|

Factsheet as on May 31, 2025 |

Factsheet as on May 31, 2025

Structure

Open Ended

Fund Category

Mid Cap

Fund Manager

Rupesh Patel

Exit Load

Within 1 Month - 1%

Fund Size

Rs 36836 crs

Launch Date

October 08, 1995

Investment Objective

The primary investment objective is to achieve long term growth of capital by investing in equity and equity related securities through a research based investment approach

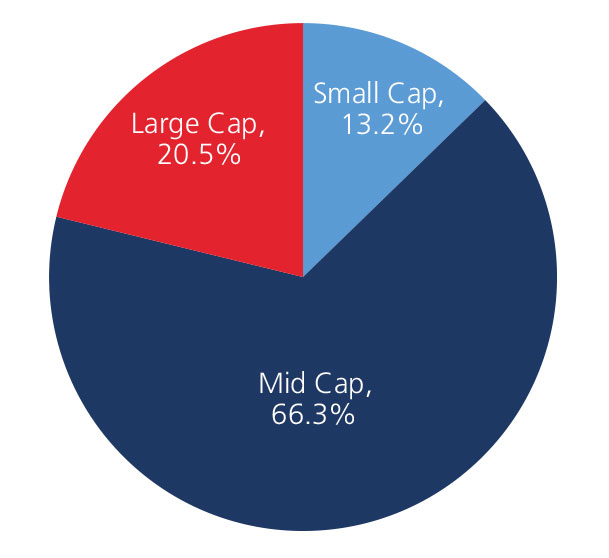

Market Cap Allocation

Scheme Performance

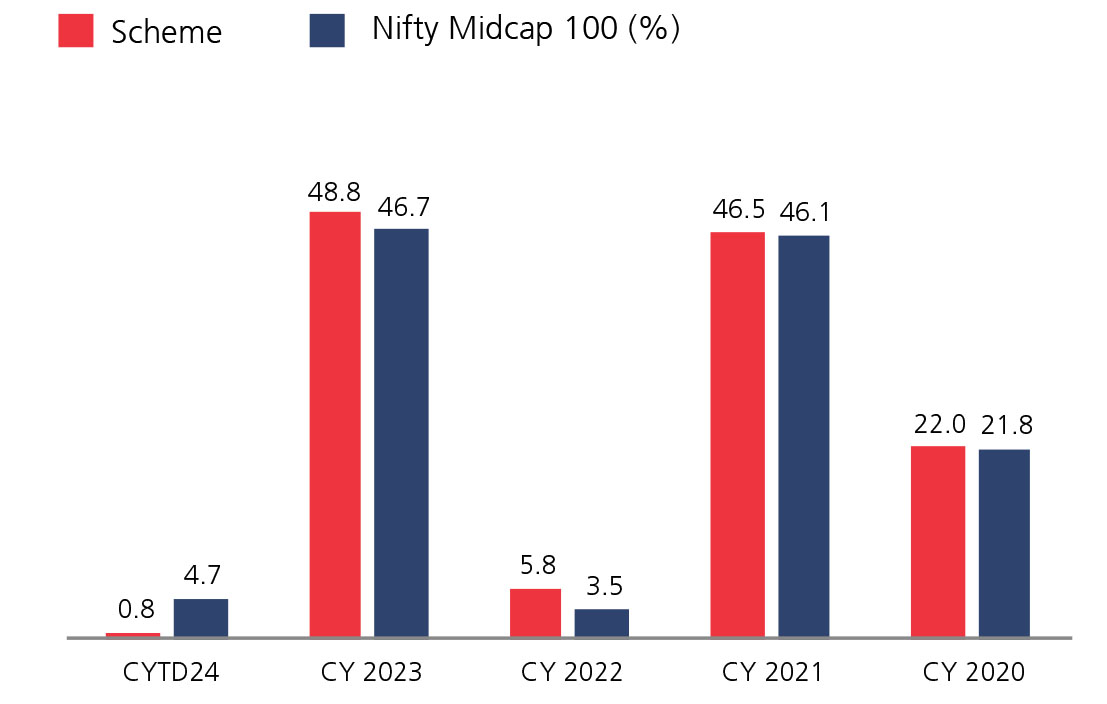

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 13.17 | 32.01 | 27.94 | 34.60 |

| Nifty Midcap 100 (%) | 11.08 | 30.41 | 26.62 | 33.99 |

Top 10 Holdings

| Company Name | % of Assets |

| BSE Ltd. | 3.8 |

| Cholamandalam Financial Holdings Ltd. | 2.7 |

| Fortis Healthcare Ltd. | 2.5 |

| Persistent Systems Ltd. | 2.5 |

| Power Finance Corporation Ltd. | 2.2 |

| Federal Bank Ltd. | 2.2 |

| Au Small Finance Bank Ltd. | 2.2 |

| Max Financial Services Ltd. | 2.1 |

| Voltas Ltd. | 2.0 |

| Max Healthcare Institute Ltd. | 1.9 |

Year On Year Performance (Scheme V/S Nifty Midcap 100)

Ratios

| Standard Deviation | 16.21 |

| Information Ratio | 0.44 |

| Beta | 1.04 |

| Sharpe Ratio | 0.34 |

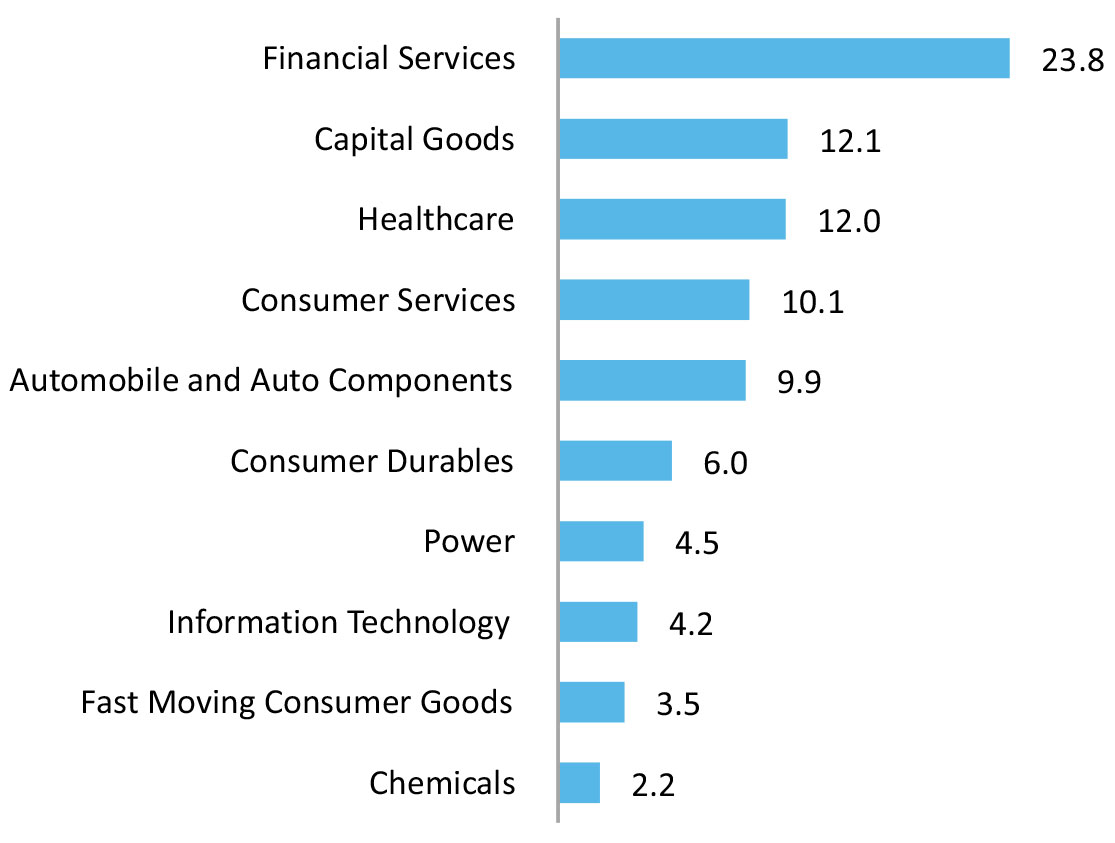

Top 10 Sectoral Holdings (%)

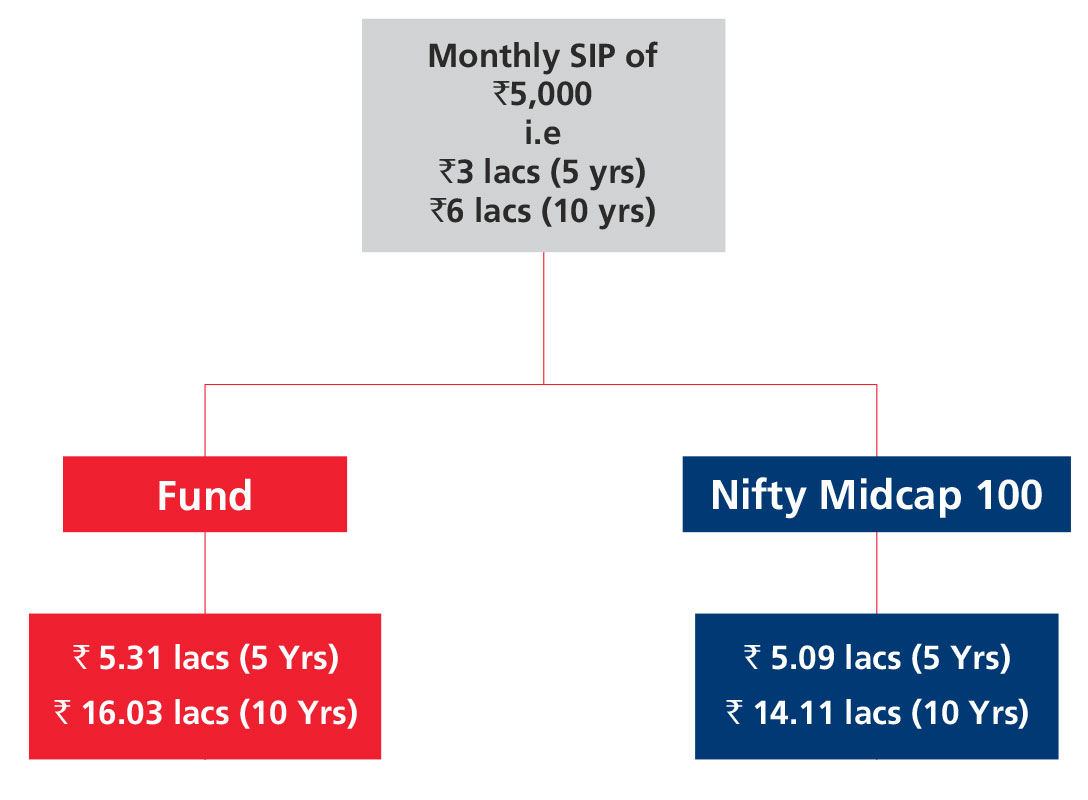

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390