|

Factsheet as on August 31, 2025 |

Factsheet as on August 31, 2025

Structure

Open Ended

Fund Category

Long Duration

Fund Manager

Pranay Sinha, Divya Dutt Sharma, Lokesh Maru

Exit Load

Nil

Fund Size

Rs 9,533

crs

Launch Date

July 6, 2018

Investment Objective

The primary investment objective of the scheme is to generate optimal returns consistent with moderate levels of risk. This income may be complemented by capital appreciation of the portfolio. Accordingly, investments shall predominantly be made in Debt & Money Market Instruments.

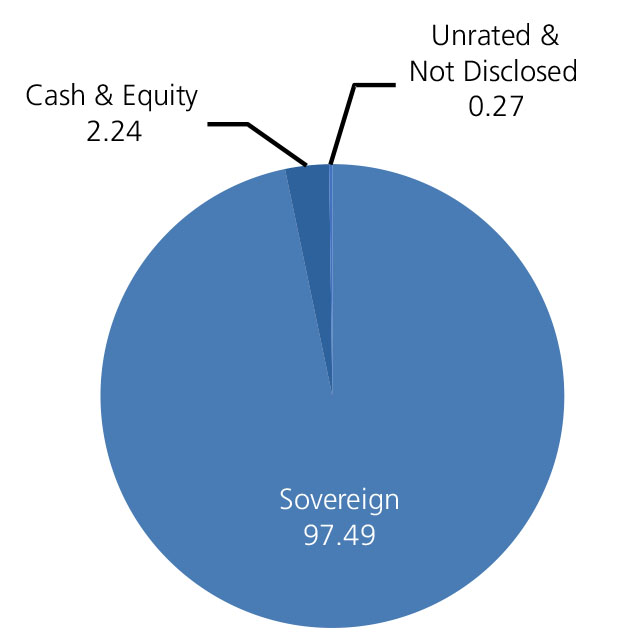

Credit quality

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 4.31 | 7.28 | 7.54 | 5.62 |

| Nifty Short Duration Debt Index | 8.16 | 7.78 | 7.36 | 6.21 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 91.00 |

| Current Assets | 1.71 |

| Triparty Repo | 1.07 |

| SBI - CDMDF - A2 Units | 0.28 |

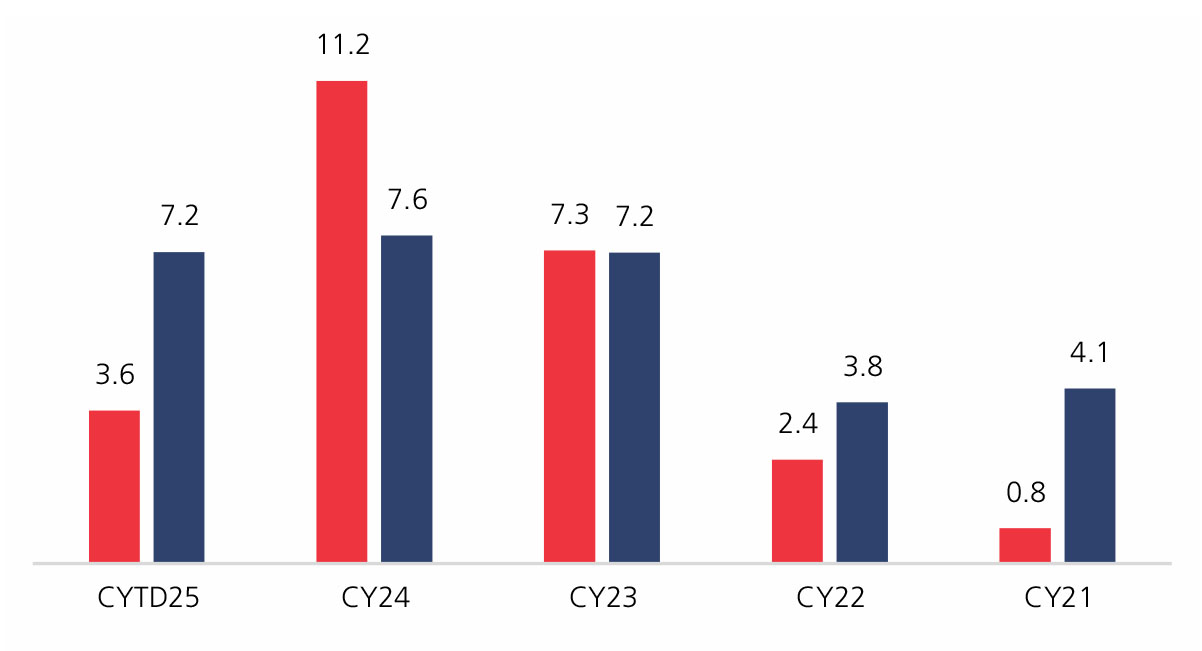

Year On Year Performance (Scheme V/S Nifty Short Duration Debt Index)

Debt Quants

| Yield to Maturity (%) | 7.25 |

| Average Maturity (yrs) | 21.76 |

| Modified Duration (yrs) | 10.49 |

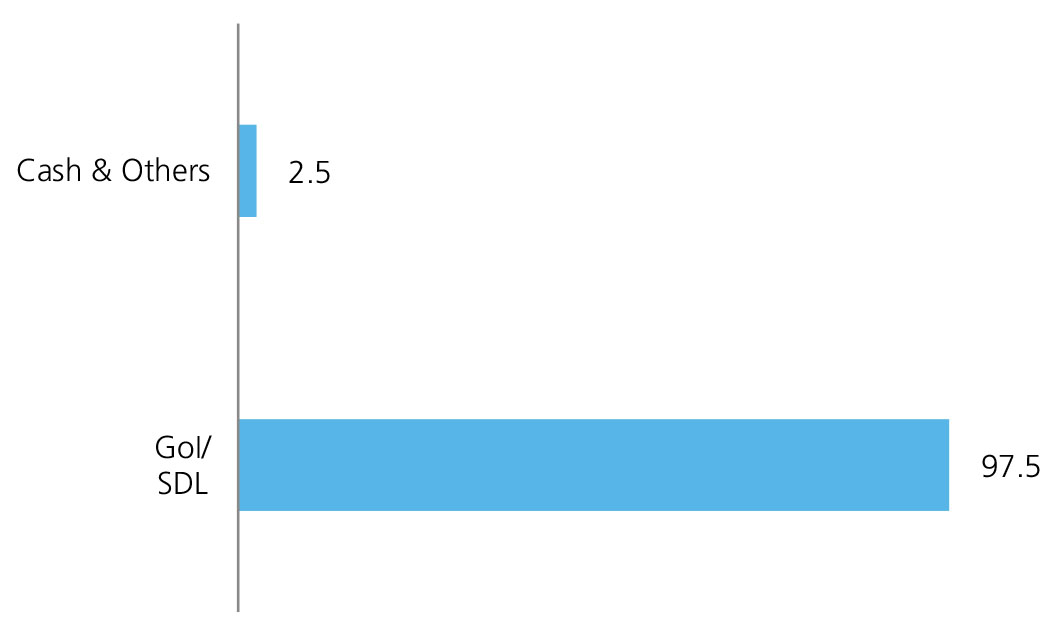

Instrument Allocation (%)

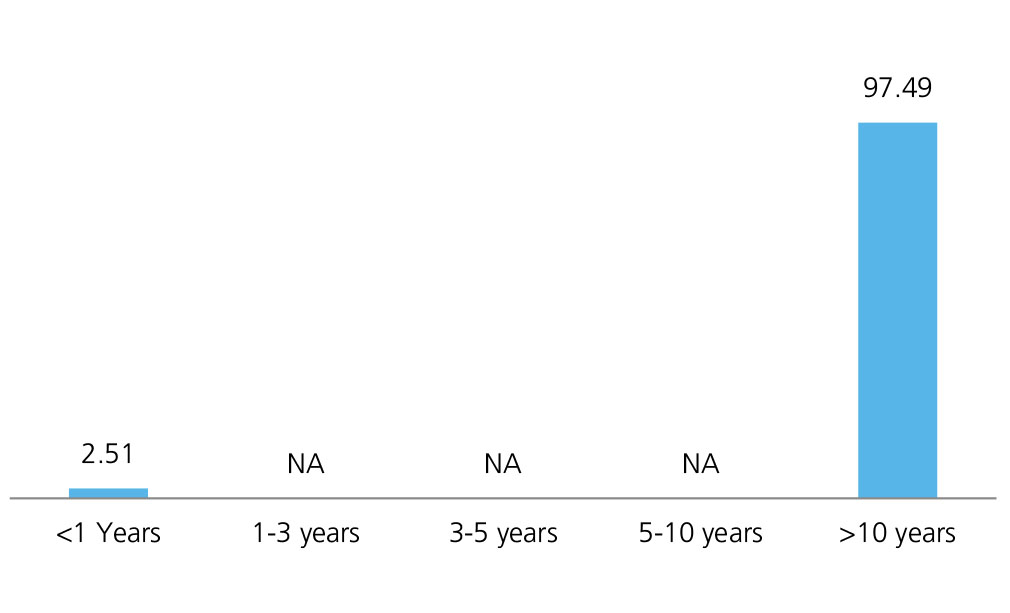

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390