|

Factsheet as on August 31, 2025 |

Factsheet as on August 31, 2025

Structure

Open Ended

Fund Category

Corporate Bond/ Banking & PSU

Fund Manager

Anupam Joshi, Dhruv Muchhal

Exit Load

Nil

Fund Size

Rs 35,821 crs

Launch Date

June 29, 2010

Investment Objective

To generate income/capital appreciation through investments predominantly in AA+ and above rated corporate bonds. There is no assurance that the investment objective of the Scheme will be realized.

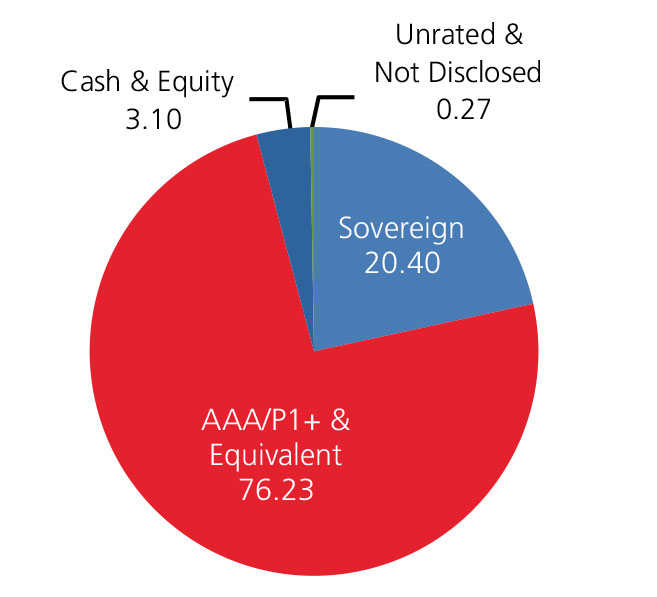

Credit quality

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 7.86 | 7.91 | 7.52 | 6.31 |

| Nifty Short Duration Debt Index | 8.16 | 7.78 | 7.36 | 6.21 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 12.66 |

| Bajaj Finance Ltd. | 3.13 |

| Current Assets | 2.74 |

| State Bank Of India | 2.23 |

| HDFC Bank Ltd. | 1.44 |

| LIC Housing Finance Ltd. | 1.42 |

| Small Industries Development Bank Of India | 1.42 |

| REC Ltd. | 1.32 |

| Triparty Repo | 0.60 |

| SBI - CDMDF - A2 Units | 0.28 |

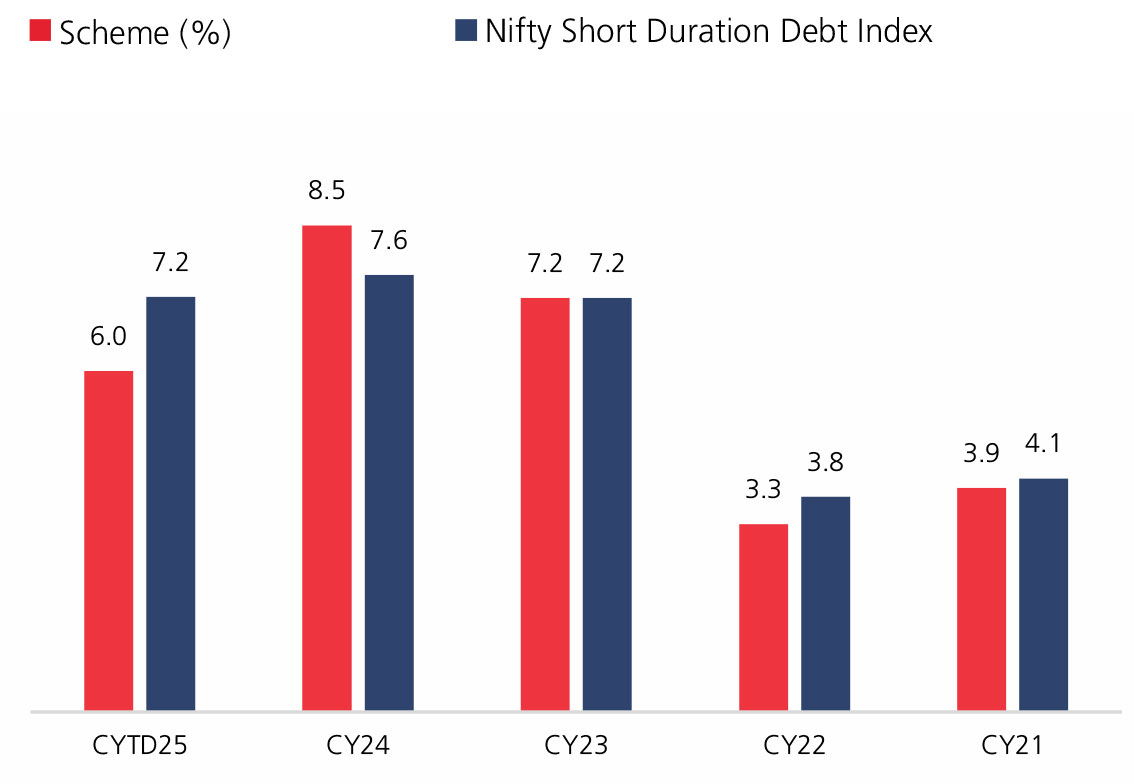

Year On Year Performance (Scheme V/S Nifty Short Duration Debt Index)

Debt Quants

| Yield to Maturity (%) | 7.06 |

| Average Maturity (yrs) | 6.92 |

| Modified Duration (yrs) | 4.17 |

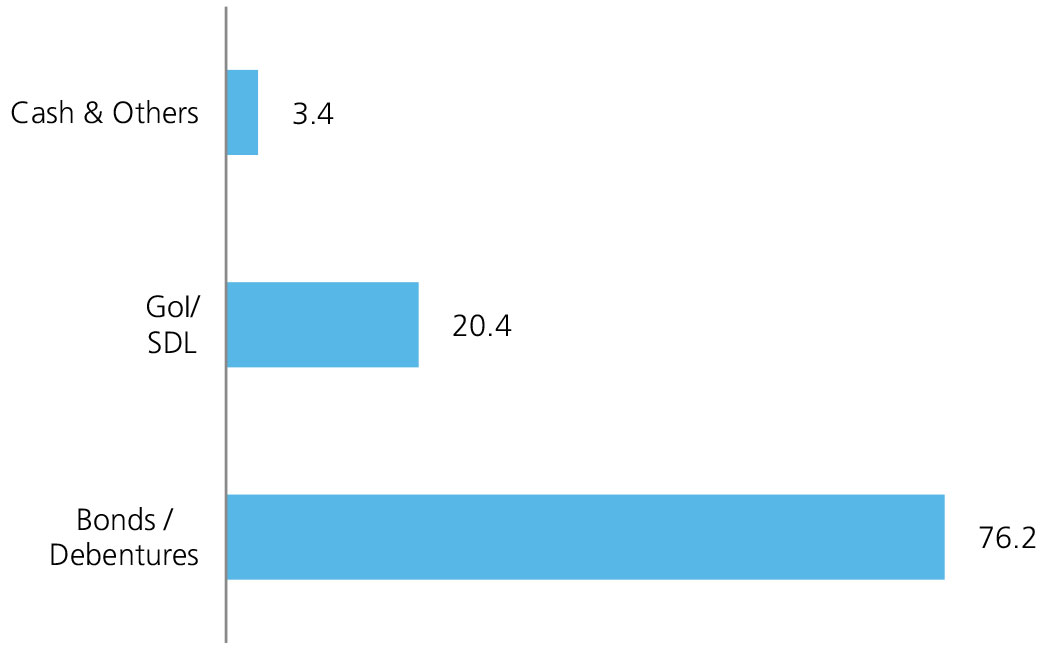

Instrument Allocation (%)

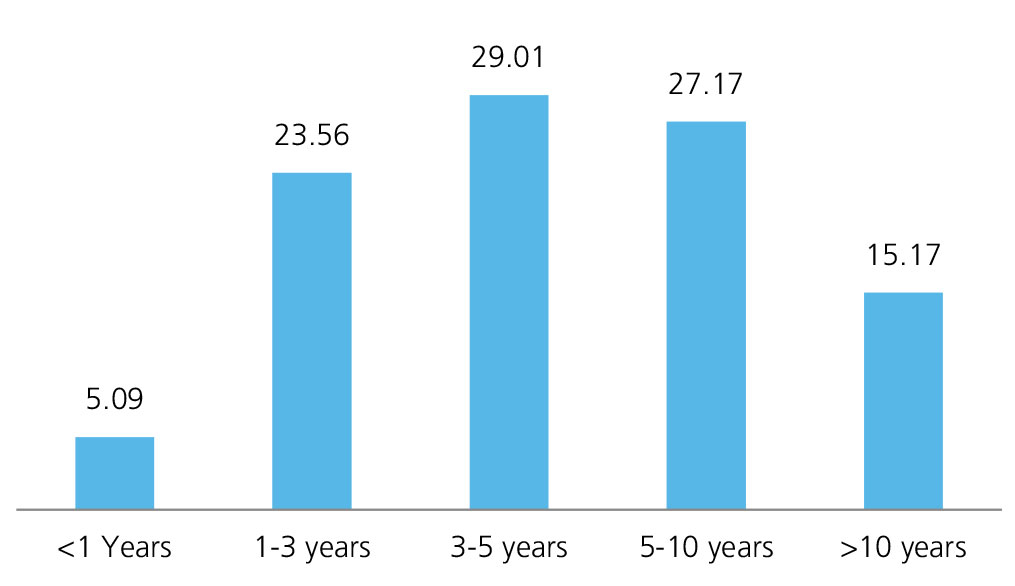

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390