|

Factsheet as on May 31, 2025 |

Factsheet as on May 31, 2025

Structure

Open Ended

Fund Category

Mid Cap

Fund Manager

Atul Bhole

Exit Load

Within 1 Year - 1%

Fund Size

Rs 53464 crs

Launch Date

March 30, 2007

Investment Objective

The investment objective of the scheme is to generate long term capital appreciation from a portfolio of equity and equity related securities, by investing predominantly in mid companies. The scheme may also invest in Debt and Money Market Instruments, as per the asset allocation table. There is no assurance that the investment objective of the Scheme will be achieved.

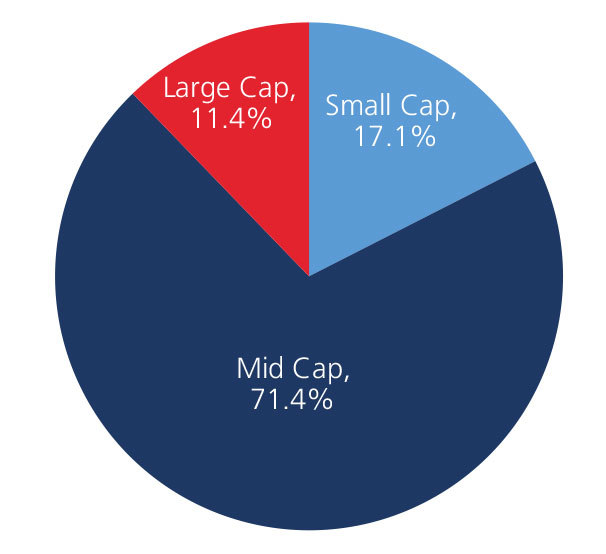

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 11.72 | 27.03 | 23.49 | 31.66 |

| Nifty Midcap 100 (%) | 11.08 | 30.41 | 26.62 | 33.99 |

Top 10 Holdings

| Company Name | % of Assets |

| Solar Industries India Ltd. | 3.3 |

| Fortis Healthcare Ltd. | 3.3 |

| IPCA Laboratories Ltd. | 3.0 |

| Mphasis Ltd. | 3.0 |

| GE Vernova T&D India Ltd. Erstwhile Ge T&D India Ltd. | 3.0 |

| Dixon Technologies India Ltd. | 2.7 |

| Oberoi Realty Ltd. | 2.6 |

| J. K. Cement Ltd. | 2.5 |

| Coromandel International Ltd. Coromandel Fertilisers Ltd. | 2.5 |

| Oracle Financial Services Software Ltd. | 2.4 |

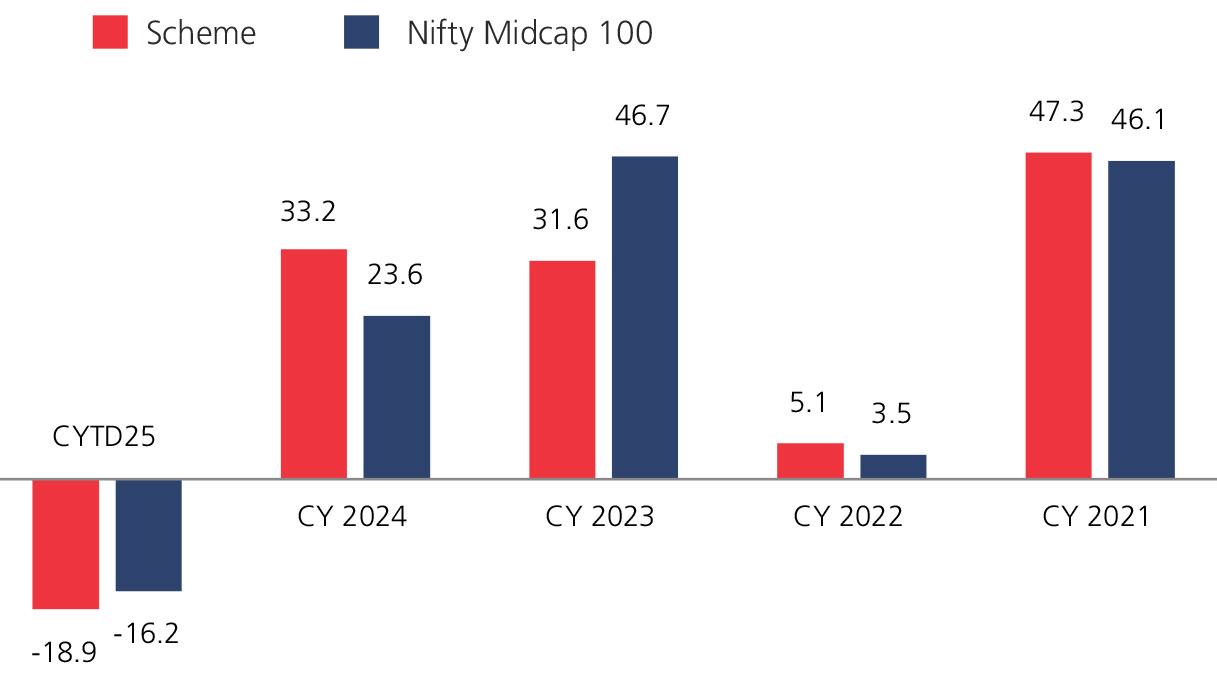

Year On Year Performance (Scheme V/S Nifty Midcap 100)

Ratios

| Standard Deviation | 16.23 |

| Beta | 0.98 |

| Information Ratio | 0.20 |

| Sharpe Ratio | 0.28 |

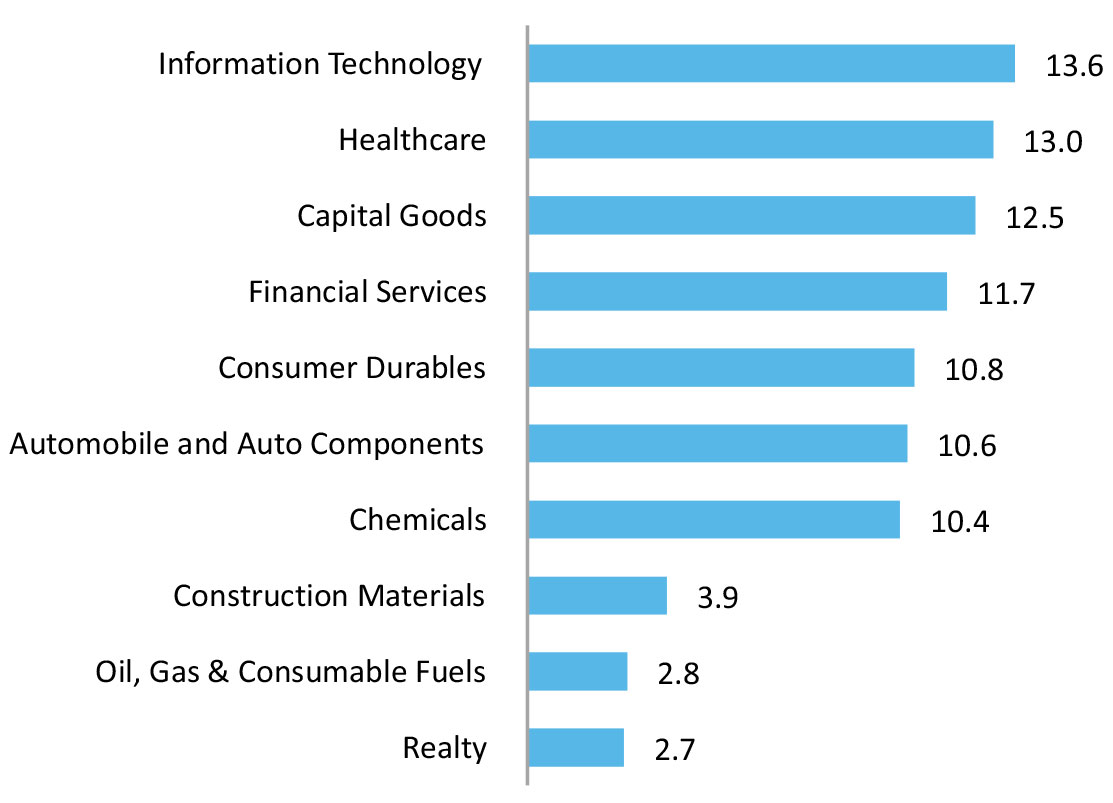

Top 10 Sectoral Holdings (%)

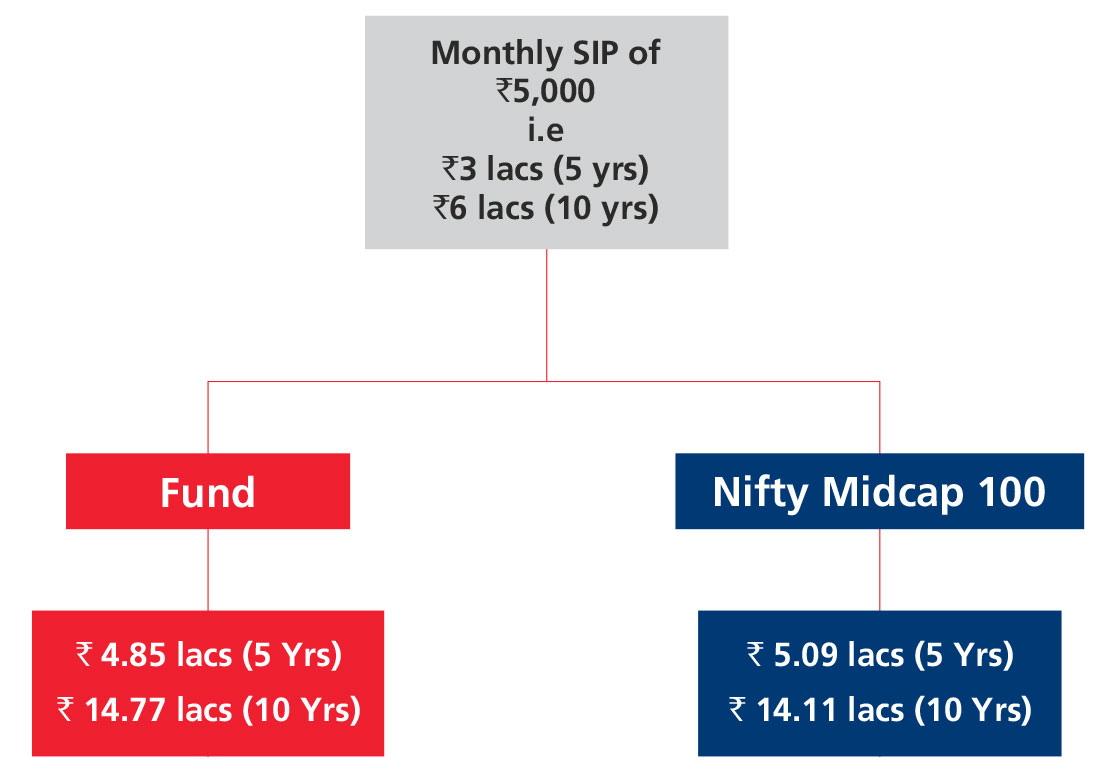

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390