|

Factsheet as on July 31, 2025 |

Factsheet as on July 31, 2025

Structure

Open Ended

Fund Category

Mid Cap

Fund Manager

R Janakiraman,

Sandeep Manam, Akhil Kalluri

Exit Load

Within 1 Year - 1%

Fund Size

Rs 12540 crs

Launch Date

Dec 01, 1993

Investment Objective

Aims to achieve a high degree of capital appreciation through investments in smaller and faster growing companies.

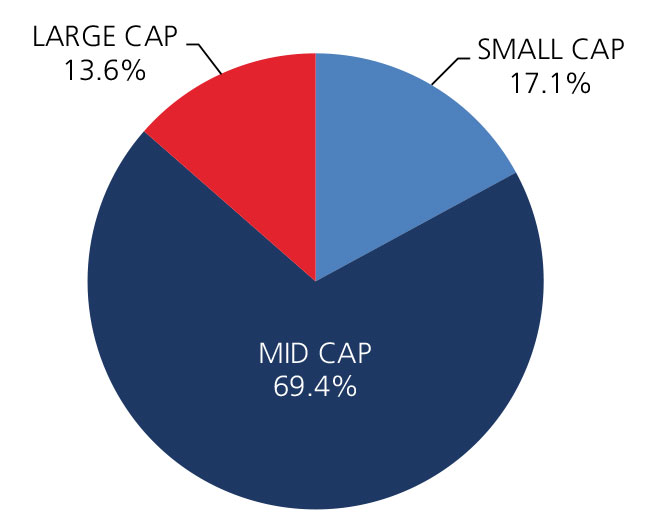

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 0.73 | 24.45 | 24.02 | 26.50 |

| Nifty Midcap 100 (%) | -2.70 | 23.32 | 24.58 | 29.96 |

Top 10 Holdings

| Company Name | % of Assets |

| Federal Bank Ltd. | 3.1 |

| Mphasis Ltd. | 2.1 |

| Prestige Estates Projects Ltd. | 2.1 |

| J. K. Cement Ltd. | 2.1 |

| Cummins India Ltd. | 2.0 |

| Max Financial Services Ltd. | 2.0 |

| IPCA Laboratories Ltd. | 1.9 |

| APL Apollo Tubes Ltd. | 1.9 |

| PB Fintech Ltd. | 1.9 |

| Biocon Ltd. | 1.8 |

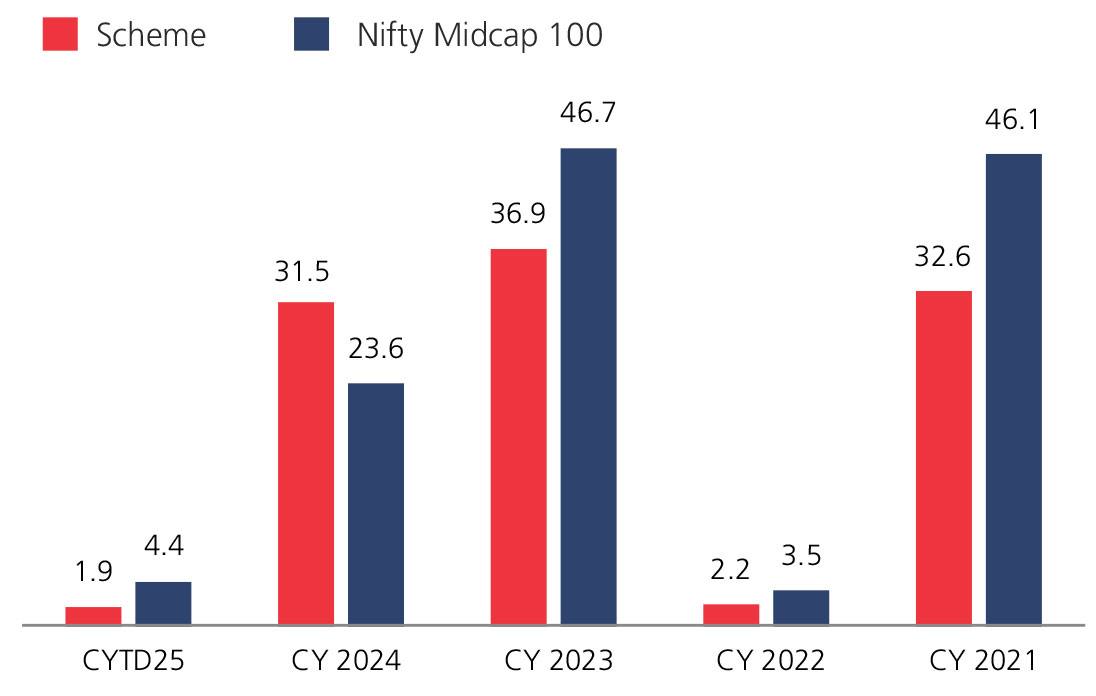

Year On Year Performance (Scheme V/S Nifty Midcap 100)

Ratios

| Standard Deviation | 14.50 |

| Beta | 0.99 |

| Information Ratio | 0.34 |

| Sharpe Ratio | 0.31 |

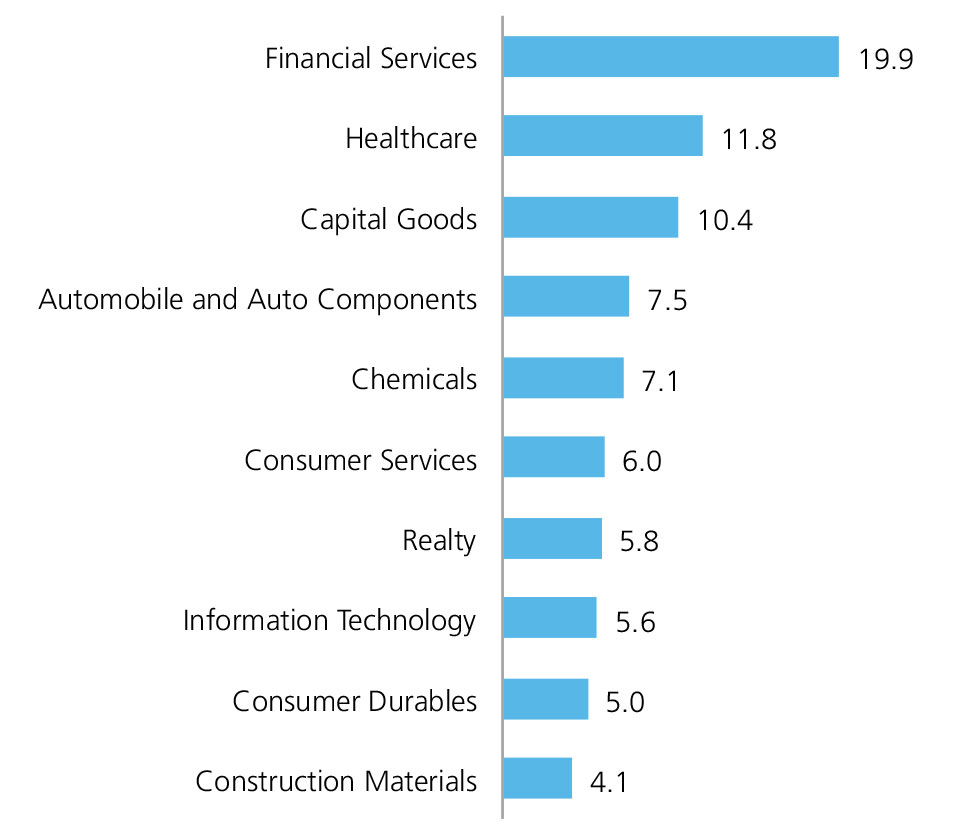

Top 10 Sectoral Holdings (%)

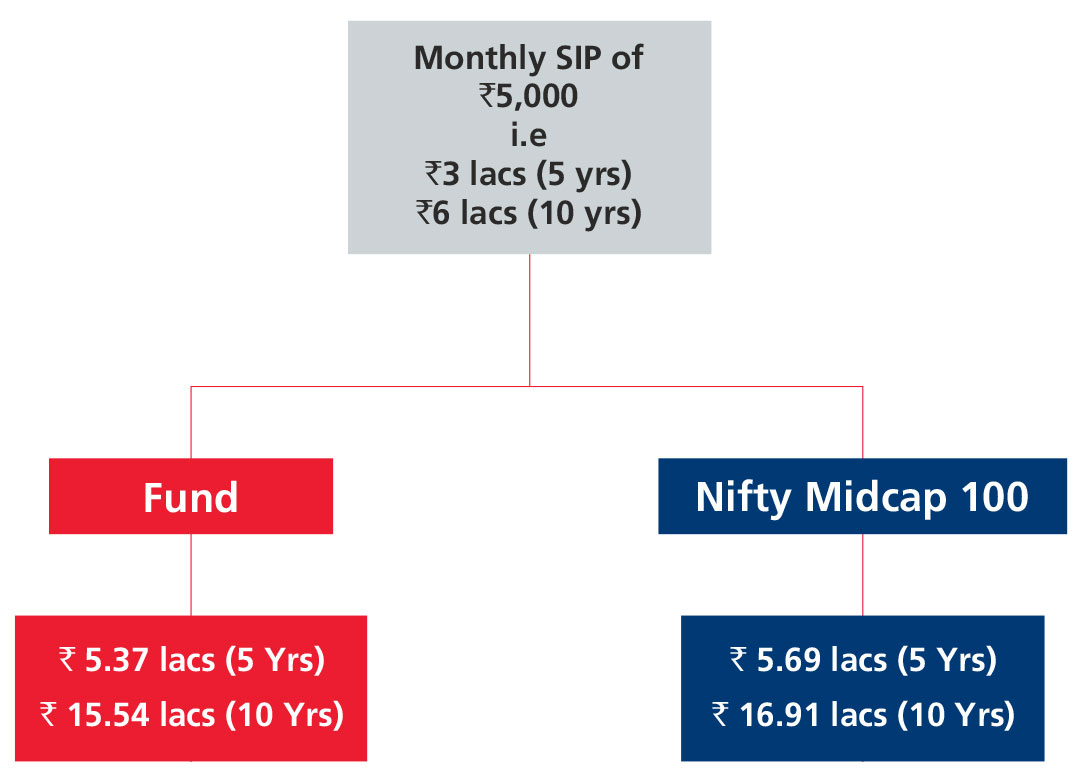

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390