|

Factsheet as on December 31, 2025 |

Factsheet as on December 31, 2025

Structure

Open Ended

Fund Category

Multi Asset Allocation

Fund Manager

DineshDinesh Balachandran, Mansi Sajeja, Vandna Soni

Exit Load

Within 1 Year - 1%

Fund Size

Rs 13,033 crs

Launch Date

December 21, 2005

Investment Objective

To provide the investors an opportunity to invest in an actively managed portfolio of multiple asset classes.

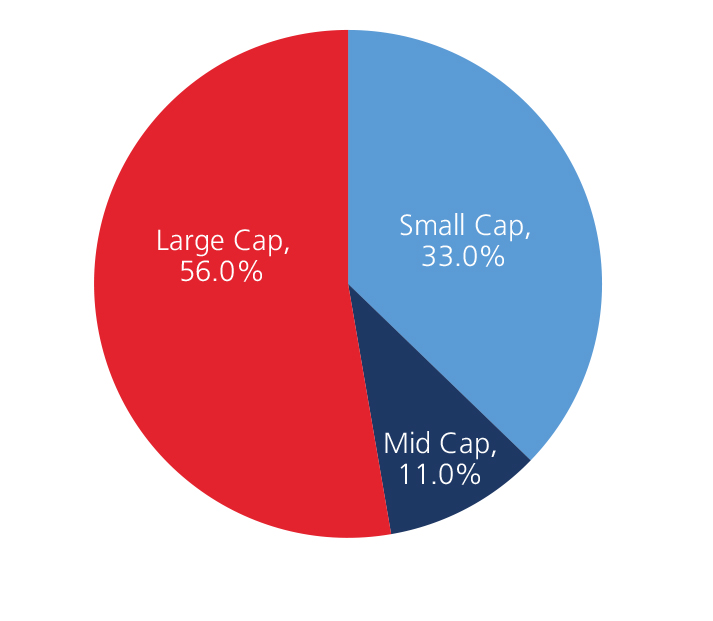

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 18.58 | 15.58 | 18.45 | 14.77 |

| 45% BSE 500 45% BSE 500 TRI + 40% Crisil Composite Bond Fund Index + 10% Domestic prices of Gold + 5% Domestic prices of silver | 18.46 | 16.17 | 15.86 | 12.48 |

Top 10 Holdings

| Company Name | % of Assets |

| Reliance Industries Ltd. | 2.1 |

| HDFC Bank Ltd. | 2.0 |

| Federal Bank Ltd. | 1.8 |

| PB Fintech Ltd. | 1.4 |

| Privi Speciality Chemicals Ltd. | 1.3 |

| Bandhan Bank Ltd. | 1.3 |

| Indian Oil Corporation Ltd. | 1.3 |

| Gokaldas Exports Ltd. | 1.2 |

| Punjab National Bank | 1.2 |

| ITC Ltd. | 1.2 |

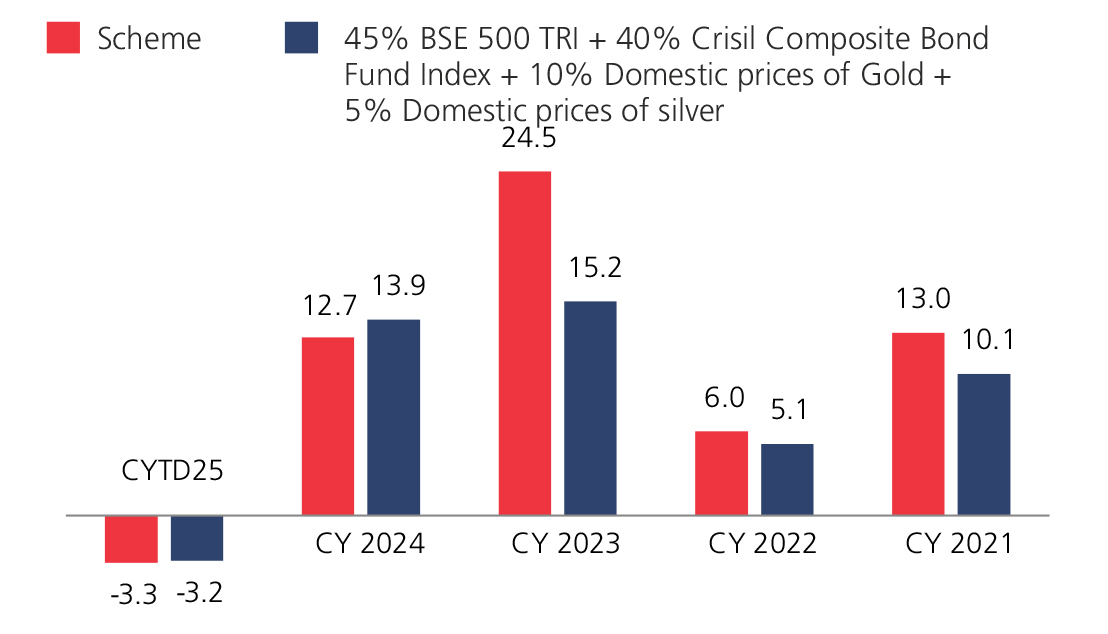

Year On Year Performance (Scheme V/S 45% BSE 500 TRI + 40% Crisil Composite Bond Fund Index + 10% Domestic prices of Gold + 5% Domestic prices of silver)

Ratio

| Standard Deviation | 6.67 |

| Information Ratio | - |

| Beta | 0.72 |

| Sharpe Ratio | 0.40 |

Asset Allocation

| Equity | 39.75 |

| Debt | 32.50 |

| Others | 27.75 |

Top 5 Sectoral Holdings (%)

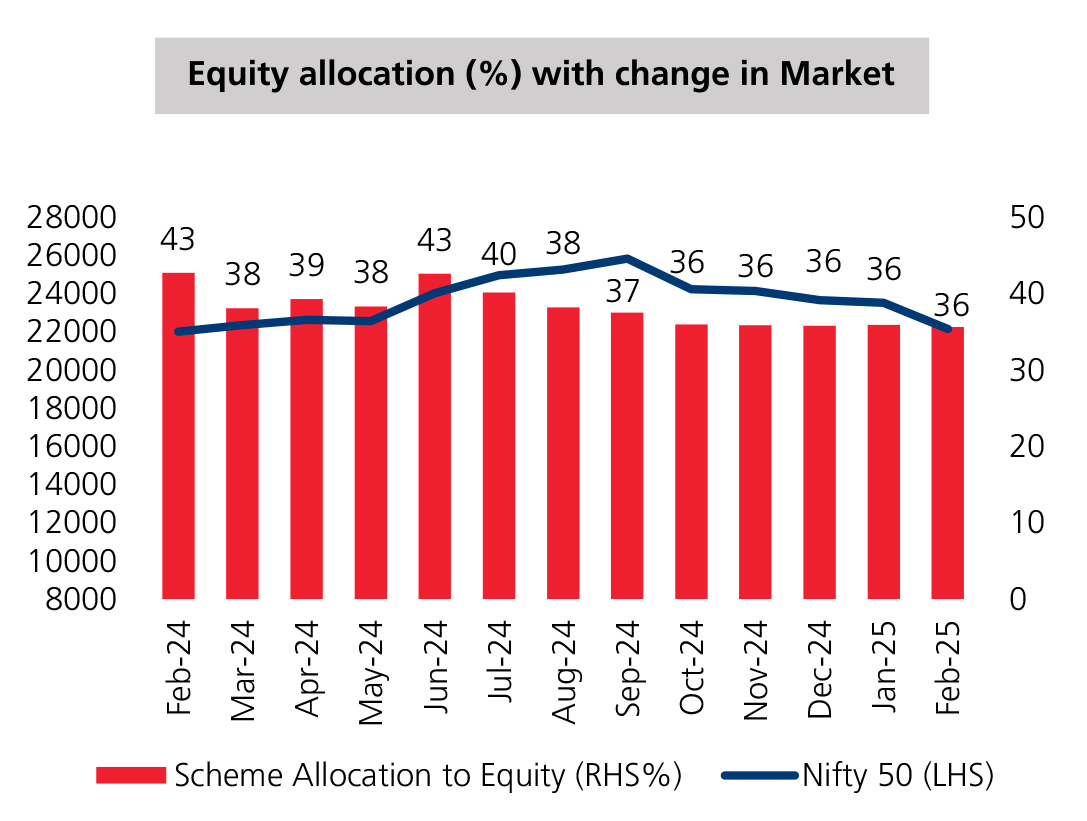

Equity Allocation vs Nifty 50

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390