|

Factsheet as on July 31, 2025 |

Factsheet as on July 31, 2025

Structure

Open Ended

Fund Category

Balanced Advantage

Fund Manager

Abhishek Bisen, Hiten Shah, Rohit Tandon

Exit Load

Within 1 Year - 1%

Fund Size

Rs 17537 crs

Launch Date

August 03, 2018

Investment Objective

The investment objective of the scheme is to generate capital appreciation by investing in a dynamically balanced portfolio of equity & equity related securities and debt & money market securities. There is no assurance or guarantee that the investment objective of the scheme will be achieved.

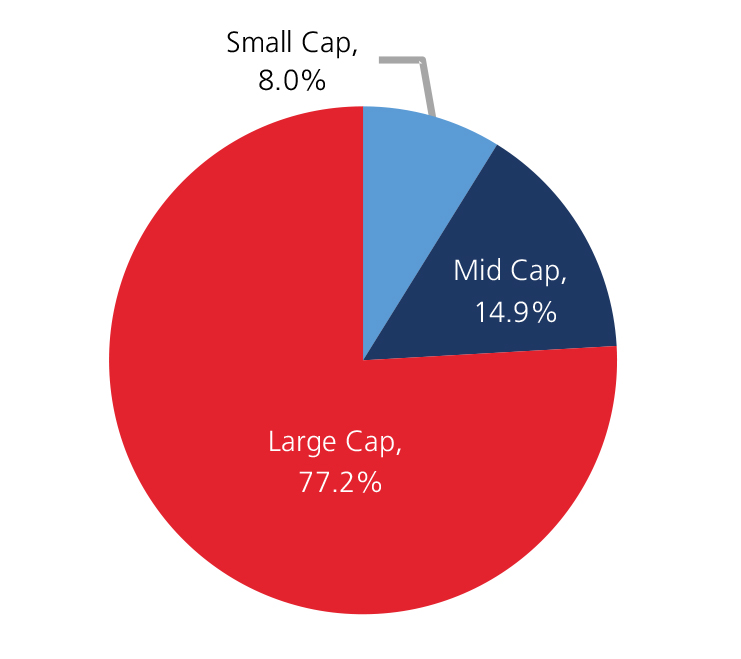

Market Cap Allocation

Scheme Performance

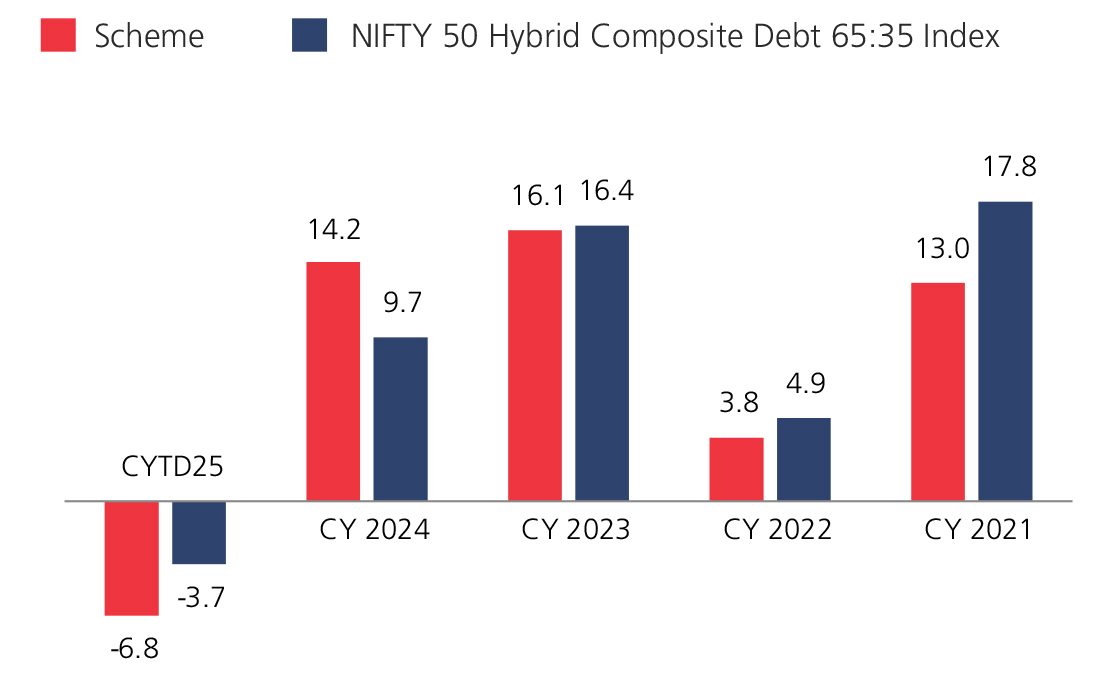

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 3.91 | 12.56 | 12.41 | 12.49 |

| NIFTY 50 Hybrid Composite Debt 65:35 Index | 3.46 | 11.74 | 12.25 | 14.51 |

Top 10 Holdings

| Company Name | % of Assets |

| ICICI Bank Ltd. | 4.2 |

| Reliance Industries Ltd. | 3.9 |

| HDFC Bank Ltd. | 3.1 |

| State Bank Of India | 2.6 |

| Infosys Ltd. | 2.5 |

| Bharti Airtel Ltd. | 2.3 |

| Larsen & Toubro Ltd. | 1.8 |

| ITC Ltd. | 1.7 |

| Interglobe Aviation Ltd. | 1.6 |

| Bajaj Finance Ltd. | 1.3 |

Year On Year Performance Scheme V/S NIFTY 50 Hybrid Composite Debt 65:35 Index

Ratios:

| Standard Deviation | 7.10 |

| Information Ratio | 0.01 |

| Beta | 0.80 |

| Sharpe Ratio | 0.20 |

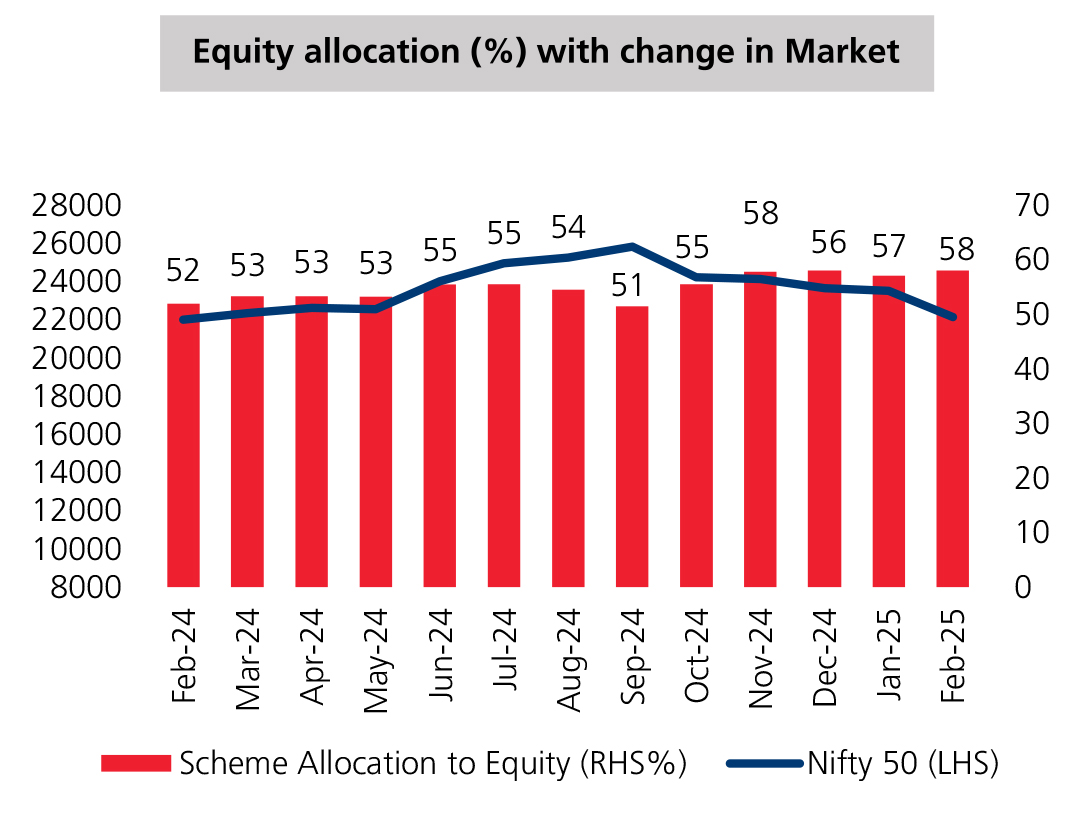

Asset Allocation

| Equity | 56.87 |

| Debt | 23.45 |

| Others | 19.73 |

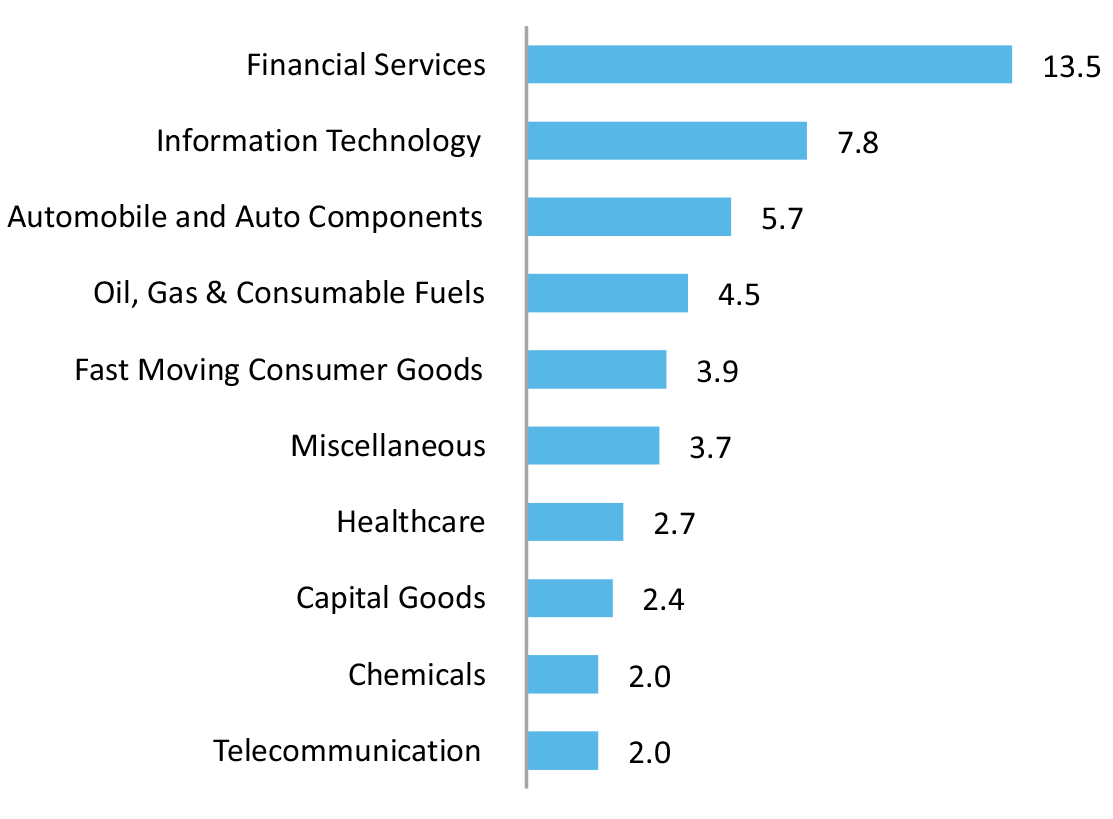

Top 10 Sectoral Holdings (%)

Equity Allocation vs NIFTY 50

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390