|

Factsheet as on August 31, 2025 |

Factsheet as on August 31, 2025

Structure

Open Ended

Fund Category

Thematic/Sectoral

Fund Manager

Chirag Dagli

Exit Load

Within 1 Month - 0.5%

Fund Size

Rs 3,107 crs

Launch Date

November 30, 2018

Investment Objective

The primary investment objective of the scheme is to seek to generate consistent returns by predominantly investing in equity and equity related securities of pharmaceutical and healthcare companies. However, there can be no assurance that the investment objective of the scheme will be realized.

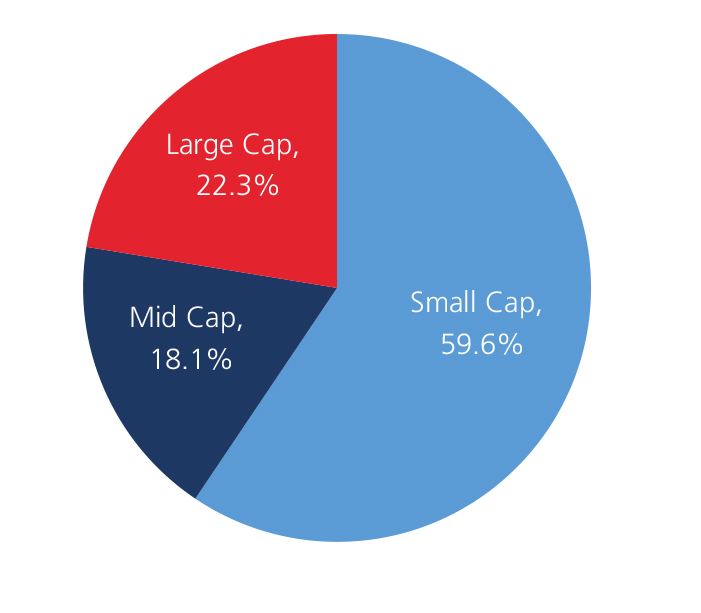

Market Cap Allocation

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | -0.81 | 22.92 | 24.24 | 19.15 |

| Nifty 500 (%) | -5.37 | 15.23 | 13.59 | 19.12 |

Top 10 Holdings

| Company Name | % of Assets |

| Cipla Ltd. | 9.2 |

| Sun Pharmaceutical Industries Ltd. | 7.9 |

| IPCA Laboratories Ltd. | 7.6 |

| Cohance Lifesciences Ltd. | 7.4 |

| Laurus Labs Ltd. | 6.1 |

| Gland Pharma Ltd. | 5.5 |

| Apollo Hospitals Enterprise Ltd. | 4.8 |

| Globus Medical Inc | 4.7 |

| Illumina Inc | 4.5 |

| Sai Life Sciences Ltd. | 4.5 |

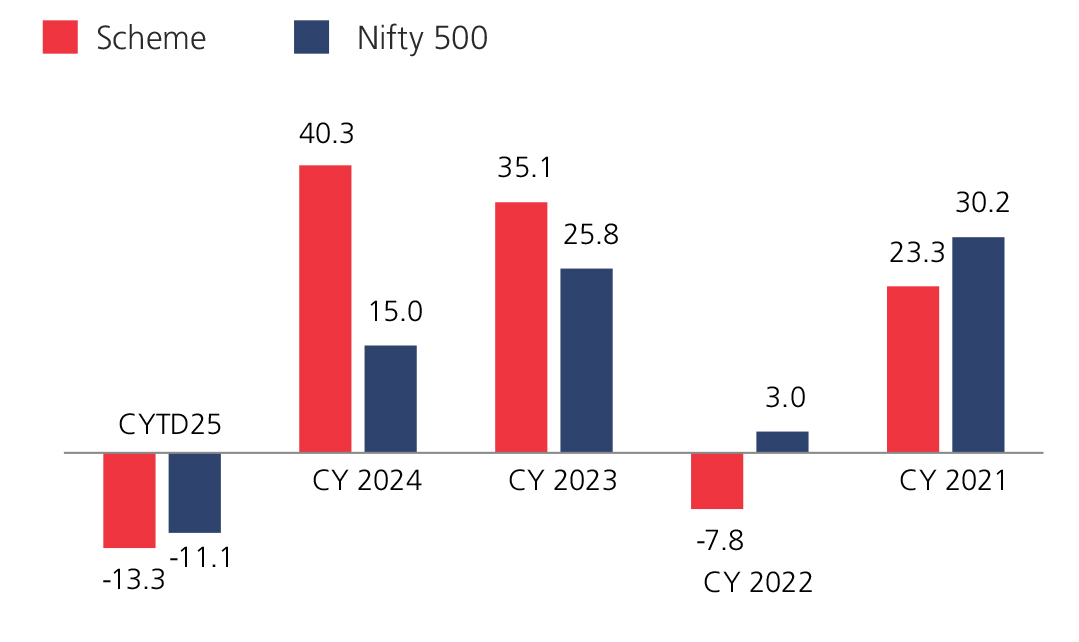

Year On Year Performance (Scheme V/S Nifty 500)

Ratios:

| Standard Deviation | 14.47 |

| Beta | 0.72 |

| Information Ratio | 0.18 |

| Sharpe Ratio | 0.28 |

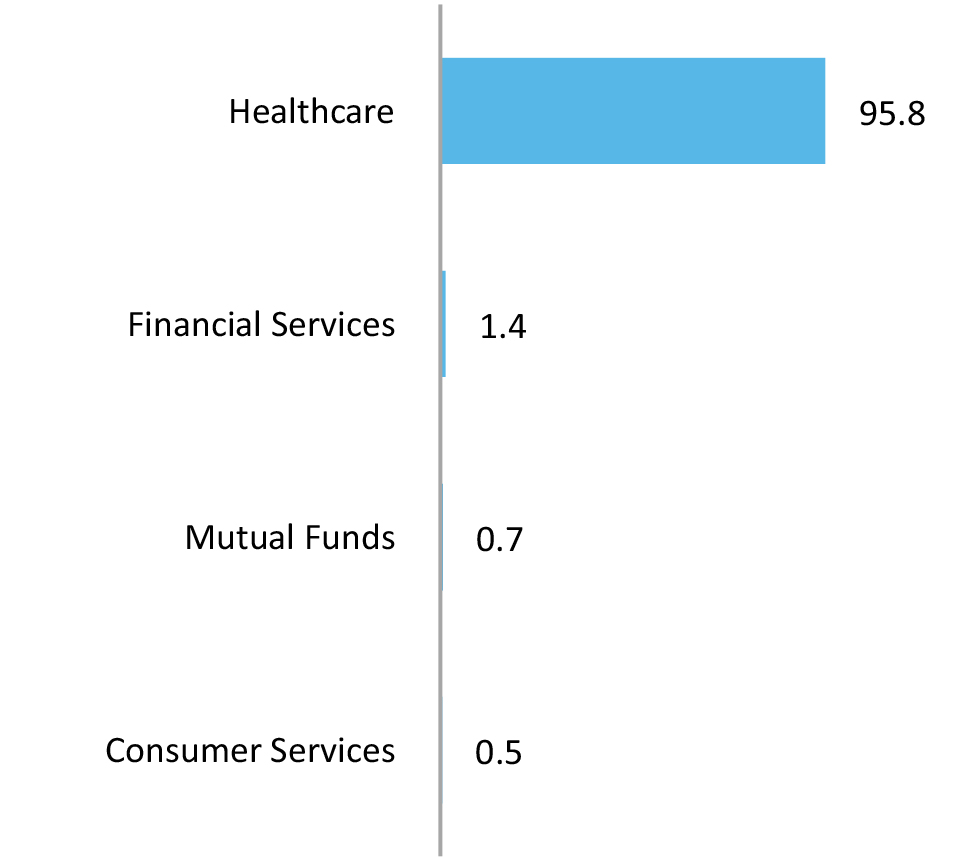

Top 10 Sectoral Holdings (%)

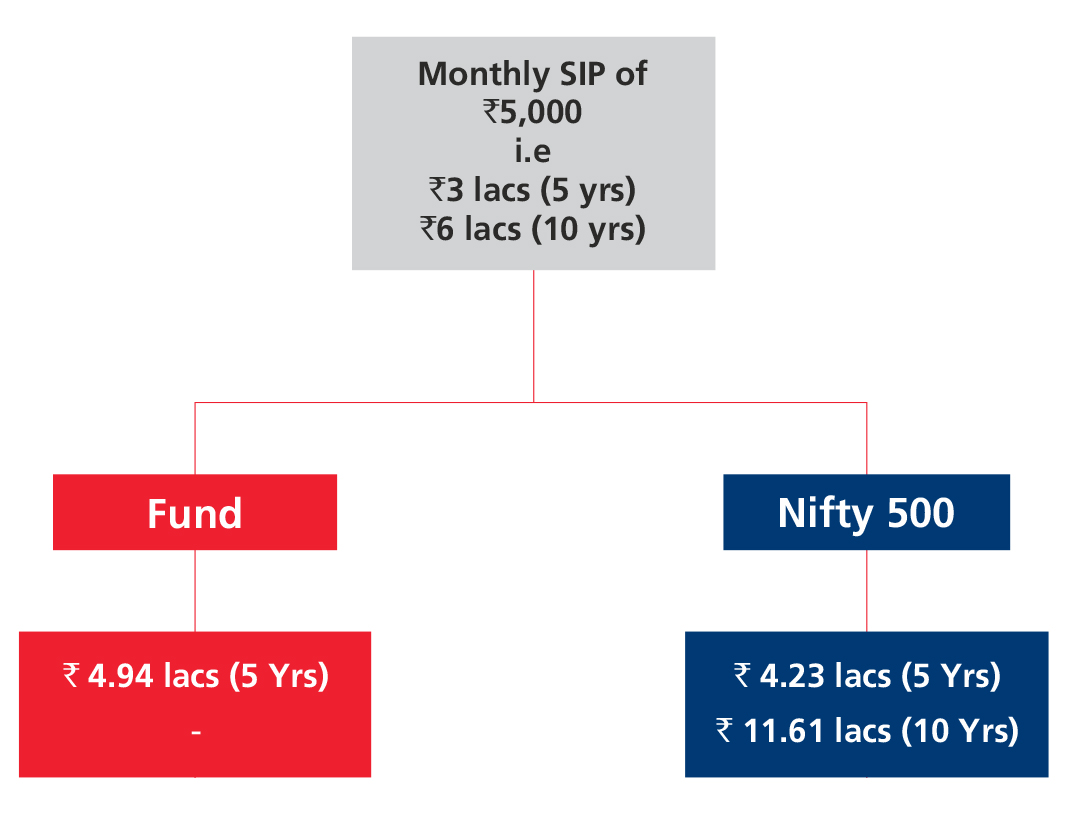

SIP Returns

Source: MFI Explorer, Bloomberg.

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390