|

Factsheet as on May 31, 2025 |

Factsheet as on May 31, 2025

Structure

Open Ended

Fund Category

Mid Cap

Fund Manager

Ankit Jain

Exit Load

Within 1 Year - 1%

Fund Size

Rs 16337 crs

Launch Date

July 29, 2019

Investment Objective

The investment objective of the scheme is to provide long term capital appreciation from a portfolio investing predominantly in Indian equity and equity related securities of midcap companies. From time to time, the fund manager may also participate in other Indian equities and equity related securities for optimal portfolio construction. There is no assurance that the investment objective of the Scheme will be realized.

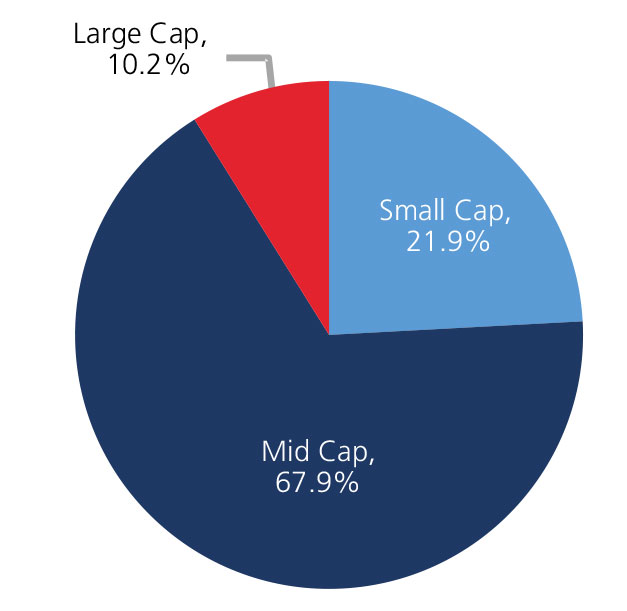

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 7.42 | 25.25 | 20.94 | 30.88 |

| Nifty Midcap 100 (%) | 11.08 | 30.41 | 26.62 | 33.99 |

Top 10 Holdings

| Company Name | % of Assets |

| Lupin Ltd. | 3.0 |

| Mphasis Ltd. | 2.7 |

| Tata Communications Ltd. | 2.5 |

| Delhivery Ltd. | 2.5 |

| Bharat Forge Ltd. | 2.5 |

| L&T Finance Ltd.Erstwhile L&T Finance Holding Ltd. | 2.4 |

| Prestige Estates Projects Ltd. | 2.3 |

| Dalmia Bharat Ltd. | 2.2 |

| Axis Bank Ltd. | 2.1 |

| Hindustan Petroleum Corporation Ltd. | 2.0 |

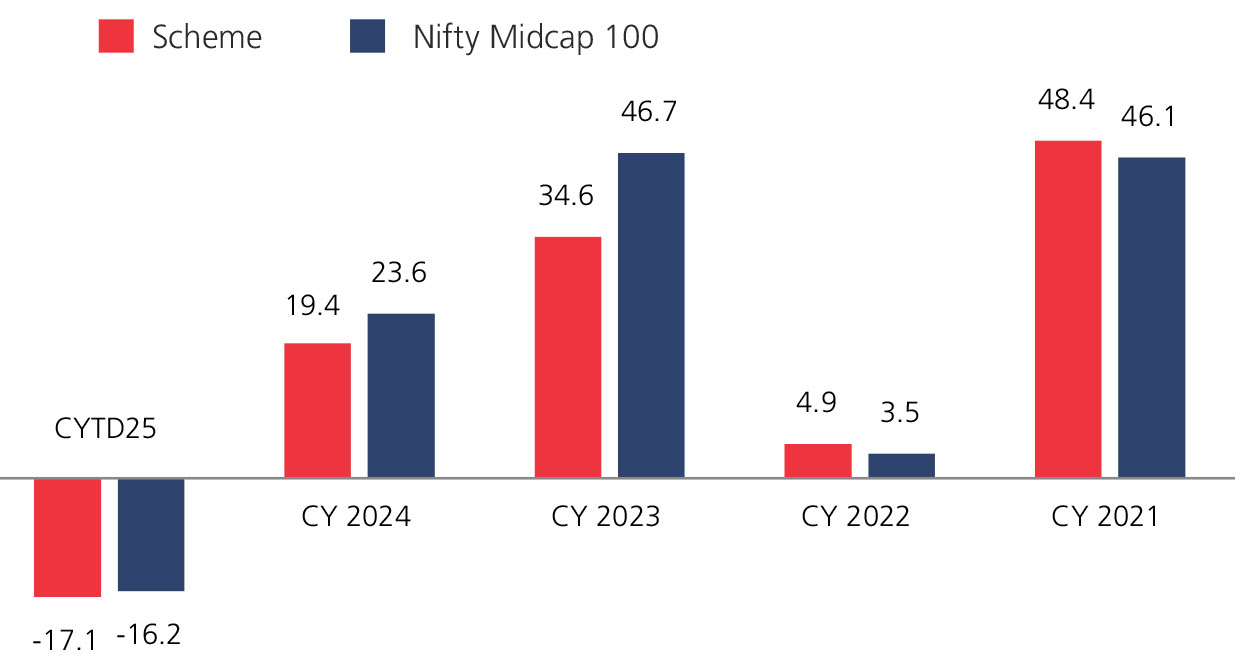

Year On Year Performance (Scheme V/S Nifty Midcap 100)

Ratios

| Standard Deviation | 16.88 |

| Beta | 1.09 |

| Information Ratio | 0.16 |

| Sharpe Ratio | 0.23 |

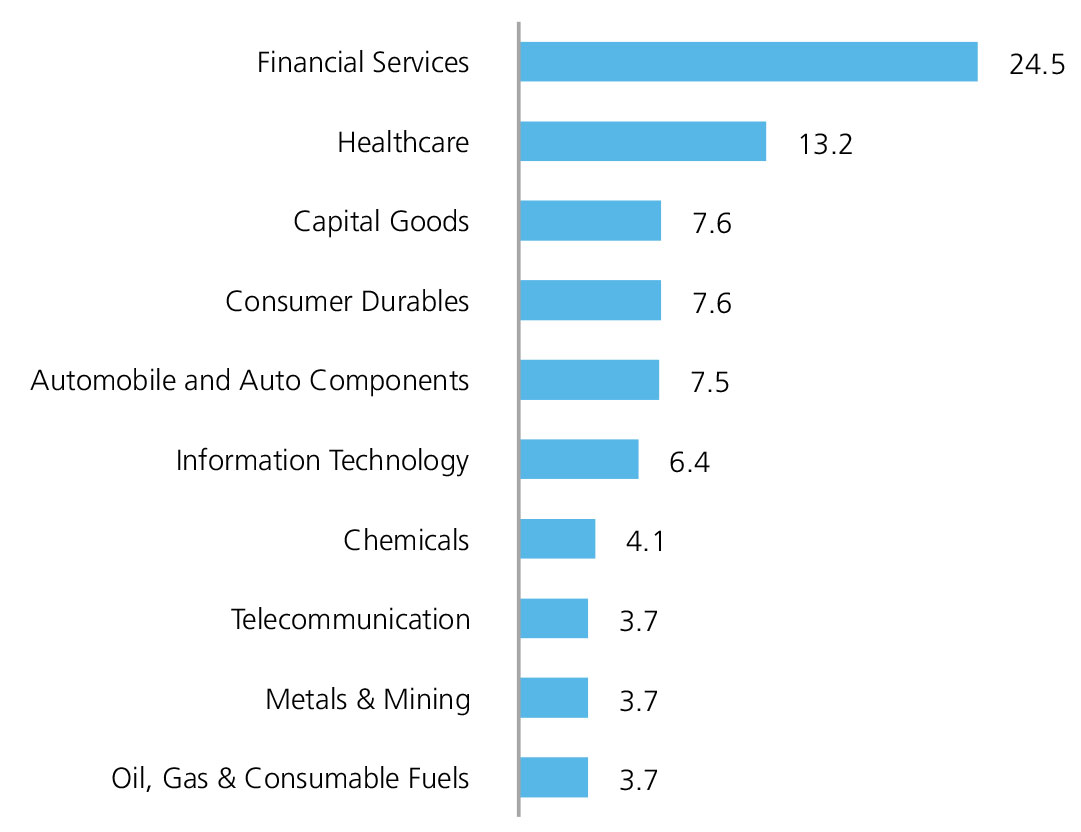

Top 10 Sectoral Holdings (%)

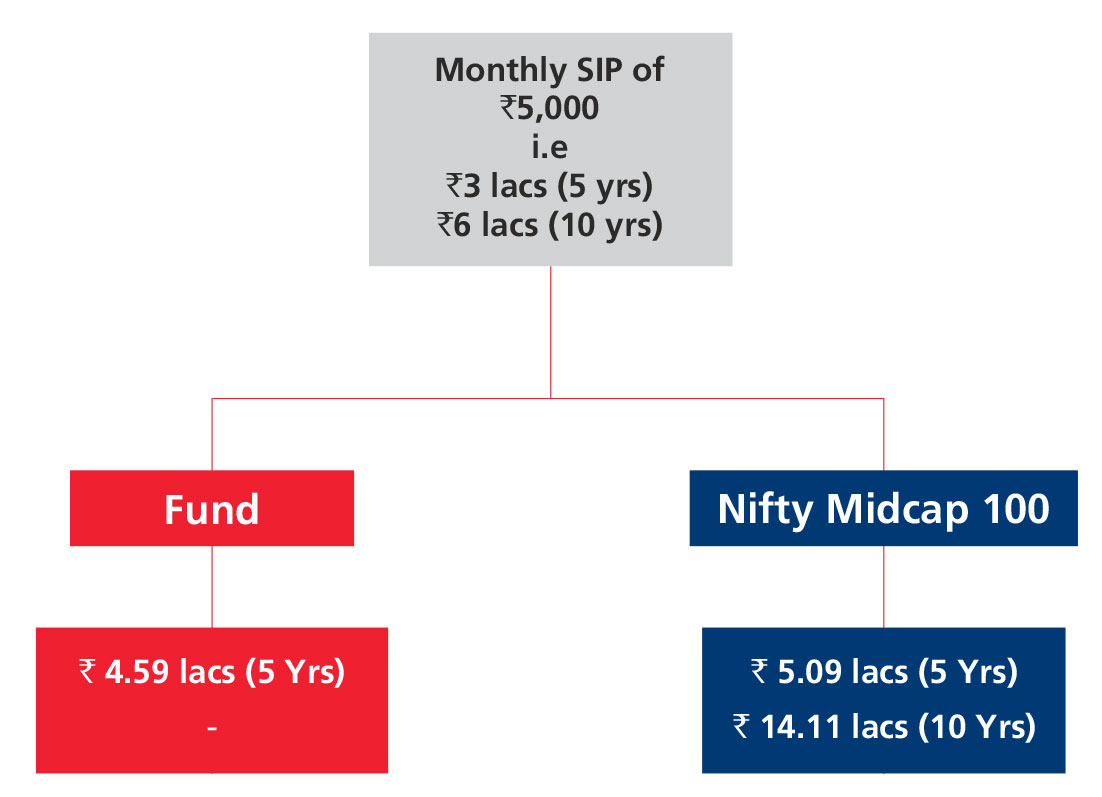

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390