|

Factsheet as on November 30, 2024 |

Factsheet as on November 30, 2024

Structure

Open Ended

Fund Category

Short Term 1-3 yrs (Corporate Bond/ Banking & PSU/Short Duration) - Active

Fund Manager

Rajiv Radhakrishnan, Mansi Sajeja, Pradeep Kesavan

Exit Load

Nil

Fund Size

Rs 13,354 crs

Launch Date

July 27, 2007

Investment Objective

To provide investors an opportunity to generate regular income through investments in a portfolio comprising predominantly of debt instruments which are rated not below investment grade and money market instruments such that the Macaulay duration of the portfolio is between 1 year and 3 years.

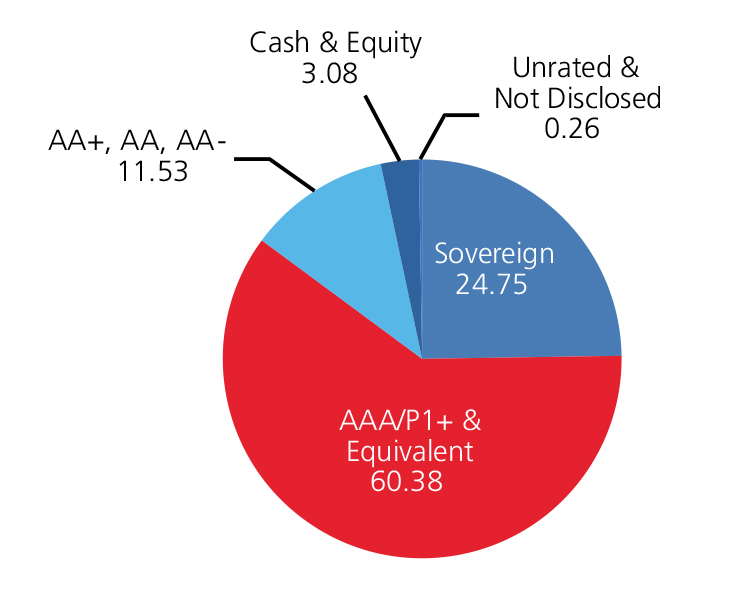

Credit quality

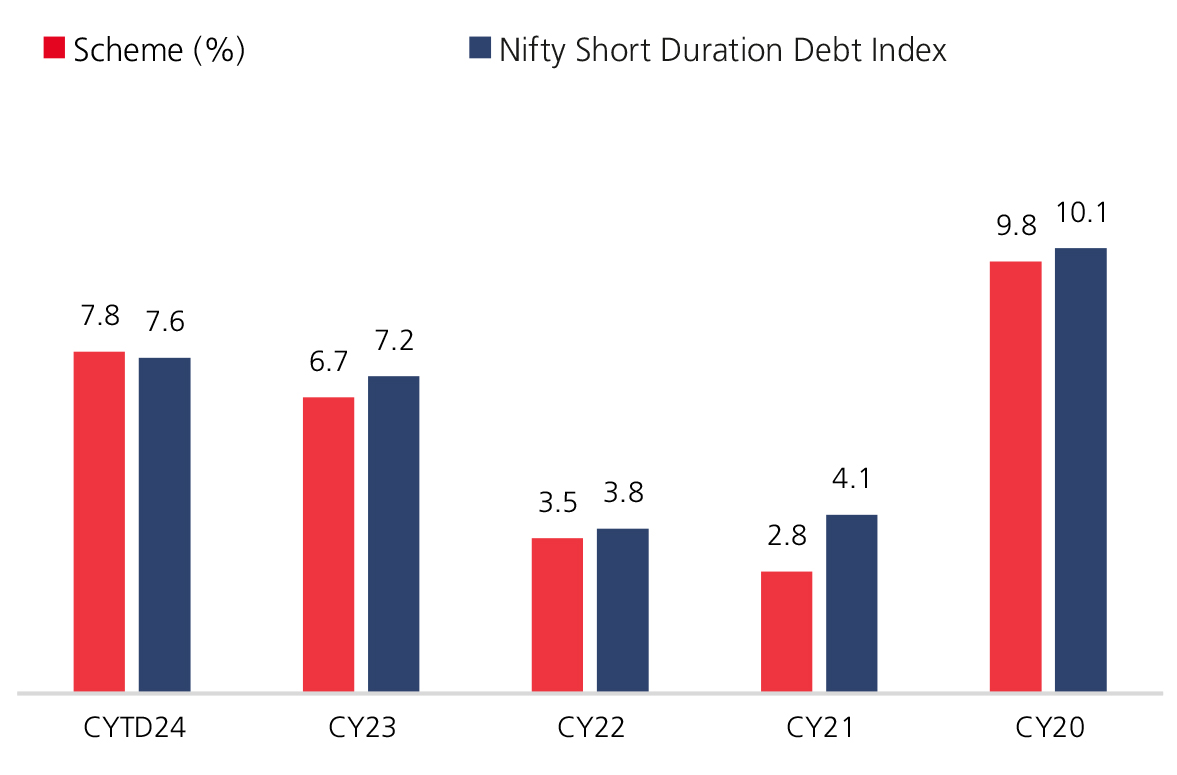

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 7.93 | 7.18 | 5.80 | 5.98 |

| Nifty Short Duration Debt Index | 7.79 | 7.34 | 6.00 | 6.42 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 22.88 |

| National Bank For Agriculture & Rural Development (Nabard) | 7.68 |

| Derivative | 7.49 |

| Power Finance Corporation Ltd. | 5.39 |

| Mindspace Business Parks Reit | 4.87 |

| L&T Metro Rail (Hyderabad) Ltd. | 4.45 |

| Toyota Financial Services India Ltd. | 3.65 |

| SMFG India Credit Company Ltd. (SMICC) (Erstwhile Fullerton India Credit Company Ltd.) | 3.60 |

| Tata Communications Ltd. | 3.00 |

| Jamnagar Utilities & Power Pvt. Ltd. | 2.95 |

Year On Year Performance (Scheme V/S Nifty Short Duration Debt Index)

Debt Quants

| Yield to Maturity (%) | 7.57 |

| Average Maturity (yrs) | 3.62 |

| Modified Duration (yrs) | 2.71 |

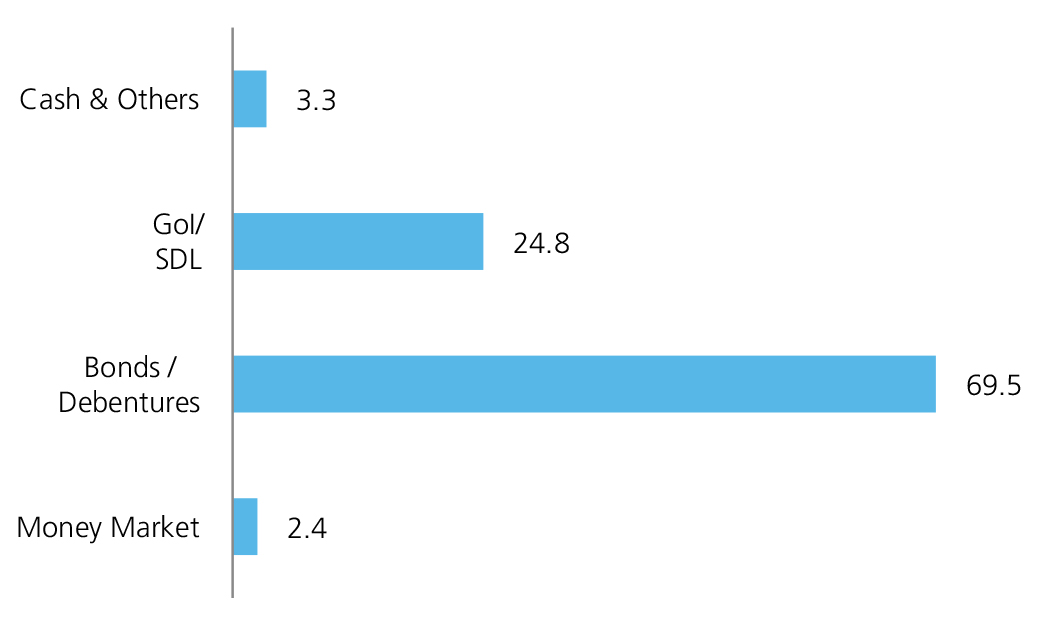

Instrument Allocation (%)

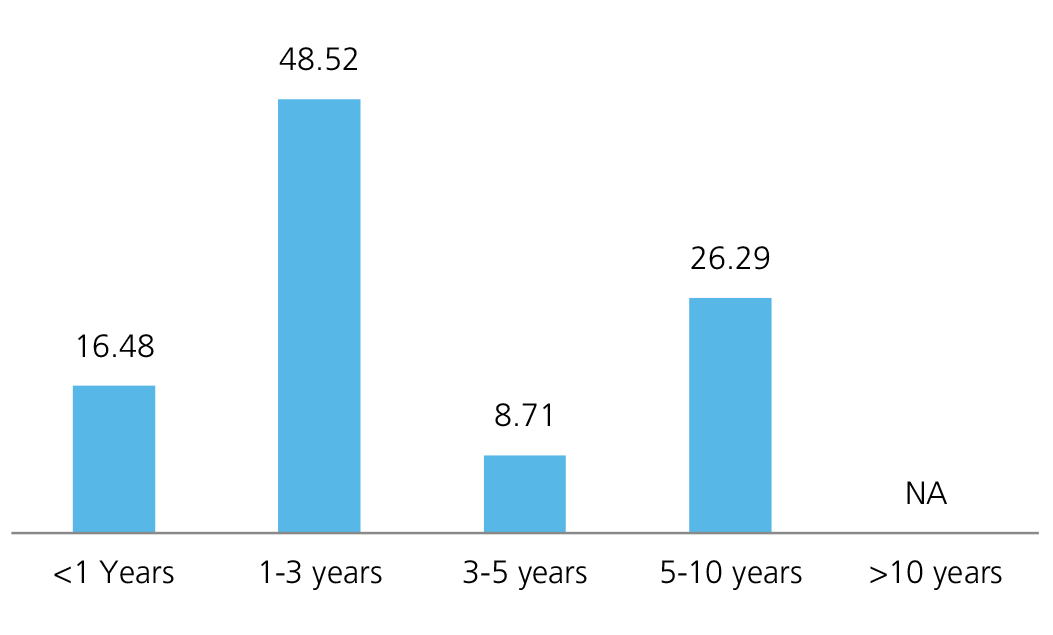

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390