|

Factsheet as on January 31, 2023 |

Factsheet as on January 31, 2023

Structure

Open Ended

Fund Category

Dynamic Debt (Medium to Long Duration/ Dynamic Bond/Gilt) - Active

Fund Manager

Karan Mundra, Vivek Ramakrishnan

Exit Load

Nil

Fund Size

Rs 345 crs

Launch Date

April 29, 1997

Investment Objective

Aims to generate attractive returns consistent with prudent risk from a diversified portfolio substantially constituted of high quality debt securities.

Credit quality

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 3.35 | 3.26 | 5.25 | 4.53 |

| Crisil Composite Bond Fund Index | 3.72 | 3.27 | 5.88 | 7.05 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 41.07 |

| Bajaj Finance Ltd. | 7.46 |

| Indian Oil Corporation Ltd. | 7.32 |

| State Bank Of India | 6.93 |

| Axis Bank Ltd. | 6.74 |

| LIC Housing Finance Ltd. | 4.55 |

| NIIF Infrastructure Finance Ltd. (Erstwhile IDFC Infrastructure Finance Ltd.)(Erstwhile IDFC Infra | 4.52 |

| National Thermal Power Corporation Ltd. | 4.48 |

| Power Finance Corporation Ltd. | 4.42 |

| Power Grid Corporation Of India Ltd. | 3.15 |

Year On Year Performance (Scheme V/S Crisil Composite Bond Fund Index)

Debt Quants

| Yield to Maturity (%) | 7.48 |

| Average Maturity (yrs) | 3.76 |

| Modified Duration (yrs) | 3.06 |

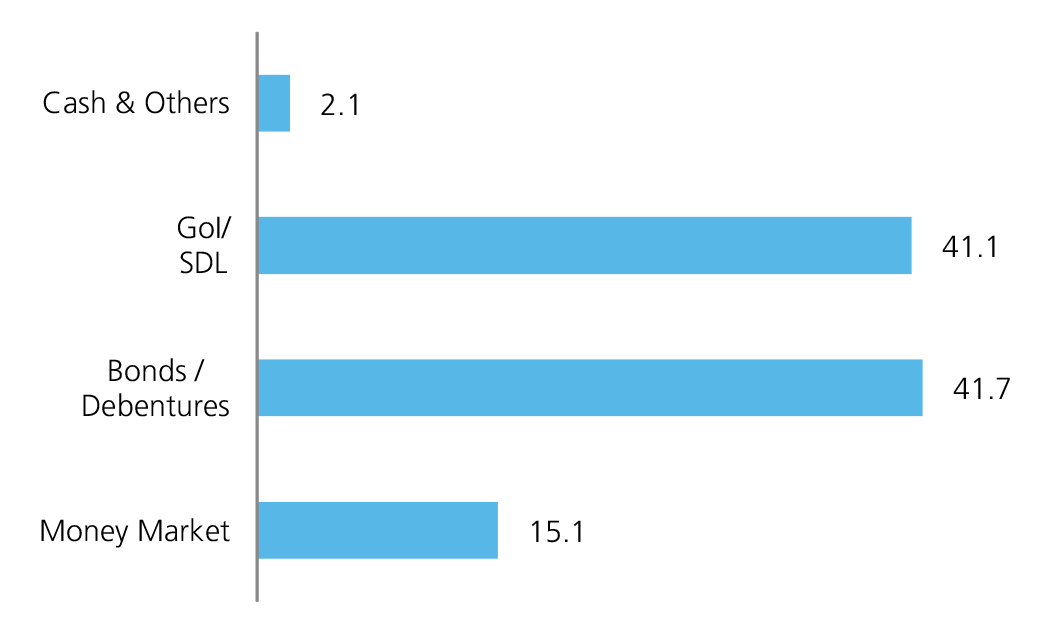

Instrument Allocation (%)

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390