|

Factsheet as on August 31, 2025 |

Factsheet as on August 31, 2025

Structure

Open Ended

Fund Category

Multi Asset Allocation

Fund Manager

S Naren, Manish Banthia, Ihab Dalwai, Akhil Kakkar, Sri Sharma, Gaurav Chikane,Sharmila D mello, Masoomi Jhurmarvala

Exit Load

Within 1 Year - 1%

Fund Size

Rs 64,770 crs

Launch Date

October 31, 2002

Investment Objective

To generate capital appreciation and income for investors by investing across asset classes.However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.

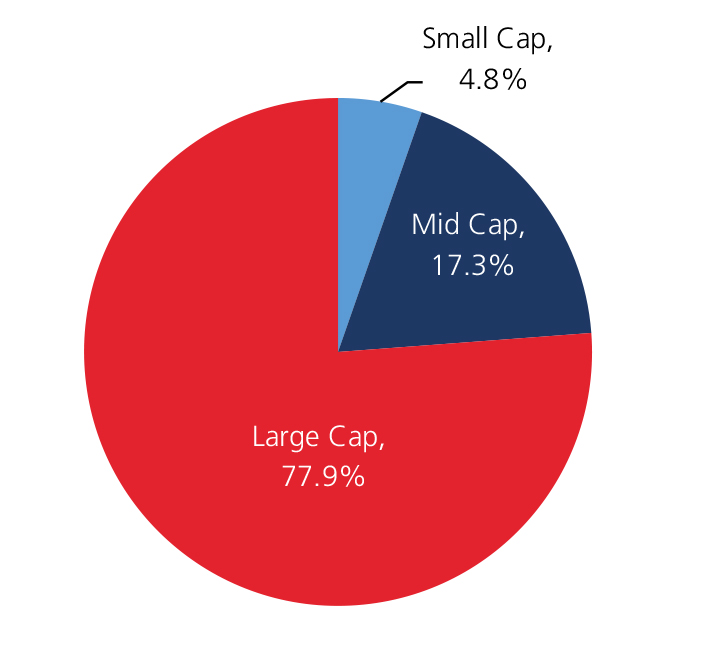

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 6.83 | 18.63 | 18.69 | 22.88 |

| Nifty 200 TRI (65%) + Nifty 200 TRI (65%) + Nifty Composite Debt Index (25%) + Domestic Price of Gold (6%) + Domestic Price of Silver (1%) + iCOMDEX Composite Index (3%) | 2.30 | 15.08 | 13.00 | 15.00 |

Top 10 Holdings

| Company Name | % of Assets |

| Gold | 3.5 |

| Reliance Industries Ltd. | 3.5 |

| ICICI Bank Ltd. | 3.3 |

| Maruti Suzuki India Ltd. | 2.8 |

| Axis Bank Ltd. | 2.7 |

| Infosys Ltd. | 2.1 |

| Larsen & Toubro Ltd. | 2.1 |

| SBI Cards & Payment Services Pvt. Ltd. | 1.9 |

| Nifty | 1.8 |

| Tata Consultancy Services Ltd. | 1.8 |

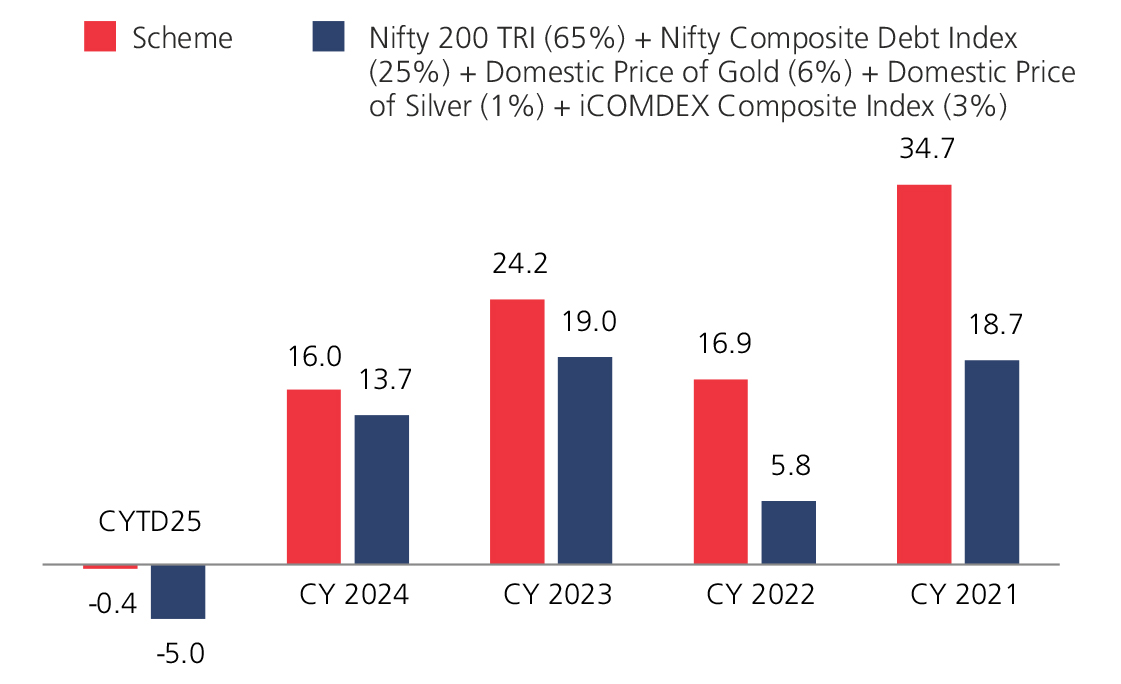

Year On Year Performance (Scheme V/S Nifty 200 TRI (65%) + Nifty Composite Debt Index (25%) + Domestic Price of Gold (6%) + Domestic Price of Silver (1%) + iCOMDEX Composite Index (3%) )

Ratio

| Standard Deviation | 7.00 |

| Information Ratio | 0.55 |

| Beta | 0.77 |

| Sharpe Ratio | 0.41 |

Asset Allocation

| Equity | 61.77 |

| Debt | 8.84 |

| Others | 29.38 |

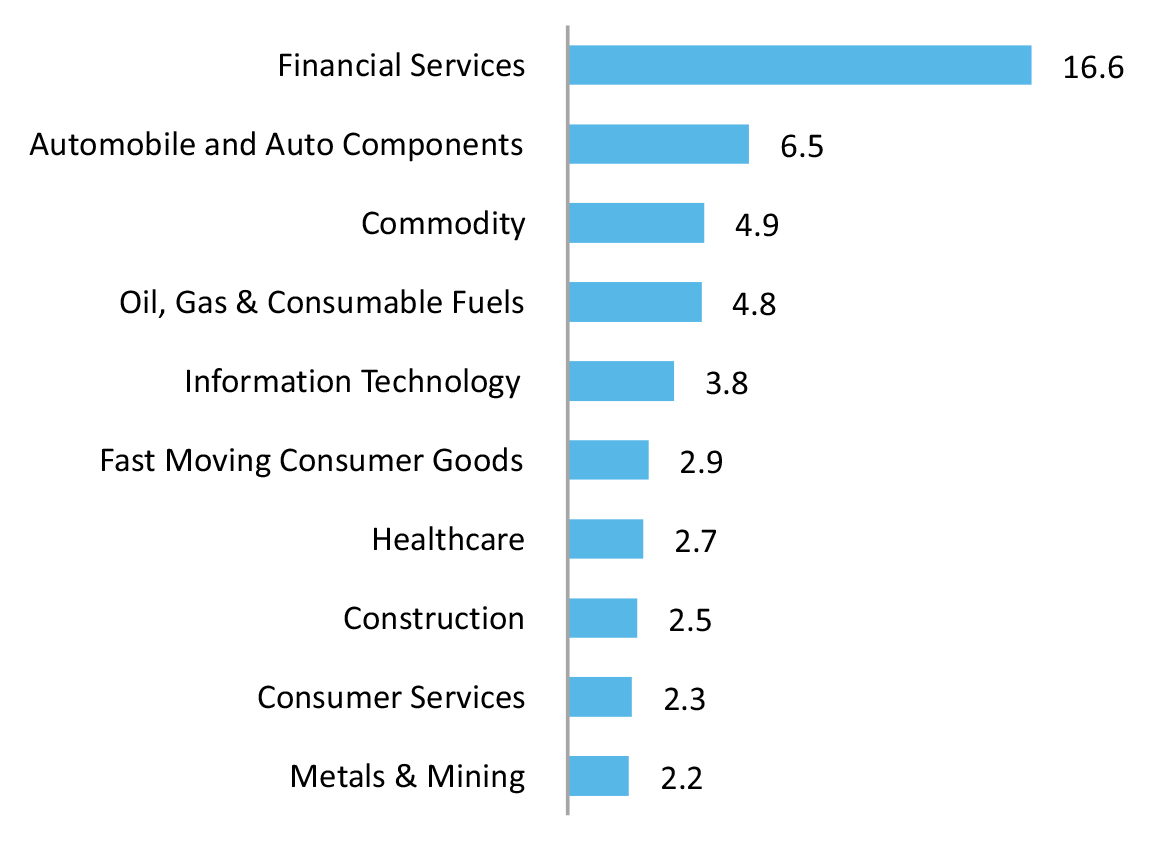

Top 10 Sectoral Holdings (%)

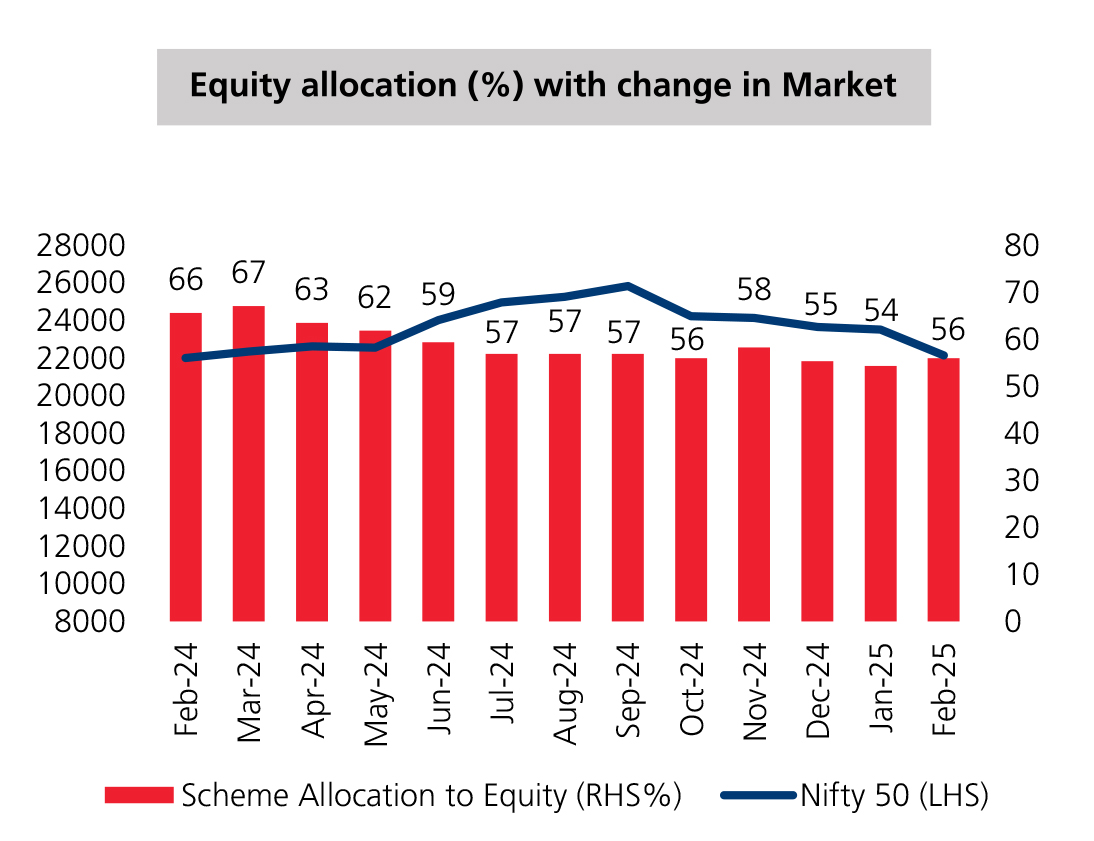

Equity Allocation vs Nifty 50

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390