|

Factsheet as on August 31, 2025 |

Factsheet as on August 31, 2025

Structure

Open Ended

Fund Category

Corporate Bond/ Banking & PSU

Fund Manager

Suyash Choudhary, Gautam Kaul, Brijesh Shah

Exit Load

Nil

Fund Size

Rs 15,929 crs

Launch Date

Jan 12, 2016

Investment Objective

The Fund seeks to provide steady income and capital appreciation by investing primarily in corporate debt securities across maturities and ratings. Disclaimer: There is no assurance or guarantee that the objectives of the scheme will be realised.

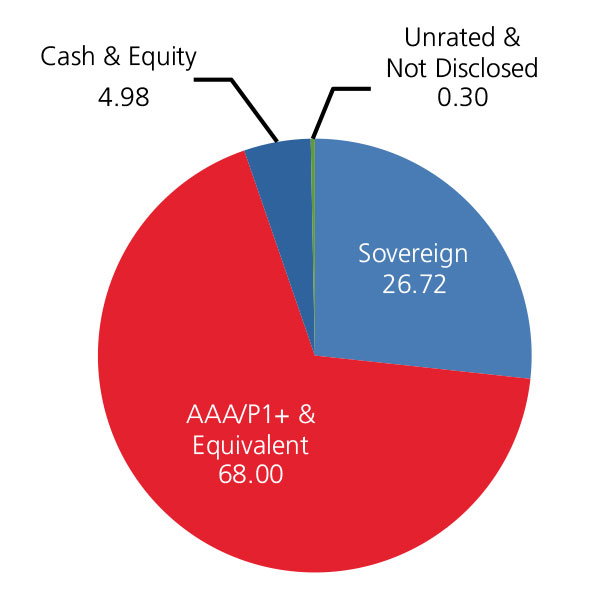

Credit quality

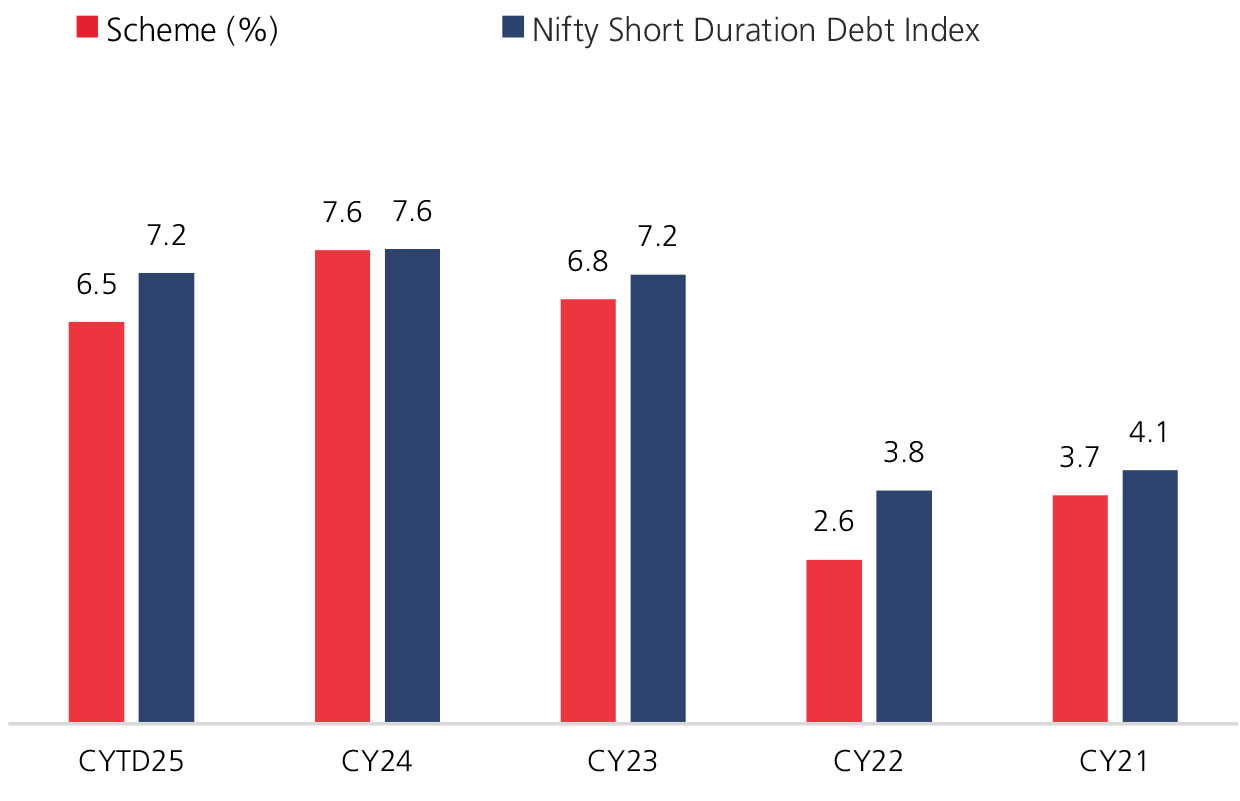

Scheme Performance

| 1 Year | 2 Years | 3 Years | 5 Years | |

| Scheme (%) | 7.97 | 7.62 | 7.12 | 5.86 |

| Nifty Short Duration Debt Index | 8.16 | 7.78 | 7.36 | 6.21 |

Top 10 Holdings (Issuer Wise)

| Company Name | % of Assets |

| GOI | 23.95 |

| Bajaj Housing Finance Ltd. | 5.85 |

| Bajaj Finance Ltd. | 4.57 |

| Current Assets | 3.92 |

| Larsen & Toubro Ltd. | 3.86 |

| Reliance Industries Ltd. | 3.80 |

| Indian Oil Corporation Ltd. | 2.73 |

| Ultratech Cement Ltd. | 2.70 |

| Triparty Repo | 0.33 |

| SBI - CDMDF - A2 Units | 0.28 |

Year On Year Performance (Scheme V/S Nifty Short Duration Debt Index)

Debt Quants

| Yield to Maturity (%) | 6.73 |

| Modified Duration (yrs) | 3.15 |

| Average Maturity (yrs) | 4.05 |

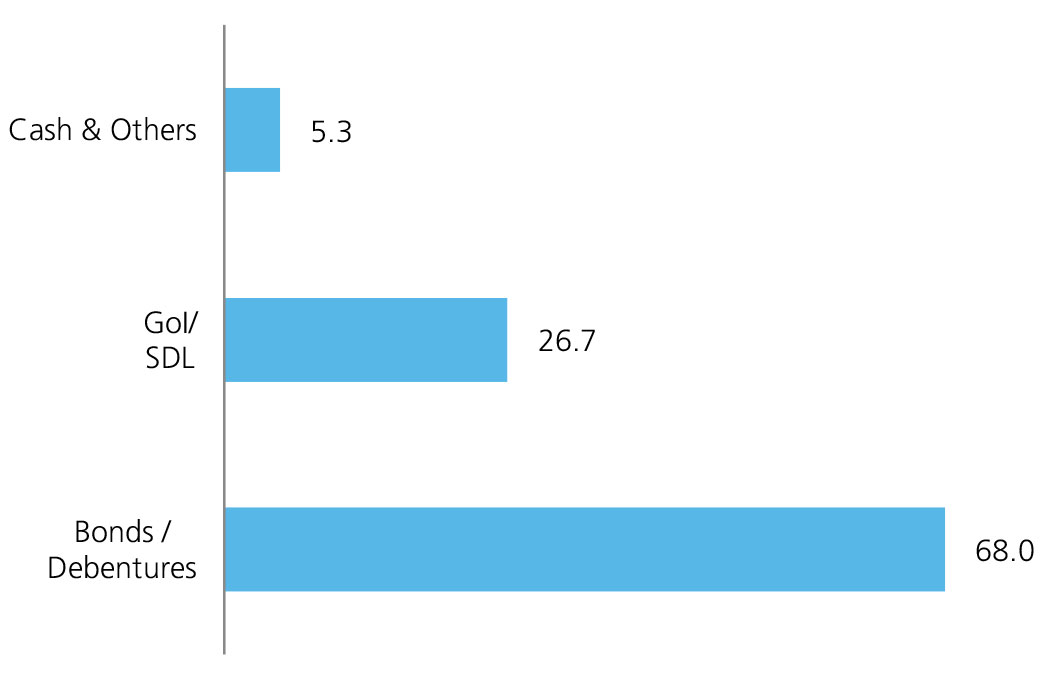

Instrument Allocation (%)

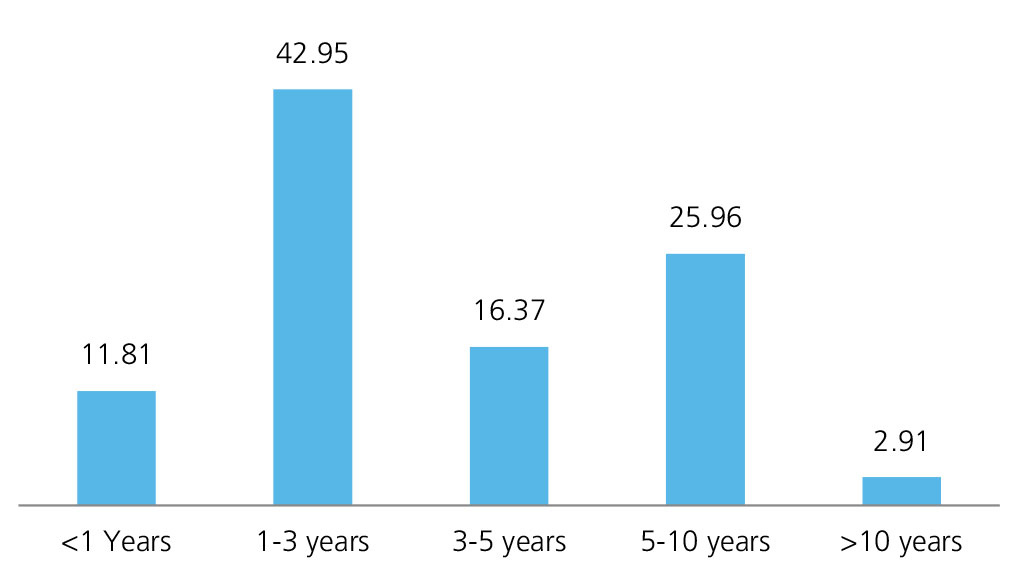

Allocation (Maturity wise)

Source: MFI Explorer

Please refer to the disclaimer and glossaries

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390

Kotak Mahindra Bank Limited, AMFI Registered Mutual Fund Distributor, ARN 1390