|

Factsheet as on November 30, 2024 |

Factsheet as on November 30, 2024

Structure

Open Ended

Fund Category

Thematic/Sectoral

Fund Manager

Harish Bihani

Exit Load

Within 1 Year - 1%

Fund Size

Rs 2694 crs

Launch Date

October 31, 2019

Investment Objective

The investment objective of the scheme is to generate capital appreciation from a diversified portfolio of equity, equity related instruments and units of global mutual funds which invests into such companies that utilize new forms of production, technology,distribution or processes which are likely to challenge existing markets or value networks, or displace established market leaders, or bring in novel products and/or business models.

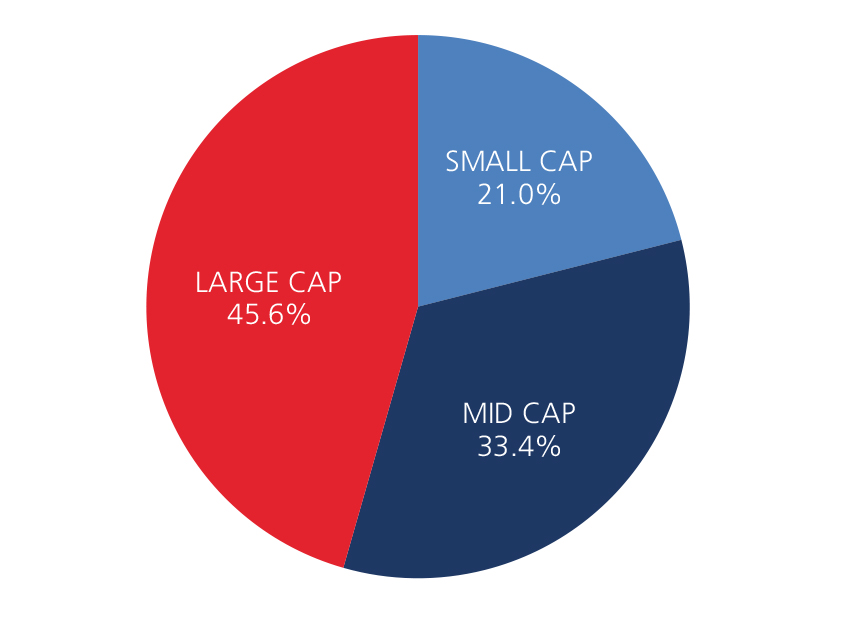

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 34.84 | 30.11 | 16.54 | 24.10 |

| Nifty 500 (%) | 26.12 | 19.28 | 15.70 | 18.23 |

Top 10 Holdings

| Company Name | % of Assets |

| International Fund | 16.2 |

| Zomato Ltd. | 4.7 |

| Bharti Hexacom Ltd. | 3.5 |

| Reliance Industries Ltd. | 3.1 |

| Interglobe Aviation Ltd. | 3.0 |

| UNO Minda Ltd. | 2.6 |

| Sun Pharmaceutical Industries Ltd. | 2.6 |

| Mahindra & Mahindra Ltd. | 2.5 |

| Maruti Suzuki India Ltd. | 2.5 |

| Persistent Systems Ltd. | 2.5 |

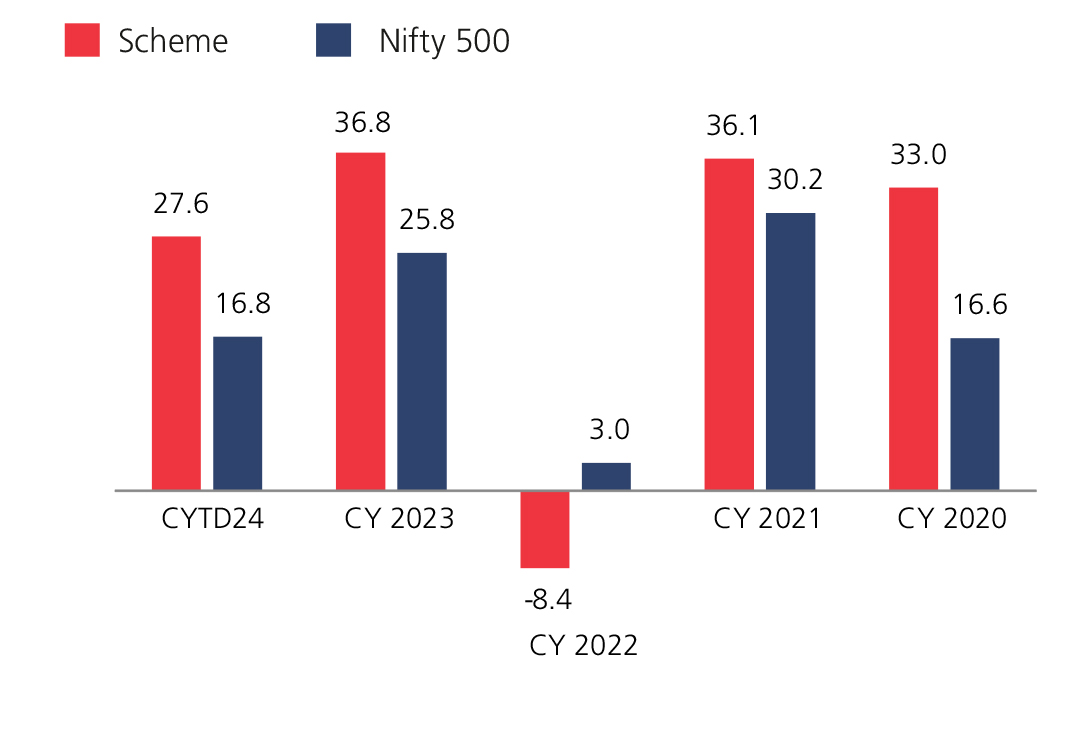

Year On Year Performance (Scheme V/S Nifty 500)

Ratios:

| Standard Deviation | 13.88 |

| Information Ratio | 0.03 |

| Beta | 0.89 |

| Sharpe Ratio | 0.19 |

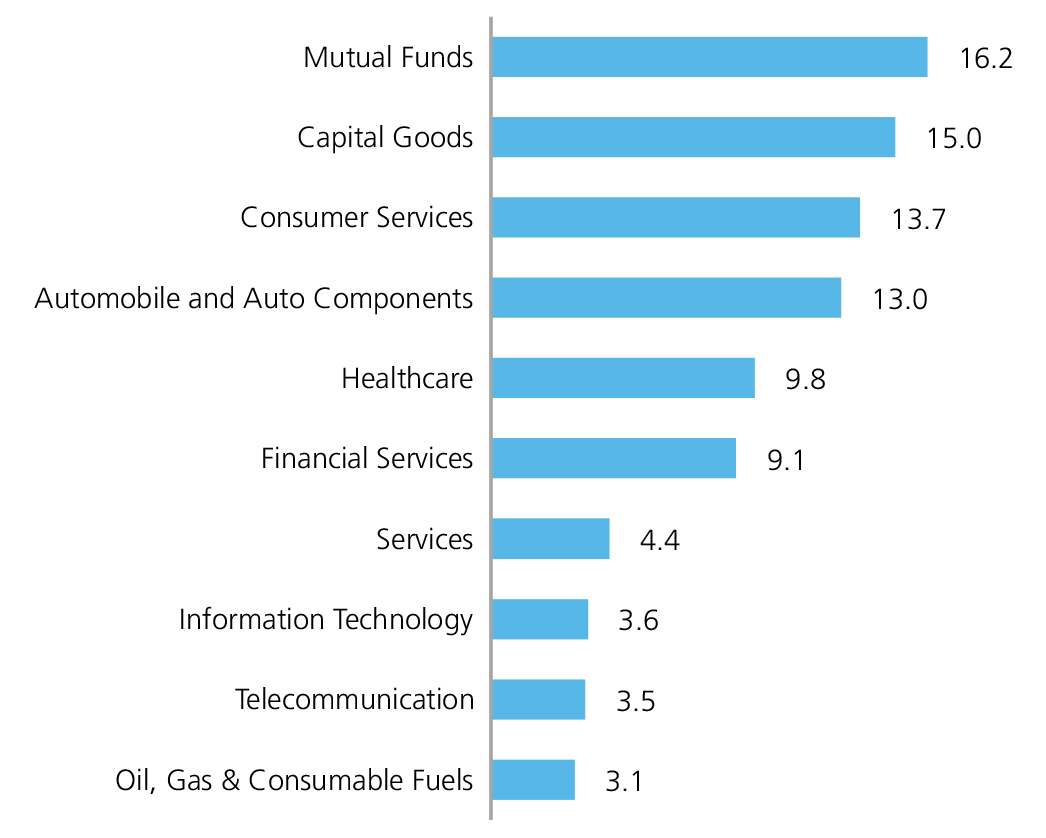

Top 10 Sectoral Holdings (%)

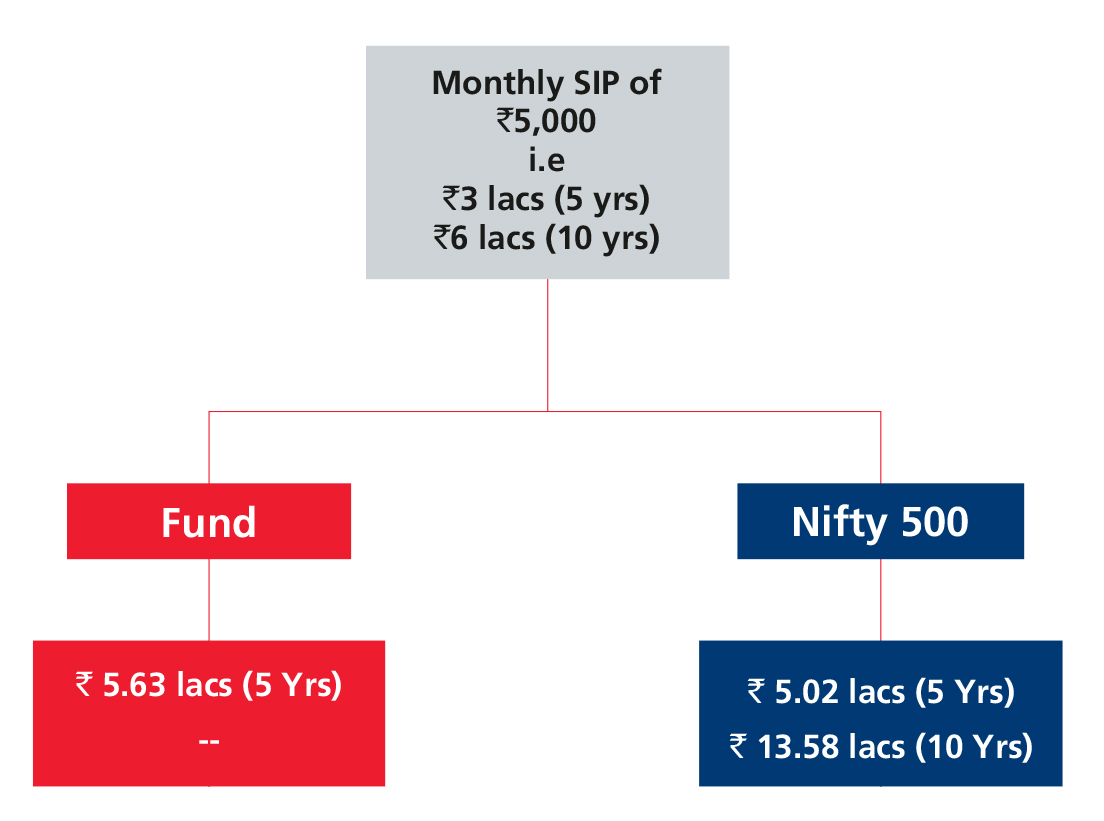

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390