|

Factsheet as on May 31, 2023 |

|

Factsheet as on May 31, 2023 |

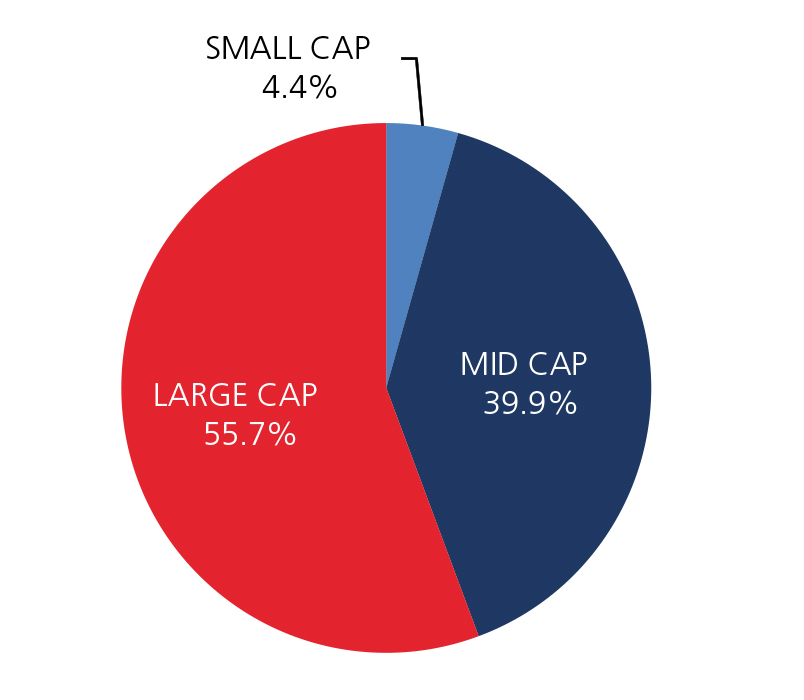

To generate capital appreciation from a diversified portfolio of predominantly Equity and Equity Related Instruments of Large and Midcap companies.

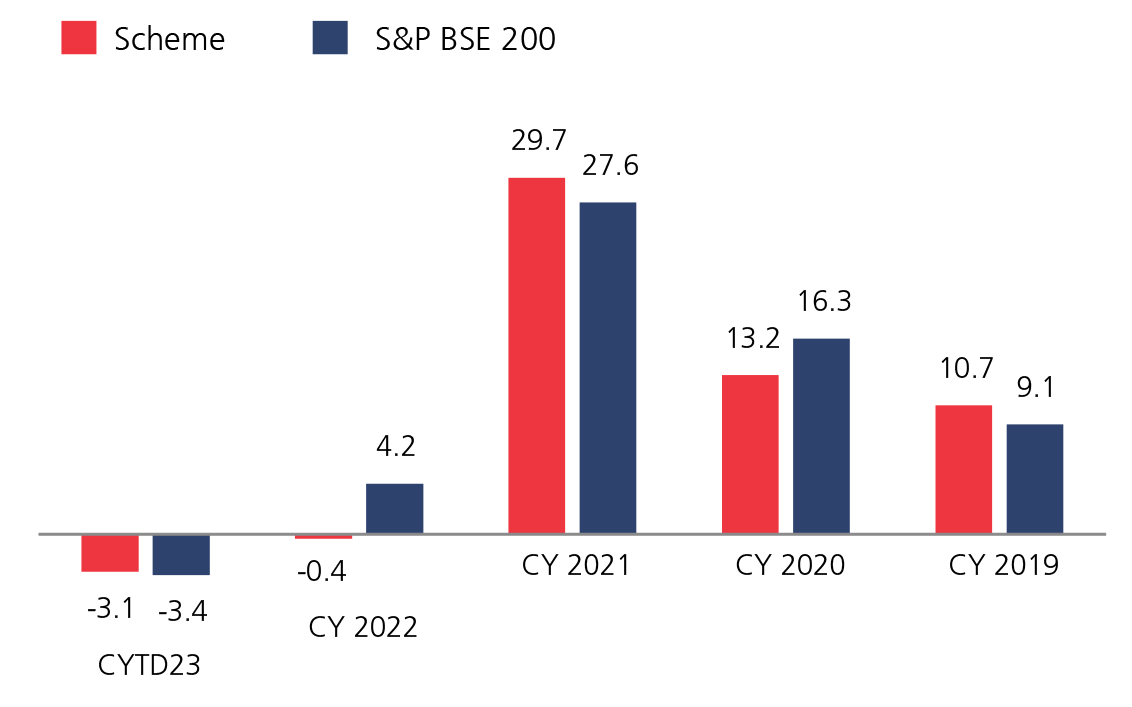

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | -2.02 | 11.93 | 11.79 | 8.87 |

| S&P BSE 200 (%) | 0.82 | 14.34 | 14.52 | 9.49 |

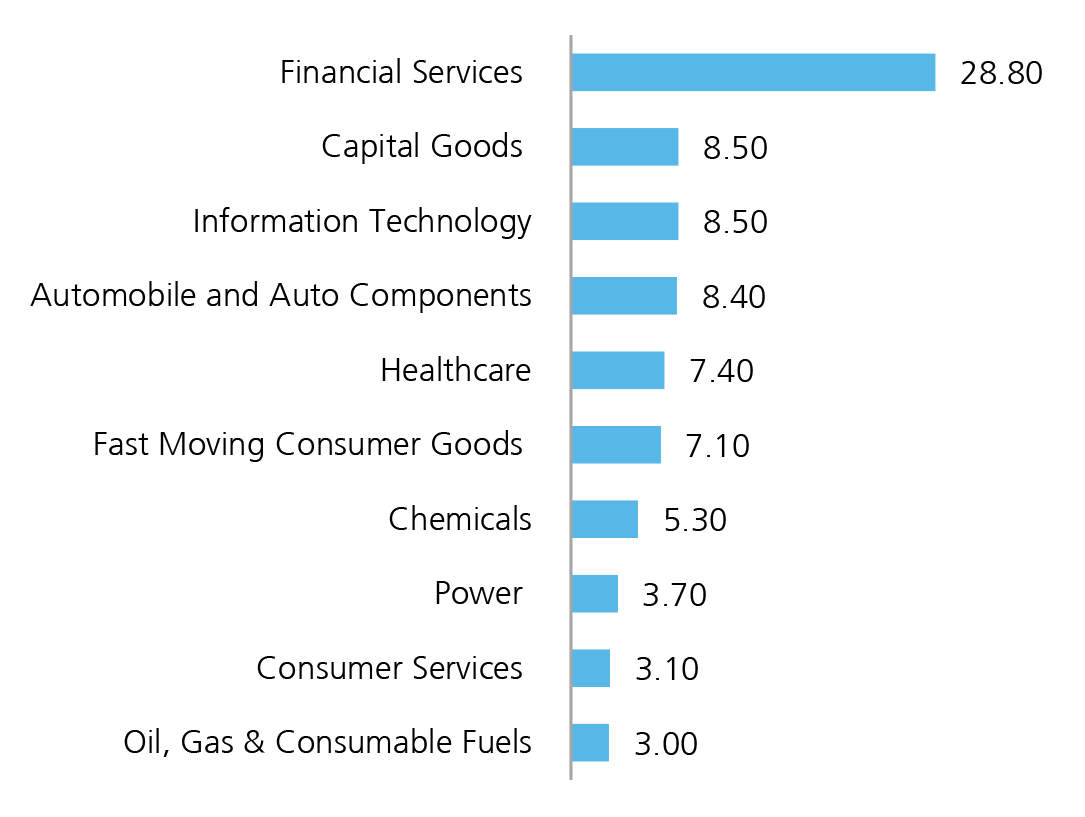

| Company Name | % of Assets |

| ICICI Bank Ltd. | 7.6 |

| HDFC Bank Ltd. | 6.6 |

| Infosys Ltd. | 5.1 |

| Axis Bank Ltd. | 3.5 |

| State Bank Of India | 3.5 |

| National Thermal Power Corporation Ltd. | 2.6 |

| Larsen & Toubro Ltd. | 2.6 |

| United Breweries Ltd. | 2.2 |

| Hindustan Unilever Ltd. | 2.1 |

| Mahindra & Mahindra Ltd. | 2.0 |

| Standard Deviation | 21.17 |

| Beta | 0.90 |

| Information Ratio | -0.13 |

| Sharpe Ratio | 0.09 |

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390