|

Factsheet as on July 31, 2025 |

Factsheet as on July 31, 2025

Structure

Open Ended

Fund Category

Balanced Advantage

Fund Manager

Bhavesh Jain, Bharat Lahoti, Rahul Dedhia, Pranavi Kulkarni

Exit Load

Within 90 Days - 1%

Fund Size

Rs 12792 crs

Launch Date

August 20, 2009

Investment Objective

The investment objective of the scheme is to generate long term capital appreciation and currentincome from a portfolio that is invested in equity and equity related securities as well as in fi xedincome securities.However, there can be no assurance that the investment objective of the scheme will be realized or that income will be generated and the scheme does not assure or guarantee any returns.

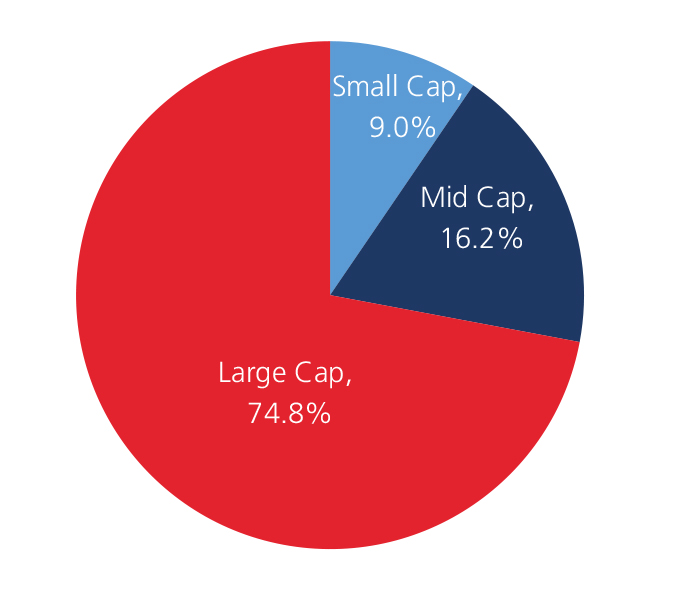

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | -0.02 | 12.02 | 12.39 | 14.15 |

| NIFTY 50 Hybrid Composite Debt 65:35 Index | 3.46 | 11.74 | 12.25 | 14.51 |

Top 10 Holdings

| Company Name | % of Assets |

| HDFC Bank Ltd. | 5.4 |

| ICICI Bank Ltd. | 4.9 |

| Reliance Industries Ltd. | 4.7 |

| Bharti Airtel Ltd. | 2.6 |

| Infosys Ltd. | 2.5 |

| State Bank Of India | 2.3 |

| Larsen & Toubro Ltd. | 2.0 |

| Bajaj Finance Ltd. | 2.0 |

| NTPC Ltd. | 1.8 |

| Sun Pharmaceutical Industries Ltd. | 1.7 |

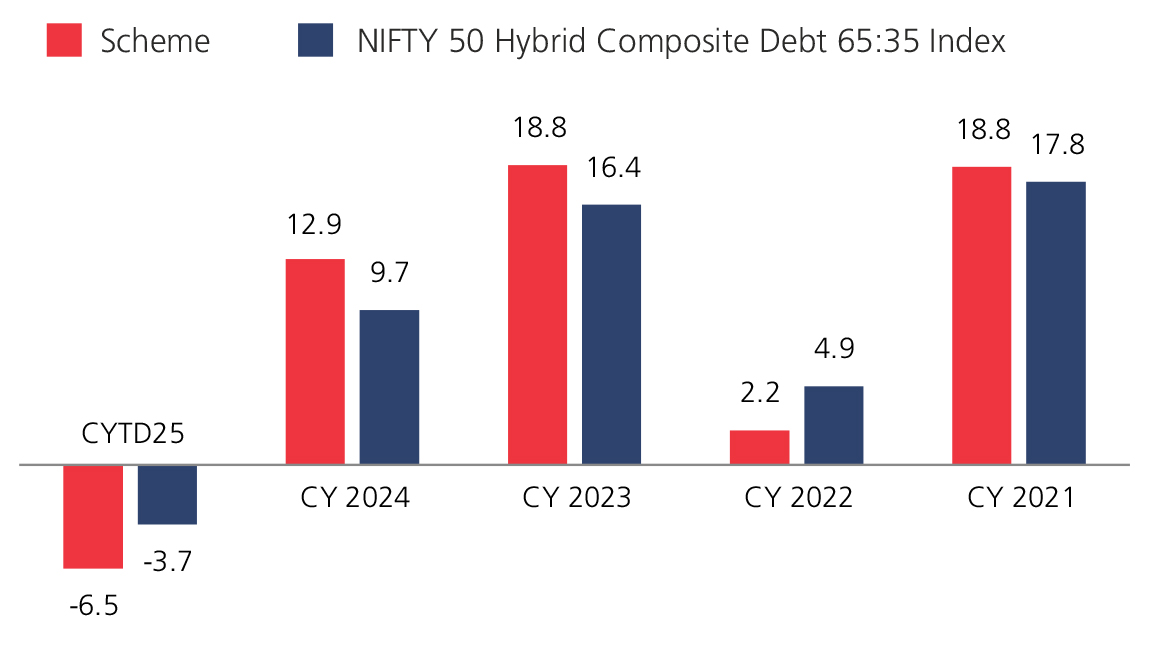

Year On Year Performance (Scheme V/S NIFTY 50 Hybrid Composite Debt 65:35 Index)

Ratio

| Standard Deviation | 8.14 |

| Information Ratio | 0.01 |

| Beta | 0.93 |

| Sharpe Ratio | 0.18 |

Asset Allocation

| Equity | 77.16 |

| Debt | 11.10 |

| Others | 11.76 |

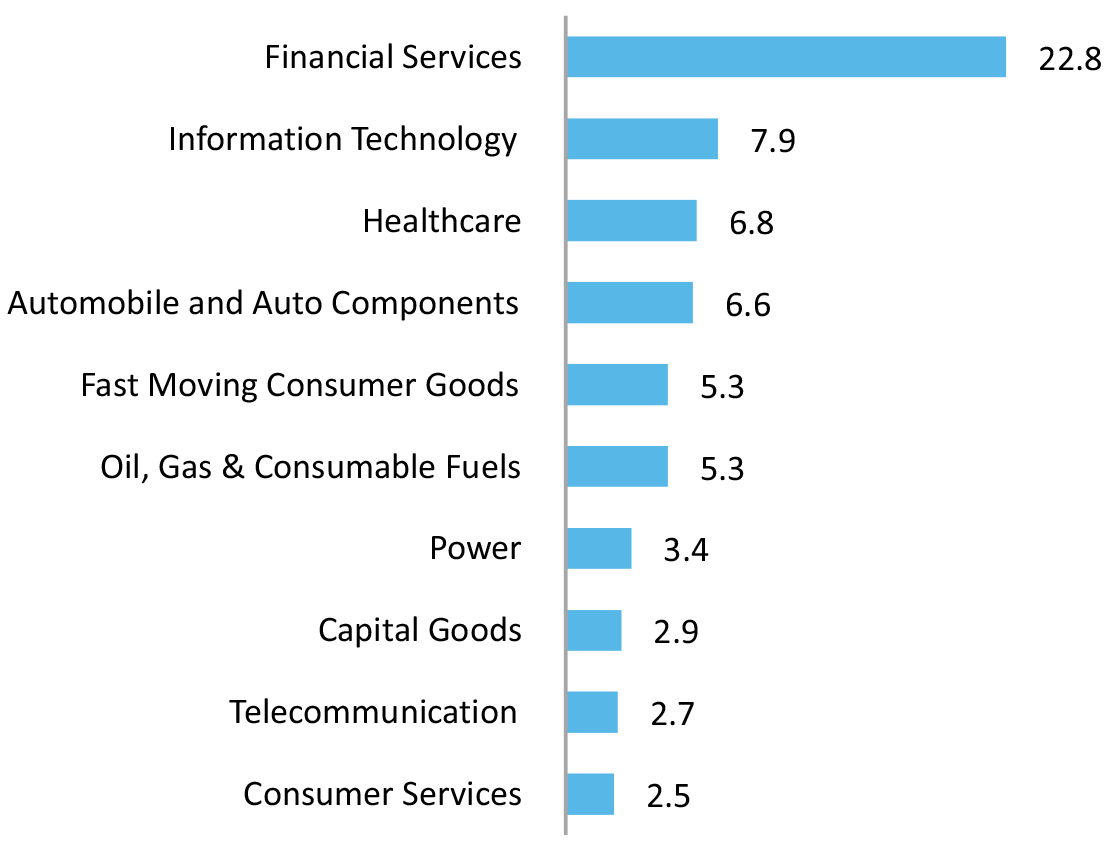

Top 10 Sectoral Holdings (%)

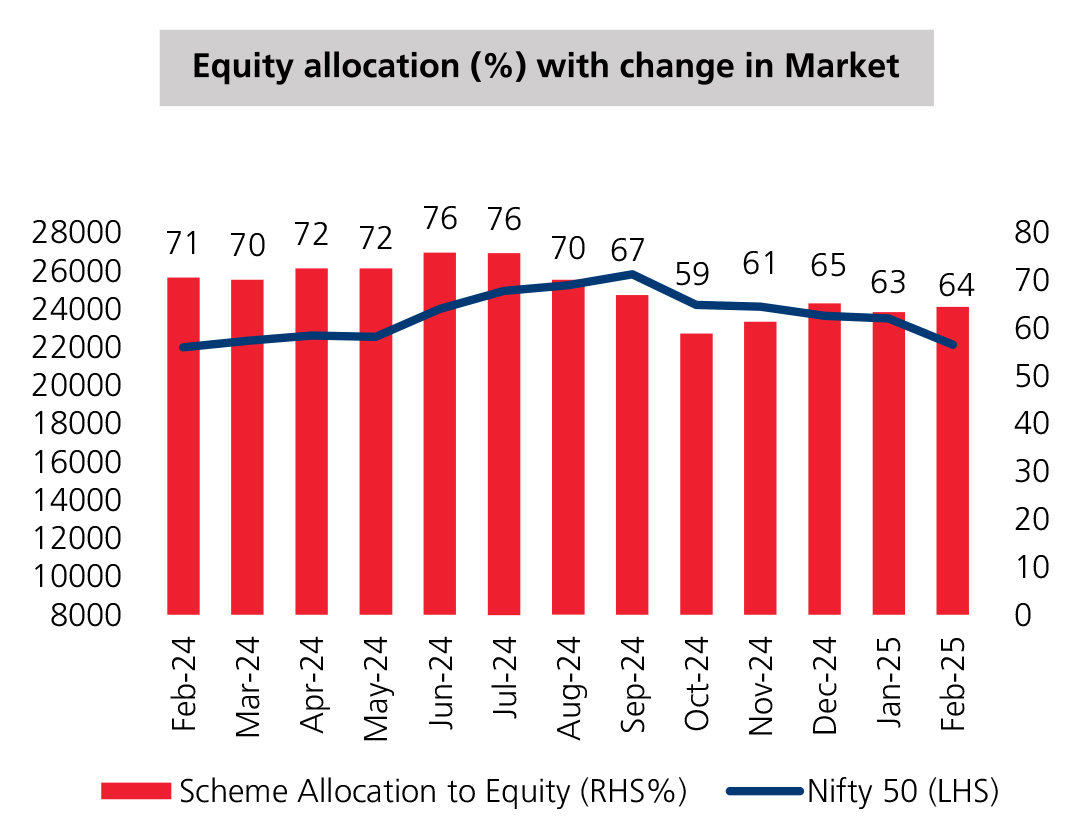

Equity Allocation vs Nifty 50

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390