|

Factsheet as on August 31, 2025 |

Factsheet as on August 31, 2025

Structure

Open Ended

Fund Category

Multi Asset Allocation

Fund Manager

Abhishek Bisen, Devender Singhal, Hiten Shah, Jeetu Valechha Sonar

Exit Load

Within 1 Year - 1%

Fund Size

Rs 8,374 crs

Launch Date

September 22, 2023

Investment Objective

The investment objective of the scheme is to generate long term capital appreciation by investing in Equity & Equity related Securities, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives. However, there is no assurance that the objective of the scheme will be achieved.

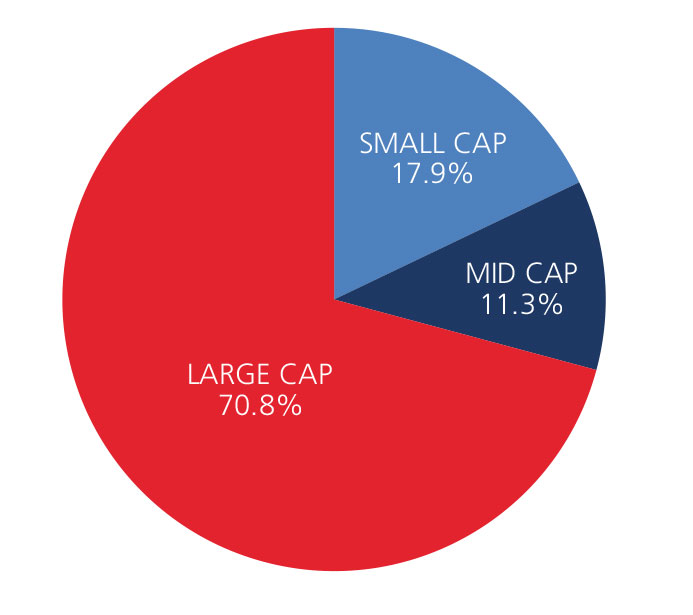

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 2.18 | NA | NA | NA |

| NIFTY 500 TRI (65%) + NIFTY Short NIFTY 500 TRI (65%) + NIFTY Short Duration Debt Index (25%) + Domestic Price of Gold (5%) + Domestic Price of Silver (5%) | 3.82 | NA | NA | NA |

Top 10 Holdings

| Company Name | % of Assets |

| Maruti Suzuki India Ltd. | 5.1 |

| State Bank Of India | 4.1 |

| Hero Motocorp Ltd. | 3.6 |

| Infosys Ltd. | 3.2 |

| NTPC Ltd. | 3.1 |

| Bharti Airtel Ltd. | 2.5 |

| HDFC Bank Ltd. | 2.4 |

| ITC Ltd. | 2.3 |

| Poonawalla Fincorp Ltd. (Erstwhile Magma Fincorp Ltd.) | 2.2 |

| Power Finance Corporation Ltd. | 2.2 |

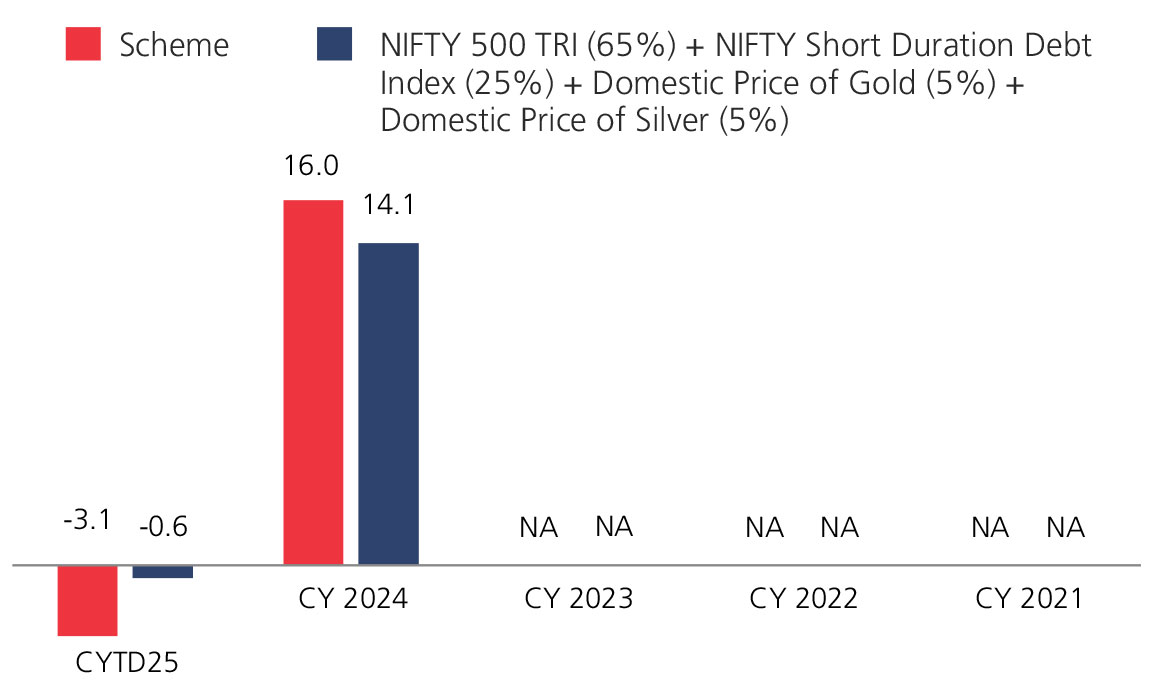

Year On Year Performance (Scheme V/S NIFTY 500 TRI NIFTY 500 TRI (65%) + NIFTY Short Duration Debt Index (25%) + Domestic Price of Gold (5%) + Domestic Price of Silver (5%) )

Ratio

| Standard Deviation | 9.46 |

| Information Ratio | - |

| Beta | 0.98 |

| Sharpe Ratio | 0.26 |

Asset Allocation

| Equity | 68.48 |

| Debt | 9.18 |

| Others | 22.34 |

Top 10 Sectoral Holdings (%)

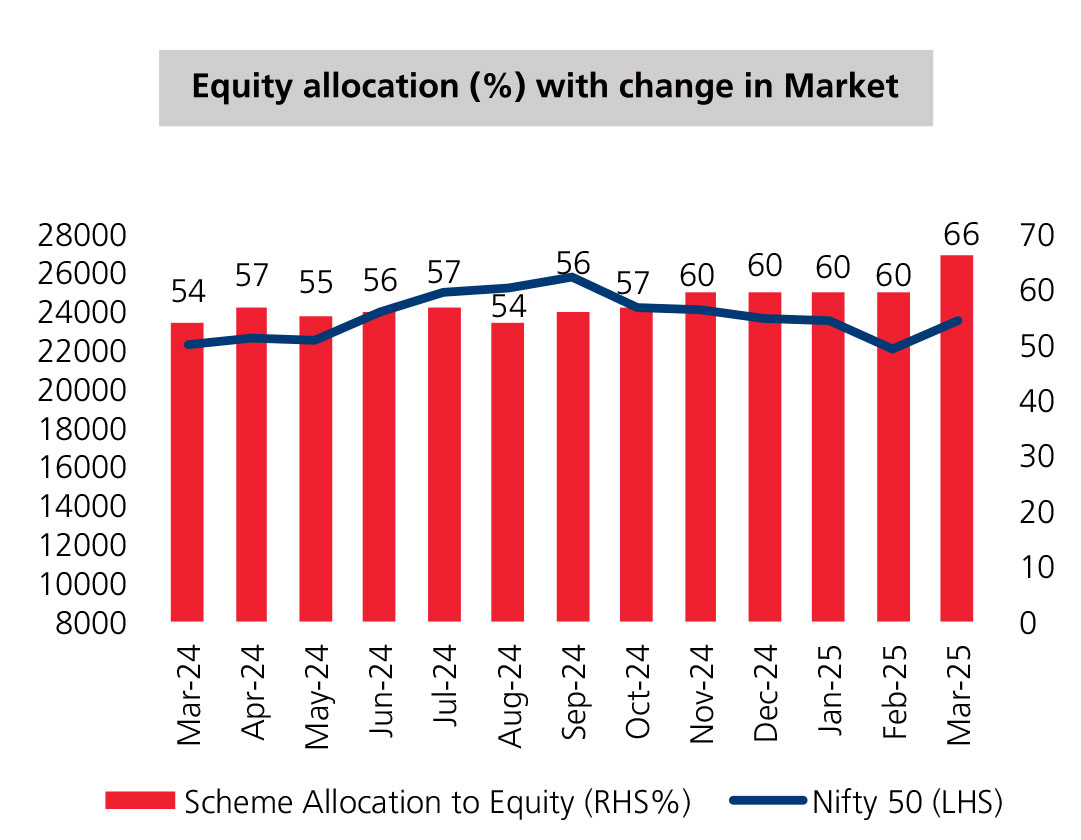

Equity Allocation vs Nifty 50

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390