|

Factsheet as on August 31, 2025 |

Factsheet as on August 31, 2025

Structure

Open Ended

Fund Category

Thematic/Sectoral

Fund Manager

Sailesh Raj Bhan, Divya Dutt Sharma, Lokesh Maru

Exit Load

Within 1 Month - 1%

Fund Size

Rs 8,357 crs

Launch Date

June 05, 2004

Investment Objective

To generate consistent returns by investing in equity or fixed income securities of pharma and other associated companies.

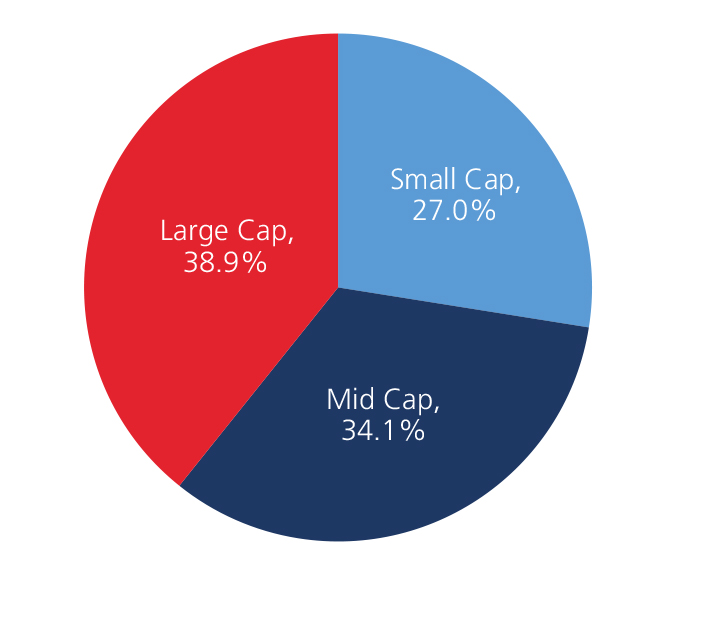

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | -2.07 | 21.16 | 22.52 | 19.01 |

| Nifty 500 (%) | -5.37 | 15.23 | 13.59 | 19.12 |

Top 10 Holdings

| Company Name | % of Assets |

| Sun Pharmaceutical Industries Ltd. | 11.9 |

| Divi Laboratories Ltd. | 7.3 |

| Cipla Ltd. | 6.1 |

| Lupin Ltd. | 6.1 |

| Apollo Hospitals Enterprise Ltd. | 5.9 |

| Dr Reddys Laboratories Ltd. | 5.9 |

| Medplus Health Services Ltd. | 3.7 |

| Vijaya Diagnostic Centre Ltd. | 3.5 |

| Glaxo Smithkline Pharmaceuticals Ltd. | 3.0 |

| Gland Pharma Ltd. | 3.0 |

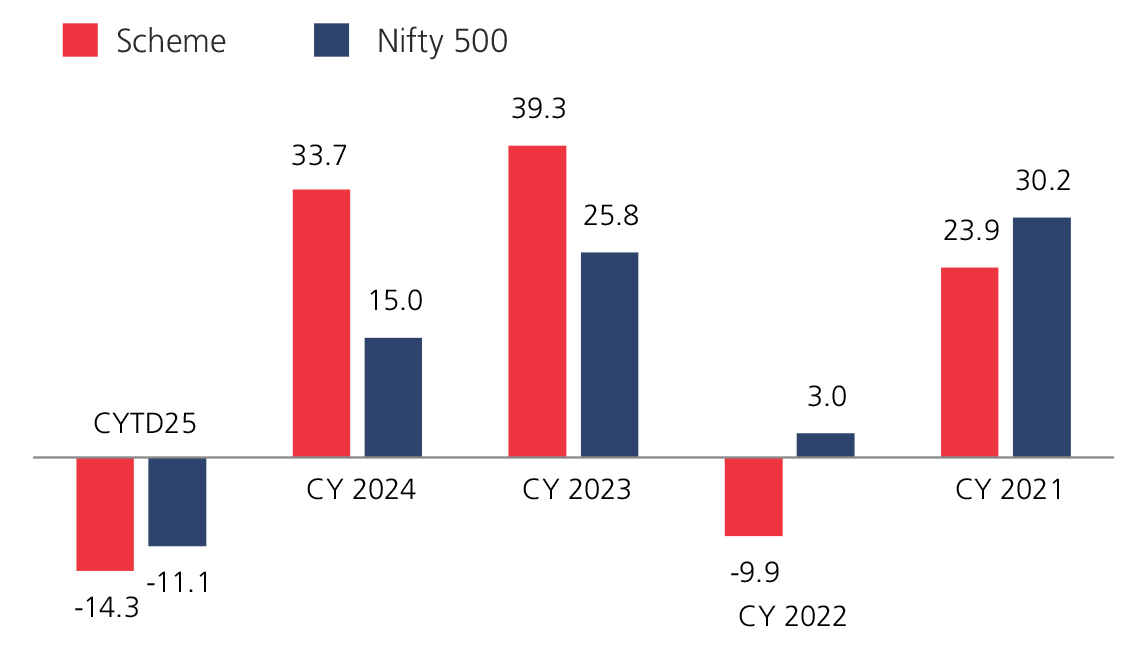

Year On Year Performance (Scheme V/S Nifty 500)

Ratios:

| Standard Deviation | 14.84 |

| Information Ratio | 0.17 |

| Beta | 0.78 |

| Sharpe Ratio | 0.26 |

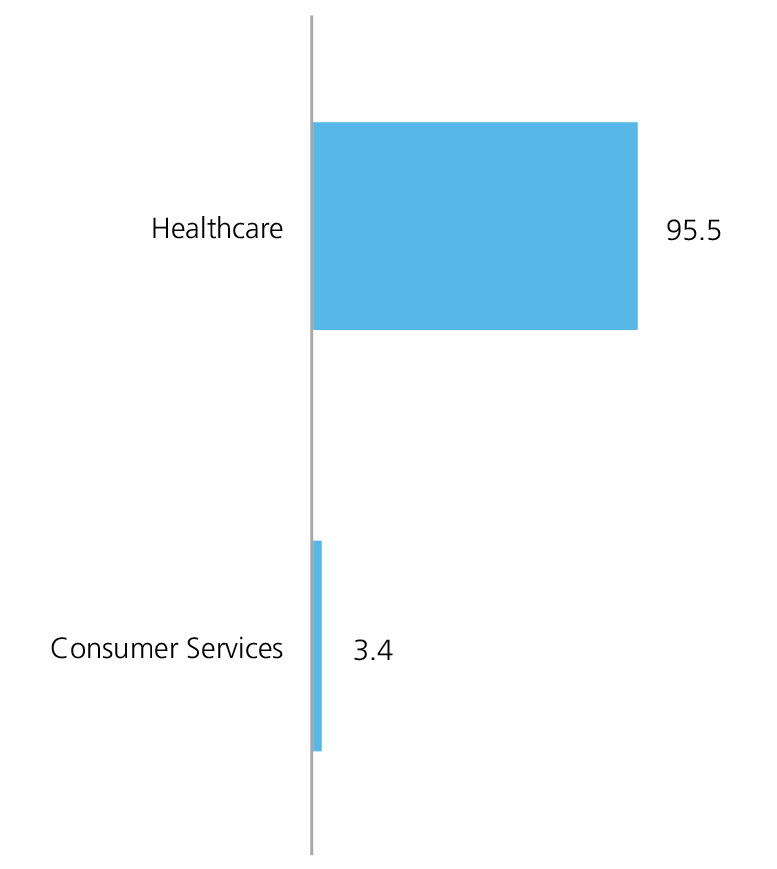

Top 10 Sectoral Holdings (%)

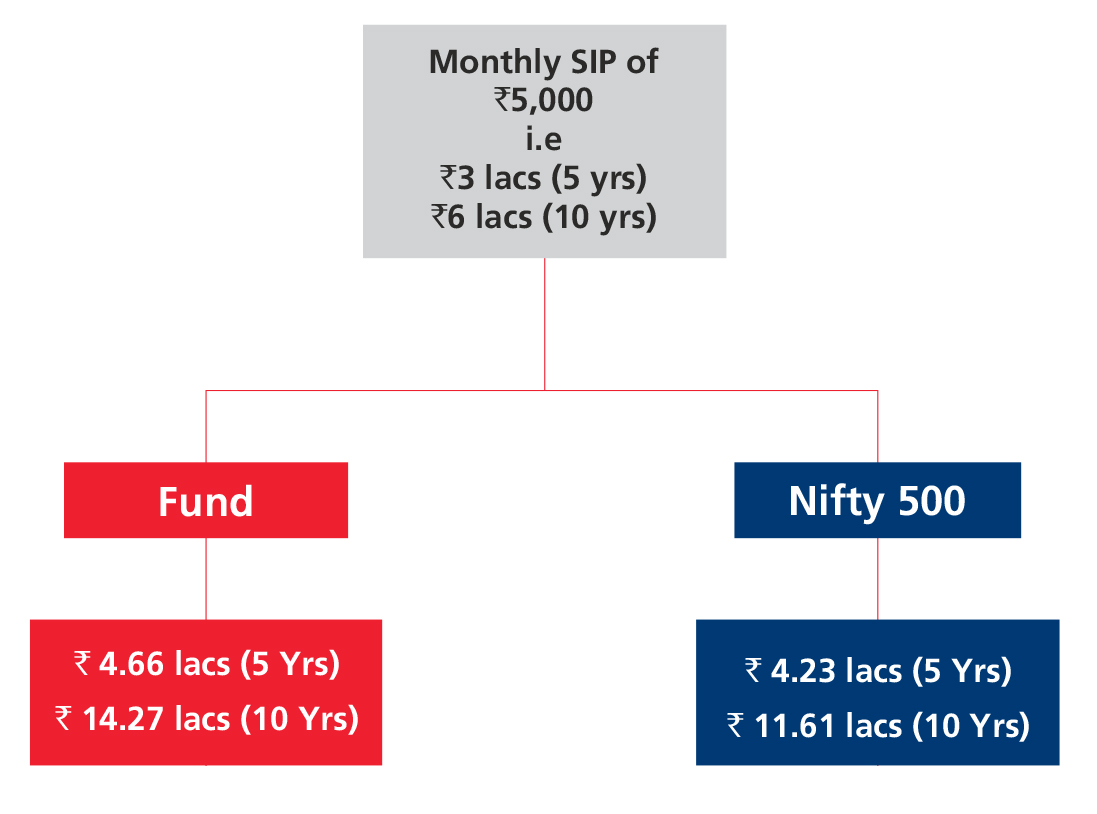

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390