|

Factsheet as on July 31, 2025 |

Factsheet as on July 31, 2025

Structure

Open Ended

Fund Category

ELSS

Fund Manager

Harsha Upadhyaya

Exit Load

Nil

Fund Size

Rs 6355 crs

Launch Date

November 23, 2005

Investment Objective

The investment objective of the scheme is to generate long term capital appreciation from a diversified portfolio of equity and equity related securities and enable investors to avail the income tax rebate, as permitted from time to time.

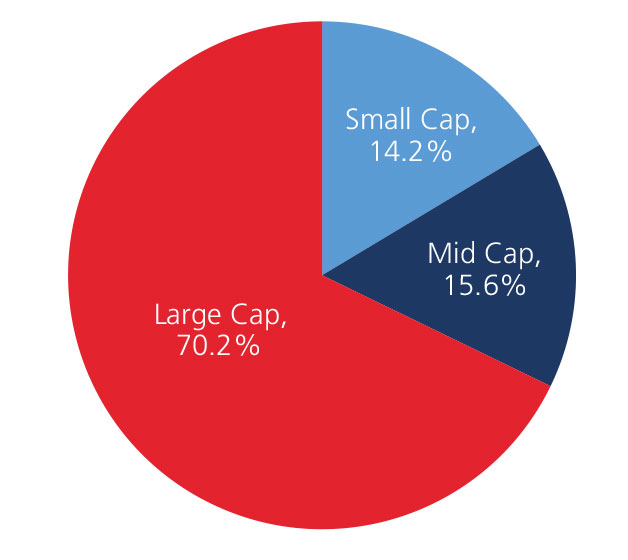

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | -3.93 | 15.98 | 17.40 | 21.79 |

| BSE 200 (%) | -2.86 | 14.63 | 14.60 | 19.30 |

Top 10 Holdings

| Company Name | % of Assets |

| HDFC Bank Ltd. | 9.5 |

| ICICI Bank Ltd. | 6.1 |

| Bharti Airtel Ltd. | 3.8 |

| Infosys Ltd. | 3.6 |

| State Bank Of India | 3.4 |

| Tech Mahindra Ltd. | 3.1 |

| Axis Bank Ltd. | 2.9 |

| NTPC Ltd. | 2.6 |

| Bosch Ltd. | 2.5 |

| Hindustan Petroleum Corporation Ltd. | 2.5 |

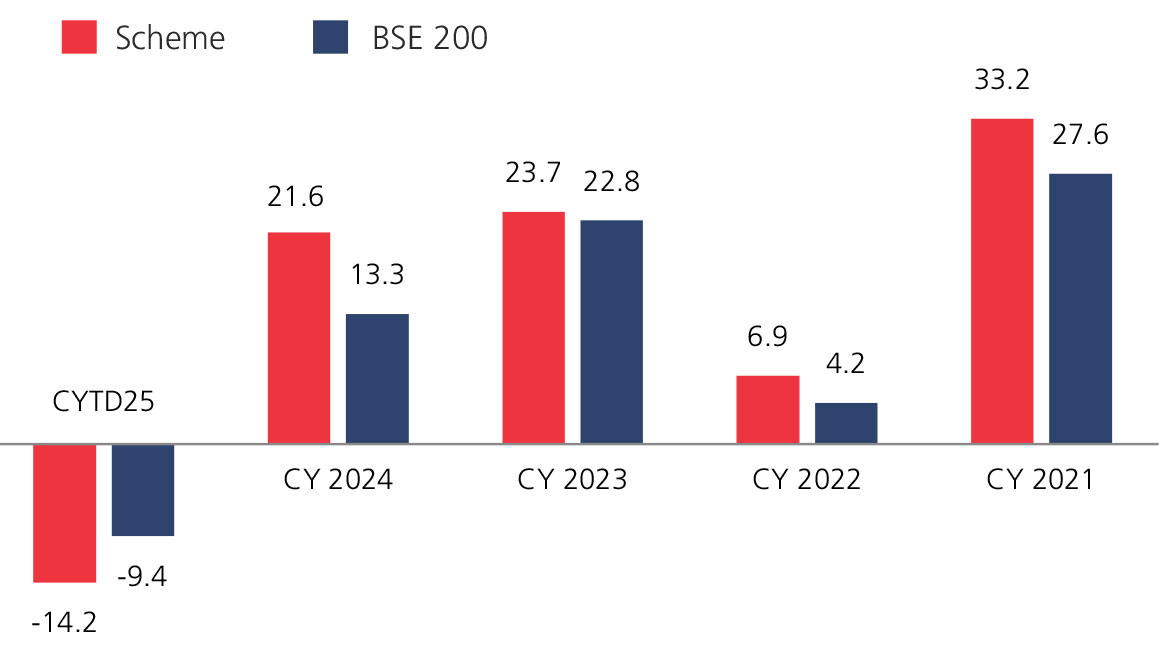

Year On Year Performance (Scheme V/S BSE 200)

Ratios

| Standard Deviation | 12.81 |

| Information Ratio | 0.15 |

| Beta | 0.92 |

| Sharpe Ratio | 0.23 |

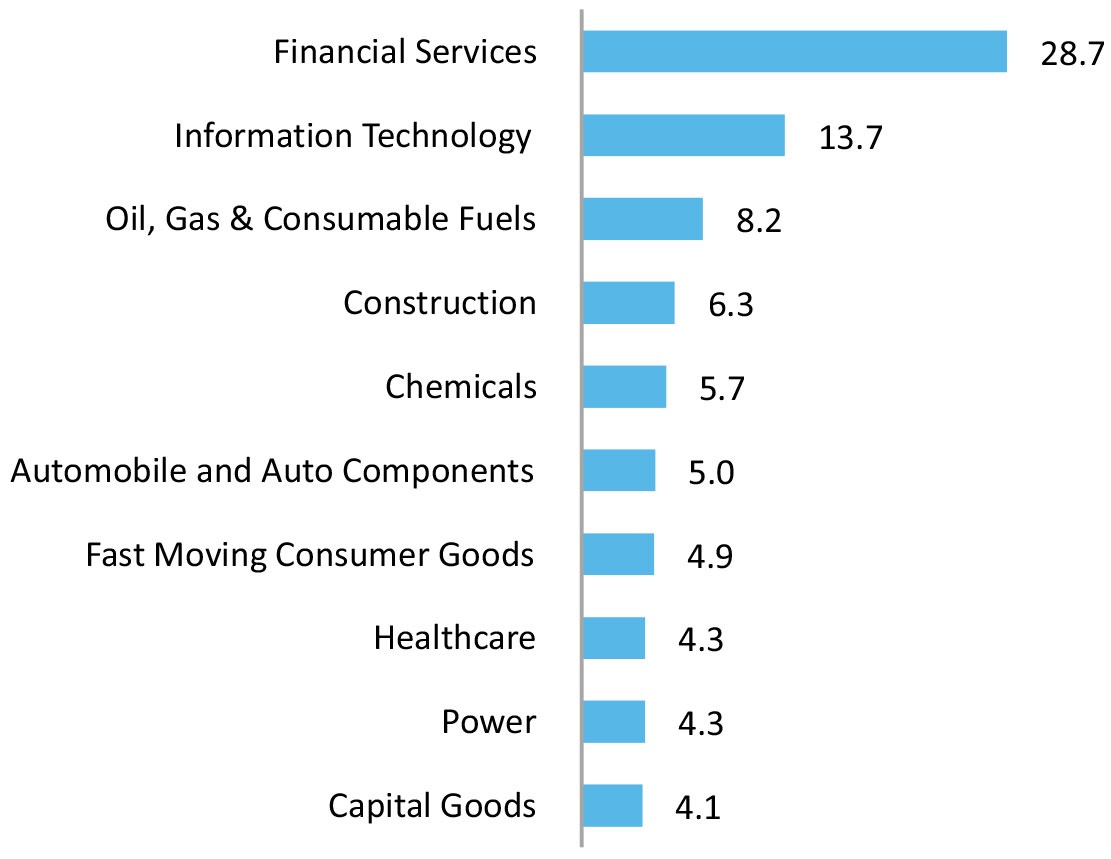

Top 10 Sectoral Holdings (%)

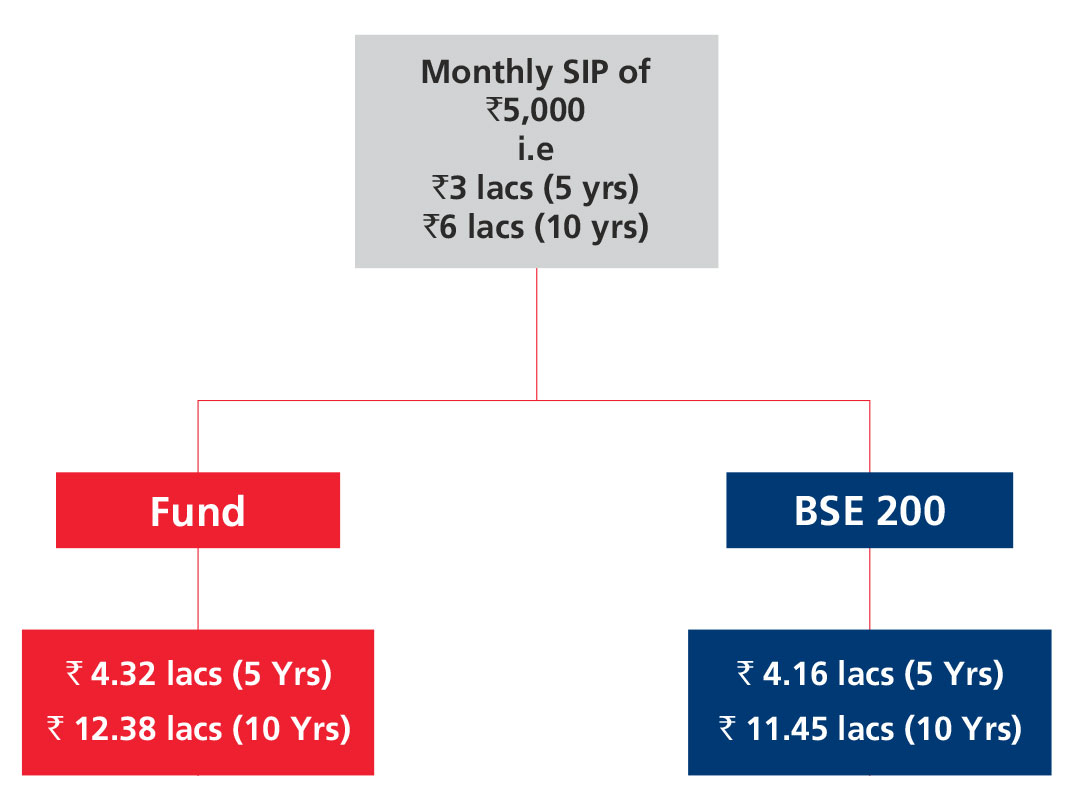

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390