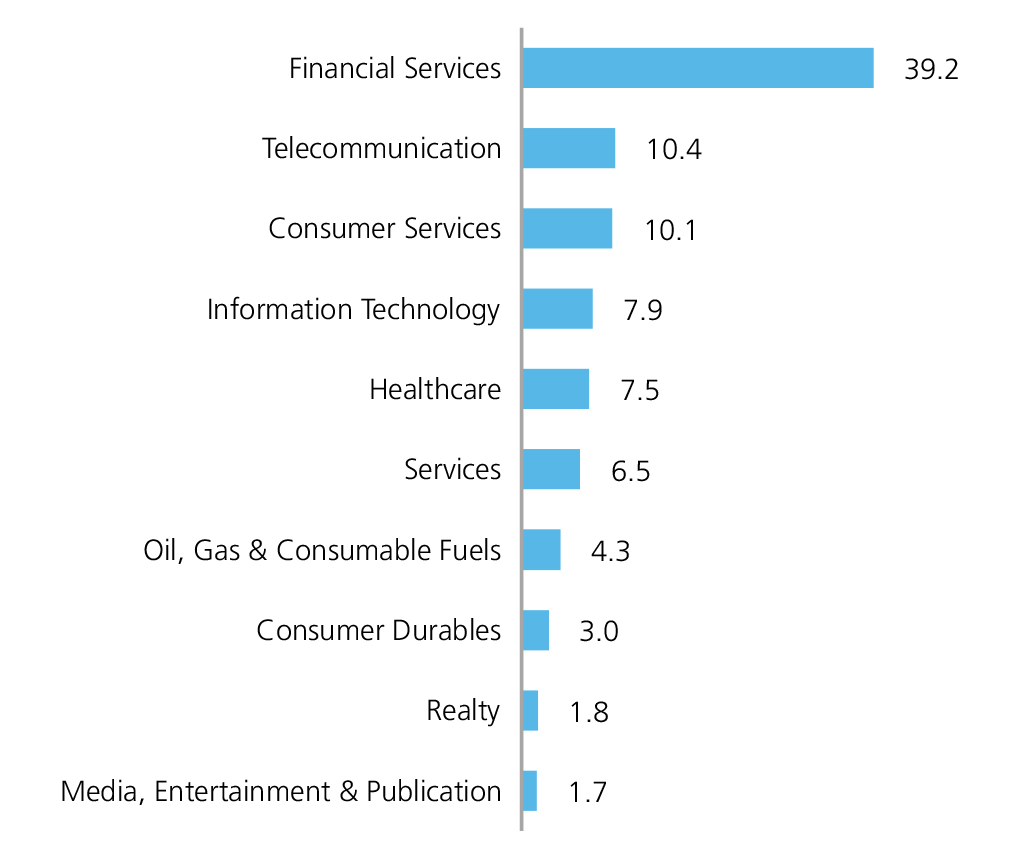

Top 10 Sectoral Holdings (%)

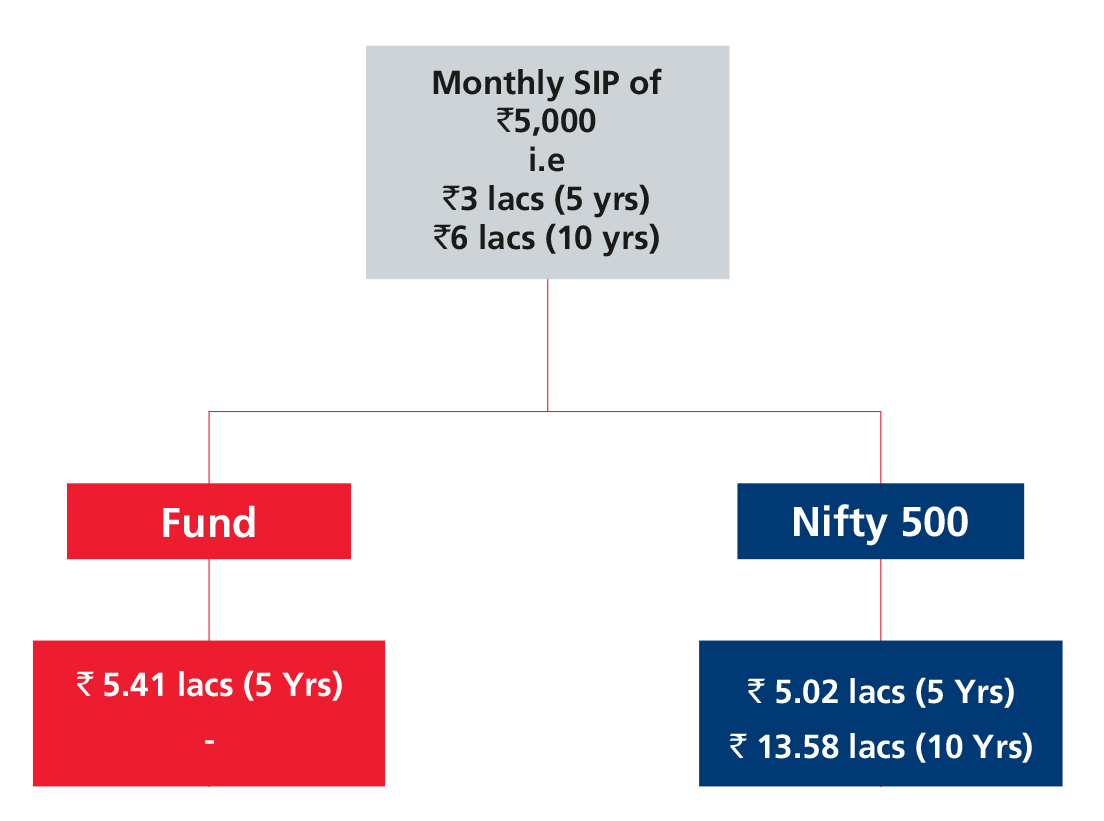

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390